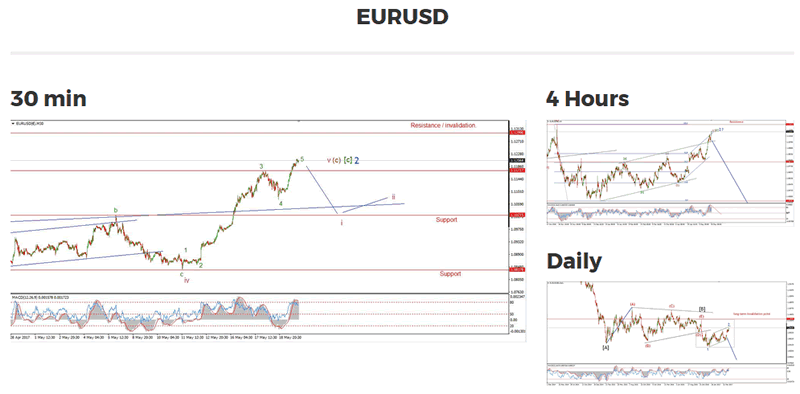

EURUSD reaches DO or DIE moment!

Currencies / Euro May 20, 2017 - 12:42 PM GMTBy: Enda_Glynn

My Bias: short in wave 3 blue.

My Bias: short in wave 3 blue.

Wave Structure: downward impulse wave 1, 2 blue

Long term wave count: lower in wave 3 blue

Important risk events: EUR: Eurogroup Meetings. USD: FOMC Members Speak.

Bon soir mes amis.

We have reached the end of another week.

And after a week of impulsive action in wave (c) brown,

where each consecutive subwave has extended the price higher.

EURUSD is now flirting with the upper invalidation line for this bearish wave count.

That invalidation line lies at 1.1299,

A break of that high will mean going back to the drawing board to figure it out.

That being said, at this moment I cannot find a better fitting wave count than the current operating count.

The market is still rallying in a second wave,

with wave '3' blue to the downside the next logical step in the wave pattern.

The technical setup looks very bearish right now,

Both the 4hr RSI and MACD are declining off 10 month highs this week!

This is not the type of momentum setup that would inspire confidence on the bullish side.

Wave (c) brown has extended, but it still sports a completed 5 wave structure.

therefore this rally is complete.

Momentum has diverged to the downside,

And of course the news on the USD is fully lopsided towards the negative.

All of this points to one thing,

EURUSD is set for big declines in the very near future.

It is time to prepare.

For the early trade next week I will be watch that critical level at 1.1299.

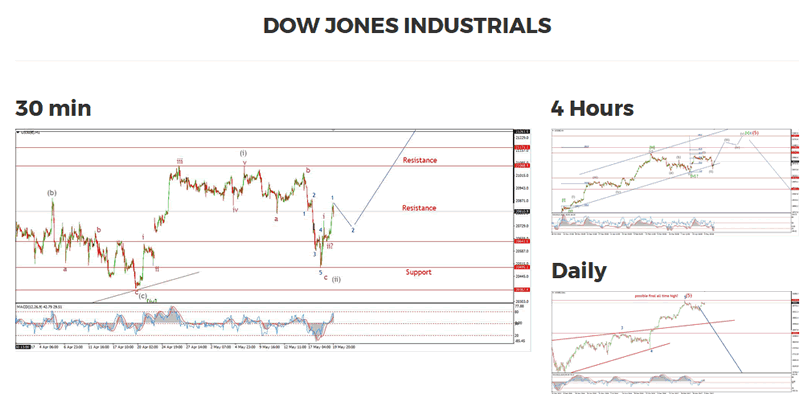

My Bias: market topping process ongoing

Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high.

Long term wave count: Topping in wave (5)

Important risk events: USD: FOMC Members Speak.

The DOW bounced higher today in what may be the beginning of wave 'iii' pink.

I have shown a series of 1,2 waves to the upside,

This indicates an acceleration phase may well be underway, again!

Right now on the chart, I have labelled three degrees of 1,2 waves to the upside.

If this interpretation proves correct,

Then we are on for another big rally dead ahead.

20641, the low of wave 'ii' pink, is important.

as a break of this low will postpone that rally for a few more days.

This new wave count I am working with points to another all time high in the region of 21874.

But this new high should not last long.

I have been harping on for a while now about how we are witnessing a topping process in this half cycle.

The next major phase of market action is to the downside.

And as each wave closes out we are lurching closer to that day.

For early trade next week, watch for wave '2' blue to complete in the 20750 region,

From there, wave 'iii' should come on strong.

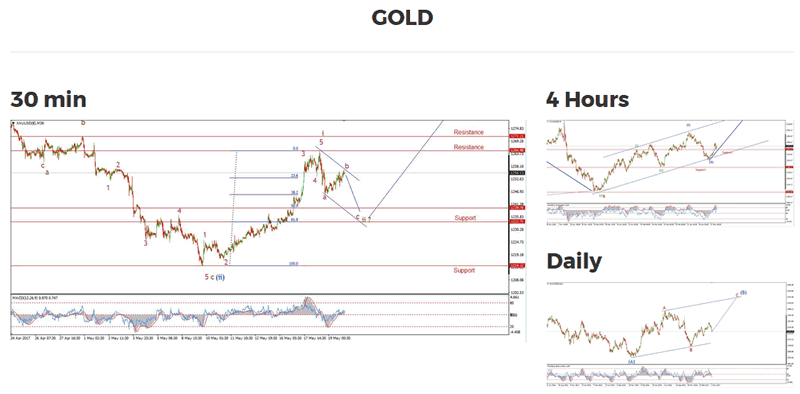

My Bias: Long towards 1550

Wave Structure: ZigZag correction to the upside.

Long term wave count: Topping in wave (B) at 1550

Important risk events: USD: FOMC Members Speak.

GOLD is now completing a very bullish elliott wave signal off recent lows.

Five waves up in wave 'i' brown,

and three waves down underway in wave 'ii' brown

Todays overlapping action points to a correction in wave 'b' pink.

with wave 'c' to follow.

Once this action completes the correction in wave 'ii' will be over,

the trend channel is pointing to a low in wave 'ii' at about 1233 at the 62% retracement level.

At that point, the price should rally strongly into wave 'iii' brown.

Thats the focus for Monday.

Wishing you all a great weekend,

until we meet again monday evening!

Enda Glynn

http://bullwaves.org

I am an Elliott wave trader,

I have studied and traded using Elliott wave analysis as the backbone of my approach to markets for the last 10 years.

I take a top down approach to market analysis

starting at the daily time frame all the way down to the 30 minute time frame.

© 2017 Copyright Enda Glynn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.