An Ethereum Price Forecast For 2017

Currencies / BlockChain May 22, 2017 - 12:10 PM GMTBy: InvestingHaven

The price of cryptocurrency Ethereum in 2017 is going through the roof, similar to the price of Bitcoin and several other cryptocurrencies. Our Ethereum price forecast for 2017 and later is very bullish.

The price of cryptocurrency Ethereum in 2017 is going through the roof, similar to the price of Bitcoin and several other cryptocurrencies. Our Ethereum price forecast for 2017 and later is very bullish.

Interestingly, there are no Ethereum price forecasts available on the web. So we are among the first ones to forecast the Ethereum price for 2017 and later. There is even no Ethereum price forecast on the official Ethereum site ethereum.org.

Ethereum price in 2017

The price of Ethereum is not moving ‘accidentally’ higher. There are several coins in cryptocurrencies universe, not all though, that are moving strongly higher. That is really a result of supply/demand dynamics. And here is the biggest news: this trend only got started. Are we saying that a bubble could develop over time? Yes that’s what we are saying, but not anytime soon yet.

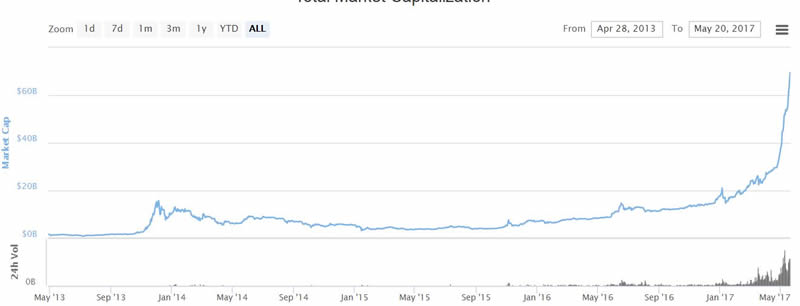

The total market cap of all cryptocurrencies combined has surpassed $60B meantime. To put that figure into perspective: Tesla’s market cap is $50B, Boeing Airlines $100B, Coca Cola $180B (rounded figures for April / May 2017).

In other words, cryptocurrencies are being bought and sold in this world, transactions take place, so they are on their way to become mainstream. Look how trading volume has exploded, see below chart, at the bottom of the chart.

There is nowhere any level of mainstream acceptance yet. Most people even have not heard of cryptocurrencies. So the above chart is about to become much ‘worse’.

The price of Ethereum in 2017 has literally exploded. Rightfully so, because its usage has exploded as well, as we will show in the charts in this article.

Note that readers can consult the latest Ethereum price in several ‘traditional’ currencies. Also, readers interested in Ethereum price news can consult the news section Coindesk.

At this moment in time, Ethereum’s price is trading around $125. So one Ethereum, one ‘coin’ of the cryptocurrency Ethereum, is worth $125. In recent weeks, the price of Ethereum has gone up fivefold.

An Ethereum price forecast for 2017

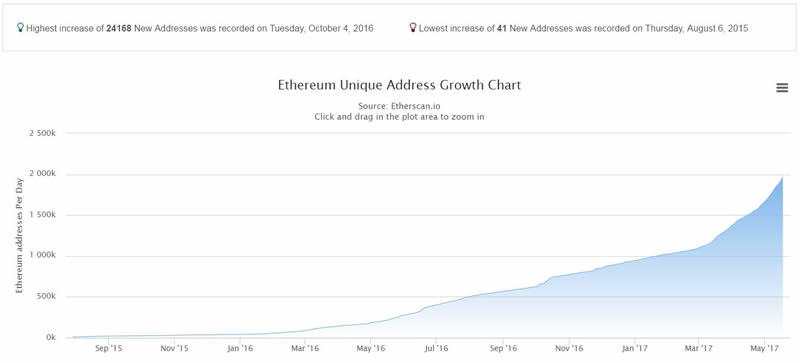

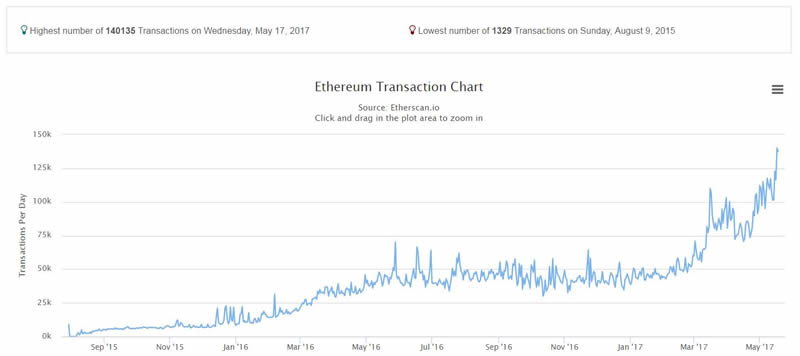

Our Ethereum price forecast is based on usage of Ethereum. Although it is very hard to know the volume that Ethereum projects consume, mostly because those figures are not available and many of those applications are private in nature, we can look into the usage charts to derive an idea.

Given the premature state of Ethereum, there is already a strong growth in transactions (2nd chart) and addresses (1st chart).

It is hard to forecast how these data points will develop, but the high level trend is what is of primary interest to us.

Given the enormous untapped potential of Ethereum, and the strong adoption among respected top banks across the globe, we believe this trend acceleration only got started.

Because of that, we forecast that Ethereum’s usage will go up fivefold this year.

Given those data points, our best case price forecast for Ethereum in 2017 is $550, which is a fivefold increase against the price of this wee

Original source: The article An Ethereum Price Forecast For 2017 originally appeared on InvestingHaven.com

Analyst Team

The team has +15 years of experience in global markets. Their methodology is unique and effective, yet easy to understand; it is based on chart analysis combined with intermarket / fundamental / sentiment analysis. The work of the team appeared on major financial outlets like FinancialSense, SeekingAlpha, MarketWatch, ...

Copyright © 2016 Investing Haven - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.