Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies

Currencies / BlockChain May 15, 2017 - 03:42 PM GMTBy: GoldCore

– Cyberattacks expected to spread today in “second phase”

– UK intelligence says scale of threat significant

– Microsoft slams NSA for letting hacking tools cause global malware epidemic

– Ransomware attack already crippled more than 200,000 computers in 150 countries

– 1.3 million computer systems believed to be at risk

– Europol warns many computer systems simply won’t start

– Businesses, banks and government agencies around world told to prepare

– Renault, FedEx among companies affected by cyber-attack

– Banks in China including ATMs were affected

– Hackers could shut down banks and cut off power and water supplies

– “Biggest threat to civilisation” since the Second World War – Cyber security expert

– Risks posed to digital deposits and digital wealth are the “new case for gold”

The threat posed by cyber attacks, cyber terrorism and cyber war to our increasingly complicated, technologically dependent financial system is something we have covered numerous times and becomes more clear by the day.

British and US agents have carried out mock cyber attack or ‘cyber war games’ on the Bank of England and commercial banks in the City of London and on Wall Street as part of tests on critical, but vulnerable financial infrastructure.

Should banks be hacked and customers deposit accounts compromised then the vista of potential bail ins becomes a real one. In June of 2015, JP Morgan Chase were hacked by unknown parties who stole the personal details of 83 million customers.

In July of 2014 Bloomberg reported that malware had been detected in the system of the Nasdaq exchange. Its purpose was unclear but it was believed to have been embedded there by Russian hackers.

There is also the alleged hacking of Sony Pictures by North Korea and the alleged hacking of Facebook, Instagram and Tinder. In 2012, Iran is alleged to have devastated the computer network of Saudi Aramco in a similar attack.

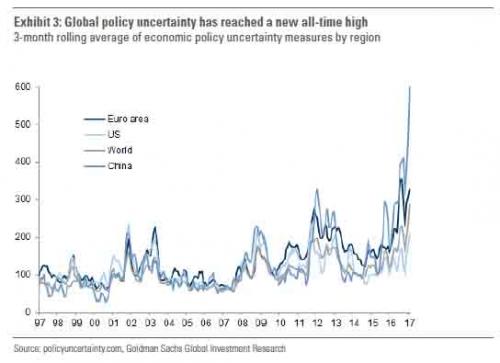

We can see a panorama of human activities which grow more vulnerable as hackers and cyber-warfare grow more sophisticated.

Banks have been hacked, stock exchanges have been hacked and critical infrastructure have been hacked in recent years. It is likely that many of these small scale attacks have been merely testing of defenses.

A concerted attack on the western financial system would likely include attempts at disabling various exchanges including stock markets and foreign exchange markets. Banks could be attacked in such a way that ATMs and wire transfers are disabled and bank balances, which are merely digital figures, could be erased.

In such an environment, our modern world, which is so dependent on technology and the monetary system, would be economically paralysed. The primary wealth would longer be primarily digital – cash, stocks and bonds – and tangible wealth would become more important.

Tangible assets include gold and silver bullion, agricultural land, water and property. We are not predicting such an outcome. We are simply looking at the facts as they are, in the context of intense geopolitical tensions, and surmising that it would be prudent to take necessary precautions and diversify into physical gold.

Gold Prices (LBMA AM)

15 May: USD 1,231.50, GBP 952.32 & EUR 1,124.61 per ounce

12 May: USD 1,227.90, GBP 955.06 & EUR 1,129.55 per ounce

11 May: USD 1,221.00, GBP 945.66 & EUR 1,122.95 per ounce

10 May: USD 1,222.95, GBP 944.61 & EUR 1,124.99 per ounce

09 May: USD 1,225.15, GBP 948.51 & EUR 1,124.20 per ounce

08 May: USD 1,229.70, GBP 948.71 & EUR 1,123.45 per ounce

05 May: USD 1,239.40, GBP 958.06 & EUR 1,130.33 per ounce

04 May: USD 1,235.85, GBP 958.15 & EUR 1,131.05 per ounce

Silver Prices (LBMA)

15 May: USD 16.59, GBP 12.83 & EUR 15.12 per ounce

12 May: USD 16.30, GBP 12.68 & EUR 14.99 per ounce

11 May: USD 16.37, GBP 12.70 & EUR 15.06 per ounce

10 May: USD 16.29, GBP 12.59 & EUR 14.99 per ounce

09 May: USD 16.22, GBP 12.55 & EUR 14.88 per ounce

08 May: USD 16.38, GBP 12.64 & EUR 14.96 per ounce

05 May: USD 16.27, GBP 12.58 & EUR 14.85 per ounce

04 May: USD 16.50, GBP 12.80 & EUR 15.09 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.