Subprime 2.0: Lending a $1 Trillion to People With No Proof of Job or Income

Interest-Rates / Financial Crisis 2017 May 28, 2017 - 11:57 AM GMTBy: Graham_Summers

SubPrime 2.0 is proving far worse than even we suspected.

If you’ve not been following this story, our view is that the auto-loan industry is Subprime 2.0: the riskiest, worst area in a massive debt bubble, much as subprime mortgage lending was the riskiest worst part of the housing bubble from 2003 to 2008.

In both instances, these lending industries were rife with fraud, terrible due diligence, and the like. So when the debt bomb blew up, they were the first to implode.

However, it would appear now that the Subprime 2.0 was even worse than Subprime 1.0 in terms of verifying income.

Santander Consumer USA Holdings Inc., one of the biggest subprime auto finance companies, verified income on just 8 percent of borrowers whose loans it recently bundled into $1 billion of bonds, according to Moody’s Investors Service.

The low level of due diligence on applicants compares with 64 percent for loans in a recent securitization sold by General Motors Financial Co.’s AmeriCredit unit. The lack of checks may be one factor in explaining higher loan losses experienced by Santander Consumer in bond deals that it has sold in recent years…

Source: Bloomberg

Santander only verified income on just 8% of autoloans. Put another way, on more than 9 out of every 10 autoloans, Santander didn’t even check if the person had a job.

Pretty horrific.

However, the story also notes that even the more diligent lender AmeriCredit verified income on only 64% of loans.

So… two of the largest autoloan lenders basically were signing off on loans without proving the person even had a JOB either roughly half the time or roughly ALL the time.

And this is on a $1.0 TRILLION debt bubble.

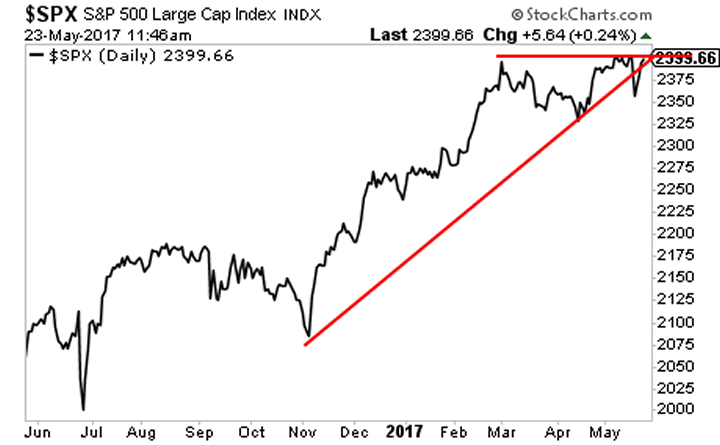

Meanwhile, stocks are flirting with all time highs.

Sounds a bit like late 2007 doesn’t it?

A Crash is coming… it’s going to horrific.

And smart investors will use it to make literal fortunes from it.

To pick up your FREE copy…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.