Crude Oil Demand Destruction Overdone?

Commodities / Crude Oil Aug 15, 2008 - 12:08 PM GMTBy: Andy_Sutton

Much ado has been made of ‘demand destruction', an economic term that refers to declining demand for a good due to high prices. The past month or so the mainstream US press has latched onto demand destruction as a reason for the decline in oil prices much in the same way they blamed speculators for high oil prices just a few weeks earlier.

Much ado has been made of ‘demand destruction', an economic term that refers to declining demand for a good due to high prices. The past month or so the mainstream US press has latched onto demand destruction as a reason for the decline in oil prices much in the same way they blamed speculators for high oil prices just a few weeks earlier.

Also, when talking about demand destruction, they will refer to US numbers only; conveniently forgetting the rest of the world. The mindset here is still that the US is the top dog and the rest of the globe is irrelevant. So let's indulge them in their narrow-mindedness for a minute and look only at US consumption as presented by the Energy Information Administration.

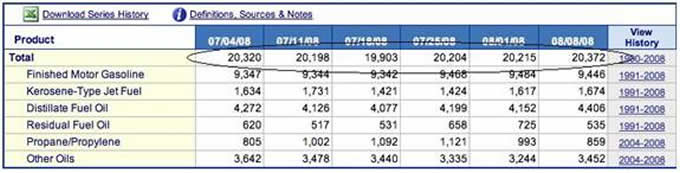

Overall oil consumption in the United States has actually been on the rise for the past 3 weeks during this period of unprecedented ‘demand destruction'. This is supported by the EIA's own numbers. (See Chart Below).

From the high of 5/23/2008 at 20.807 million barrels per day (bpd), there was a drop of 4.34% to 19.903 million bpd on 07/18/2008 . Since mid-July, usage has risen 2.36% to 20.372 million bpd.

While it will take some examination of the price and usage trends going forward, the data at this time point to demand destruction occurring somewhere in the $145/bbl range with usage picking up as prices fell back from those levels. If this is truly the correct analysis, deduction would tell us we should soon see usage return to spring levels. However, there are seasonal components involved as well. Gasoline usage typically falls as summer comes to an end. There are one or two ‘shoulder' months (August/September), then usage starts to switch over to heating. I would opine that much of Americans' driving is discretionary, in that we can willfully choose to cut back. I would counter that heating tends to be more non-discretionary. Sure, people can turn the thermostats back a few degrees, but traditionally heating demand has been more price inelastic than driving demand. This winter will prove interesting in terms of usage.

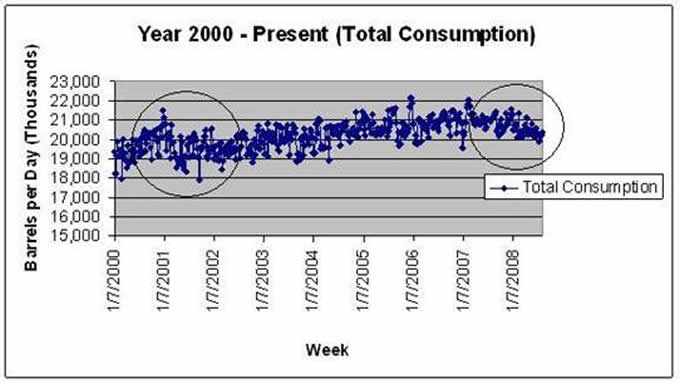

To look at a more long-term picture, I am including a chart that lists usage in the United States from the beginning of 2000. Since then, oil has risen nearly 10-fold, yet there has never been a sustained period of contraction in oil usage here in the US . This while overseas usage has literally exploded. Notice that the only two real decreases in oil consumption occurred at times when the US was either in or near a recession; NOT when the price of oil was spiking. This argues that petroleum usage is more a function of economic growth than of price; an assertion I have made for some time.

One must understand that there are many factors other than price and supply which drive demand. If we were seeing this price spike in a time of low debt load and overall economic prosperity, $4 gas wouldn't matter as much to people. Note the prior observation that usage appears to be more a function of growth than price. However, when people are relying on credit cards and other types of debt to make ends meet, and their wages lose ground each year to inflation, then $4 gas is suddenly more significant.

Much like the recent action in the Dollar, oil bears have feasted on the notion that the rest of the world will follow the US into a recession. (A recession that, by the way, our leaders still refuse to acknowledge exists). It is pretty telling that we're in such dire straits that we have to rely on bad things happening to others to continue our own fallacy of prosperity.

Changing of the guard?

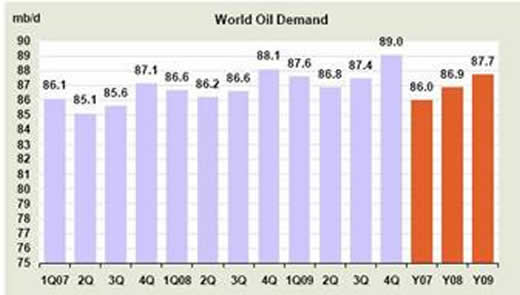

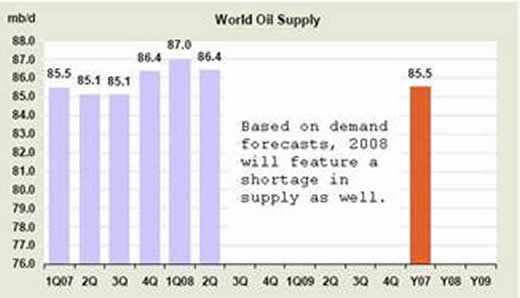

In looking at the lines of demarcation, it is worth noting that it is the OECD countries that appear headed for recession and theoretical reduced oil consumption while the rest of the world appears to be relatively unscathed so far. Granted, with the credit infection that overspreads the globe, this could certainly change. From the International Energy Agency's numbers, we see the following with regard to world oil demand and supply:

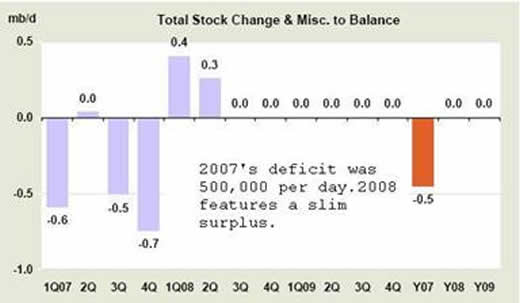

2007 featured a 500,000 bpd shortfall or a yearly shortfall of 182.5 million barrels. Interestingly enough, 2008 shows a small surplus so far, but the size of that surplus dropped in the second quarter despite record high oil prices and the demand destruction parroted by the mainstream press

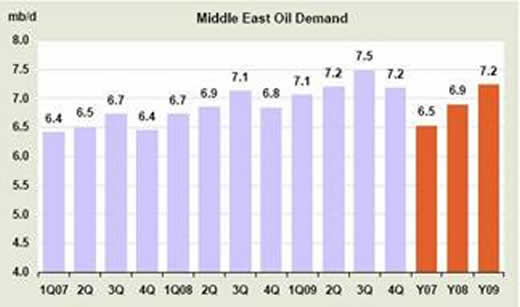

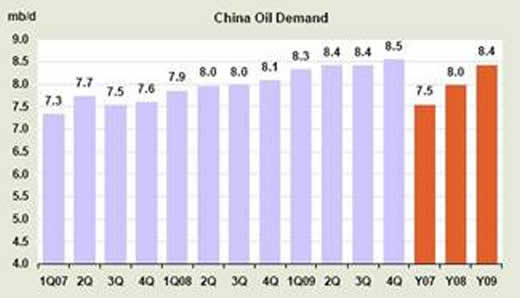

Lastly, the engines of oil consumption, China and OPEC are shown. While their petroleum usage is dwarfed by that of the US (for now), the trends are solid and distinct.

In conclusion, demand destruction certainly occurred here in the US earlier this summer. I argue this is more due to economic malaise as opposed to high prices. However, over the course of the past month, usage has increased as prices fell off their recent highs and Americans received stimulus checks. The reality of increased usage has been almost totally ignored by the press as they stick to ‘demand destruction'. In truth, nothing could be worse than the recent decline in oil prices coupled with economic ‘stimulus'. It will encourage people who had been conserving to return to life as usual. Political and economic incentives to develop alternative energy sources will disappear. Once again our energy independence could be delayed and we'll continue to rely on foreign oil. Real change is more than a political slogan; it is a long, painful process and I fear that our long term well-being has been sacrificed once again at the altar of political convenience.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.