French Elections, Brexit And Gold

Commodities / Gold and Silver 2017 May 05, 2017 - 06:50 PM GMTBy: Arkadiusz_Sieron

The first round of the French presidential elections is behind us. Now, the main developments in Europe which may affect the gold market – except the turmoil in the still fragile banking sector – are a run-off in France and Brexit. Let’s analyze them and their potential impact on the gold prices.

The first round of the French presidential elections is behind us. Now, the main developments in Europe which may affect the gold market – except the turmoil in the still fragile banking sector – are a run-off in France and Brexit. Let’s analyze them and their potential impact on the gold prices.

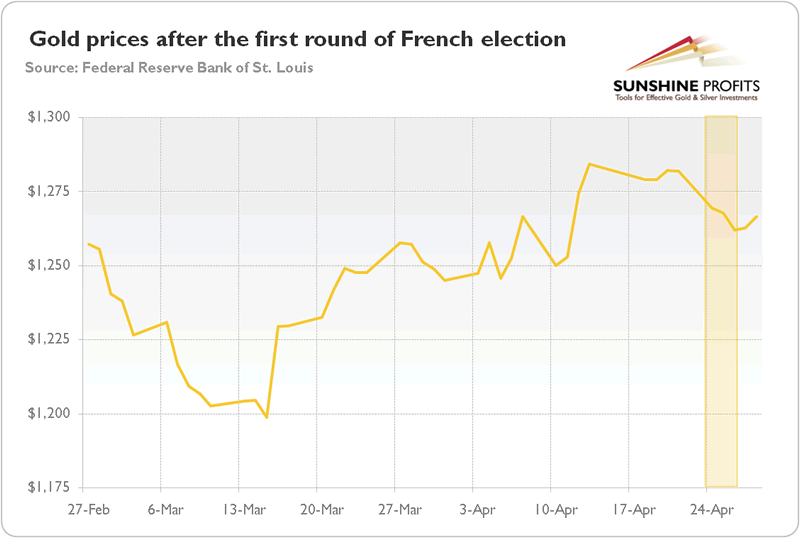

As everyone already knows, centrist Macron and nationalistic Le Pen are set to face off on May 7. That pair is the best possible outcome for the markets, as Macron is believed to easily beat Le Pen (although the race is open, especially if Jean-Luc Melenchon backs Le Pen). This is why the price of gold dropped on Monday after the first round of the election, as one can see in the chart below.

Chart 1: The price of gold before and after the first round of the French presidential elections.

As a reminder, Macron is a keen supporter of the euro and the EU. He promised to cut corporate taxes and reduce public spending (France has the highest level of government expenditure among the OECD countries – about 57 percent!). In contrast, Le Pen wants to drop the euro and hold a referendum on France’s membership in the EU. So it’s not surprising that investors are afraid of Le Pen’s agenda. Her victory would shake certain risky markets, boosting the safe-haven demand for gold. In contrast, Macron’s triumph should cause another relief rally in risky assets and the plunge in the gold prices. Moreover, Macron could be a harmless president because he lacks the backing of a major party in the French parliament. However, the impact of his win should be limited and probably softer than in the first round. This is because his lead in the polls is enormous, while the first round was a very tight race.

When it comes to Brexit, a lot has happened recently. First of all, at the end of March, Theresa May, the British Prime Minister, triggered Article 50, formally launched the Brexit process. The exit process will be very gradual, so the impact on the markets should be limited. However, given tough diplomatic relations between Brussels and London, and the amount of issues to negotiate, Brexit could easily become the messiest divorce in history. Investors should expect many dramatic and chaotic twists, potentially supporting the gold prices, at least in the short-term.

The recent May call for snap election was one of such surprises. After repeating all the times that she does not want an earlier election, May decided to take her chances in order to strengthen her mandate and gain more leeway in negotiations with the EU. Given that polls predict about a 20-point lead of Conservatives over the Labour Party, her decision seems to be a clever move. Indeed, May would not have to face voters until 2022, which gives her more flexibility in negotiations – in other words, the next elections will occur before the full consequences of Brexit will hit the UK. The snap elections will also silence supporters of the second referendum over Brexit. Hence, after the vote, May will be able to go into the detailed negotiations with a better bargaining position and the voice of the British citizens behind her.

However, there are some risks. For starters, the Liberal Democrats could gain momentum by campaigning against May’s vision for a hard Brexit. After the last year’s referendum (and Trump’s victory in the U.S.) no one should depreciate the unpredictability of politics nowadays.

As a reminder, the pound rose on expectations that Tories would win a much increased majority. Therefore, if Conservatives fail to do it, investor will be surprised and the safe-haven demand for gold may increase. Similarly, markets now expect softer Brexit, as the pressure from hardline Brexiteers on Theresa May is believed to soften after the snap election. Hence, any events increasing the odds of a hard Brexit could shake the markets and support the gold prices.

Moreover, the elections may entail far-reaching implications not only for the future of the continent, but also for the survival of the United Kingdom itself. We are in uncharted territory in a sense. After the elections, the Scottish National Party may strengthen its position and renew its demand for another independence referendum in the coming years. The future of Northern Ireland is also under question, as some politicians are calling for vote on Irish unification. And it may be the case that if Ireland unifies, the north would automatically become part of the EU. It should be now clear that there will be many bumps on the road, which is good for the yellow metal, but the macroeconomic outlook and sentiment should have decisive influence on the gold market in the long-run.

To sum up, there are many geopolitical risks left: the second round of the French presidential election in May, the snap election in the UK in June and the long process of Brexit, German federal election in September, or the tensions between the U.S. and North Korea. However, these are not the first, nor the last, relevant geopolitical events in recent history. If gold gained each time something risky happens on the planet, it would cost over $10,000. In the end, the market shrugs off geopolitical risks and eventually focuses on the macroeconomic outlook. Hence, we believe that gold investors will concentrate now on other factors, as the outcome of the first round of the French presidential election reduced the geopolitical risks on the margin.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.