The Bearish Gold Bull

Commodities / Gold and Silver 2017 May 12, 2017 - 03:25 PM GMTBy: Jordan_Roy_Byrne

The Bearish Gold Bull was the title of my presentation last weekend at the Metals Investor Forum in Vancouver, British Columbia. While the title could be ascribed to me personally for my recent tendency towards conservative and cautious views, it more importantly describes the current dichotomy in the gold sector. The mining sector saw its fundamentals hit rock bottom in 2014-2015 and became “bombed out” at the end of 2015. However, while parts of the industry have performed well, as a whole it has been unable to push higher after a torrid recovery in early 2016. A big reason is the outlook for metals prices suggests lower prices before any large advance. Until metals prices are ready to rise, the miners may find themselves in a bearish bull.

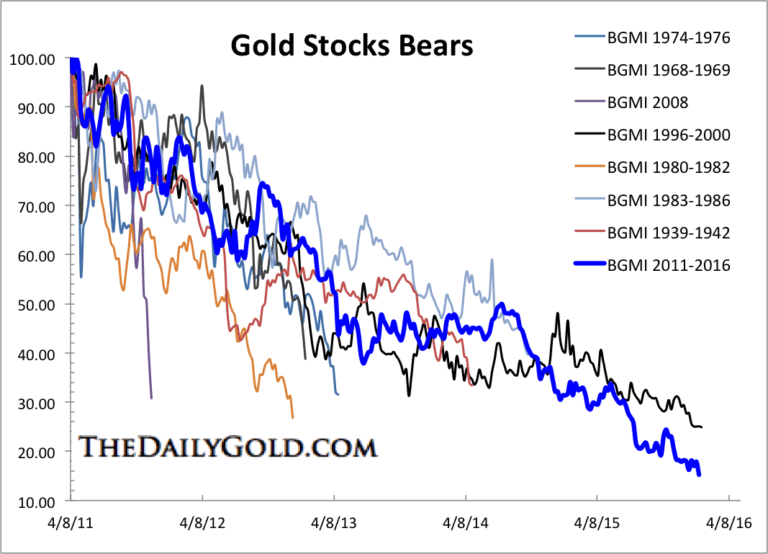

The mining stocks have fallen below their 50 and 200-day moving averages and are even struggling around their 400-day moving averages (which provided support in December 2016) but this does not threaten the epic 2015-2016 bottom. There are a plethora of valuation metrics from January 2016 that are unlikely to be seen again. That time marked the worst 5 and 10-year rolling performance for gold stocks in 90 years. Gold stocks relative to the S&P 500 hit an all-time low and Gold stocks relative to Gold hit a 90 year low. Gold stocks price to book and price to cash flow valuations were the lowest in 40 years. (The data does not go back farther than that). Finally, January 2016 marked the end of the worst bear market ever. Remember this chart?

Barrons Gold Mining Index

The fundamentals for the mining sector actually bottomed before January 2016. Fundamental indicators for the industry such as the Gold to Oil ratio and Gold priced in foreign currencies bottomed well before 2016. For the senior producers, aggregate net debt and leverage ratios began to decline after 2014 and free cash flow turned positive in 2015. In short, 2015 was a turnaround year for industry even though the average Gold price of roughly $1150/oz was $110/oz lower than in 2014. Since the end of 2015, the industry has enjoyed nearly six quarters of $1250/oz Gold. The industry is now in a better position to be able to withstand several quarters of weaker metals prices.

With respect to Gold and Silver, the ominous price action reflects the risk of worsening fundamentals for the balance of the year. Real interest rates are the primary driver for precious metals and they could rise in the months ahead. Inflation has peaked and this is reinforced by commodity prices rolling over. Meanwhile, short-term interest rates are stable at worst and rising at best. The Fed could hike three more times this year. Unless the Fed reverses course or inflation suddenly accelerates, Gold and Silver prices will be under pressure.

Overall, while the gold miners and juniors are in a new up cycle, they will not truly liftoff as a whole until metals prices are ready to rise in a sustainable fashion. Nevertheless, we should note that various individual companies are being rewarded for adding value to their projects. Our view is we want to find these companies and accumulate on weakness as that will provide a better entry point then attempting to pinpoint the next major low in metals prices. We are waiting as we expect a good buy opportunity at somepoint this summer.

For professional guidance in riding the bull market in Gold, consider learning more about our premium service including our favorite junior miners for 2017.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.