Debt Mile Markers on the Road to Ruin

Stock-Markets / Global Debt Crisis 2017 May 25, 2017 - 03:35 PM GMTBy: DeviantInvestor

We know much is currently wrong with our financial world, as discussed in the James Rickards book “The Road to Ruin” and elsewhere.

We know much is currently wrong with our financial world, as discussed in the James Rickards book “The Road to Ruin” and elsewhere.

- The official U.S. government debt is nearly $20 trillion. Unfunded liabilities are 5 – 10 times larger. Debt has doubled every 8 – 9 years for decades – since the Federal Reserve was put in charge of devaluing the dollar. Debt will continue to grow, obviously out of control.

- Millions of Americans are out of work, regardless of the official statistics.

- Prices increase, some rapidly, regardless of the official statistics on consumer price inflation.

- More government spending and debt are looming on the horizon. New and escalating wars are likely. Expect more deficits, debt, and inflation.

- The U.S. stock market is selling at all-time highs, levitated by “easy money” and unsupported by fundamentals or breadth.

Option A:

Trust the professionals who manage our digital and paper wealth which is backed only by debt, promises, fantasy, and confidence in the Federal Reserve and government. Believe official statistics and mainstream media that tell us things are peachy and not to worry.

Option B:

Use gold and silver bullion (not the paper stuff) as financial insurance to protect the buying power of some or most of our net worth. Based on a century of experience, we can depend upon central banks and global governments to devalue currencies, create more debt, and propel gold and silver prices far higher.

Really? Those options seem extreme. Why? Read on!

STOCK MARKETS:

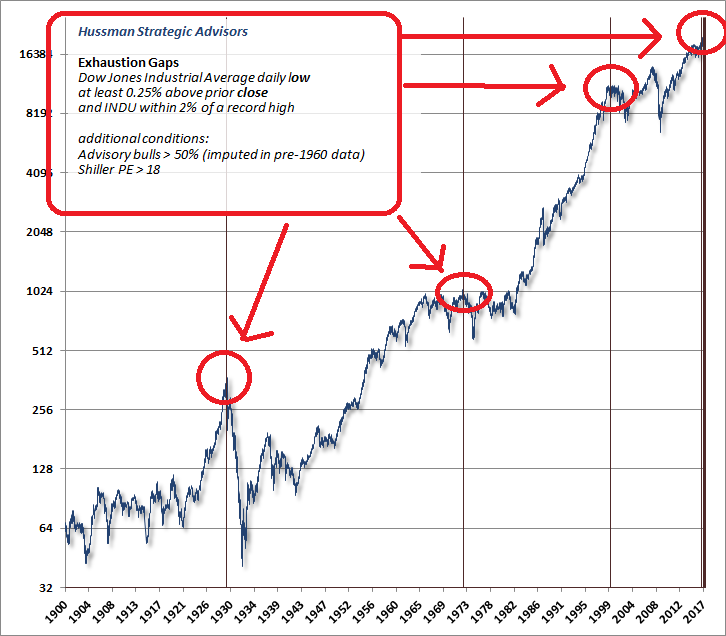

Consider John P. Hussman’s Exhaustion Gaps and the Fear of Missing Out.

Read David Stockman: Market Crash to Occur

“Our country needs a good shutdown in September to fix mess!”

“There will be no bid for the stock once the panic sets in.”

BUBBLES:

Mike Maloney created an easily understood video which is 35 minutes long and explains the “everything bubble.” Watch it! Stocks, bonds, real estate and more are discussed.

Bill Holter discusses “The End of the Empire.” (31 minutes) Watch it!

PENSION PLANS:

Constantin Gurdgiev discusses “U.S. Public Pensions System:

“Or, put more cogently, the entire system is insolvent.”

“… in … California, New Jersey, Illinois, etc. we are already facing draconian levels of taxation, and falling real incomes of private sector workers.”

“In other words, there is not a snowball’s chance in hell these gaps can be funded from general taxation in the future.”

GOLD AND SILVER:

Read Steve Warrenfeltz: Silver and Gold Pop!

Lior Gantz interviewed Gary Christenson (author) on his book “Buy Gold Save Gold! The $10 K Logic.” This youtube interview (62 minutes) discusses historical gold prices, on-going dollar devaluations, consumer price inflation, gold prices rising to $10,000 as the dollar is devalued, silver, and much more.

CONCLUSIONS:

- It is possible we will enjoy a century of global peace, return to honest money, eliminate the overhanging debt, balance the budget, and – insert your favorite fantasy here!

- Otherwise, bet on Option B – buy gold and silver bullion and store it outside the banking system. Prices will rise substantially as all fiat currencies are devalued further.

I discuss the ongoing devaluation of the dollar in my book: Buy Gold Save Gold! The $10 K Logic.” It is available at Amazon, or at gechristenson.com in paper and pdf for non-US readers.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2017 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.