Bitcoin Price Sees Most Important Action in Years

Currencies / Bitcoin May 30, 2017 - 06:23 PM GMTBy: Mike_McAra

Bitcoin is right after a period of pullback from the recent all-time high. Is this move only a temporary correction or a beginning of a more sustainable move down? In an article on CNBC, we read:

Bitcoin is right after a period of pullback from the recent all-time high. Is this move only a temporary correction or a beginning of a more sustainable move down? In an article on CNBC, we read:

Nearly $4 billion has been wiped off of the value of bitcoin in the past four days after a correction that has seen the cryptocurrency's price fall almost 19 percent from its recent record high.

On May 24, bitcoin hit an all-time high of $2.791.69. But on Monday, the digital currency was trading at an intra-day high of $2,267.73, marking a more than $520 drop or 18.7 percent decline since the record high, according to data from CoinDesk.

"The correction was actually quite brief, the prices today are still higher than that of a week ago," Bobby Lee, CEO of BTCC, a major bitcoin exchange, told CNBC by phone.

"I think the pullback was just a profit taking, a correction from the skyrocketing prices of last week."

Is this the case? The short answer is that no one can really know for sure. The longer one is that the current situation looks like a typical correction from the top. The extent of the move down has been limited so far and the volume on which it has taken place has been relatively modest, at least compared with previous tops. This doesn’t necessarily mean that the correction is now over as the rebound from the move down has been rather weak.

For now, let’s focus on the charts.

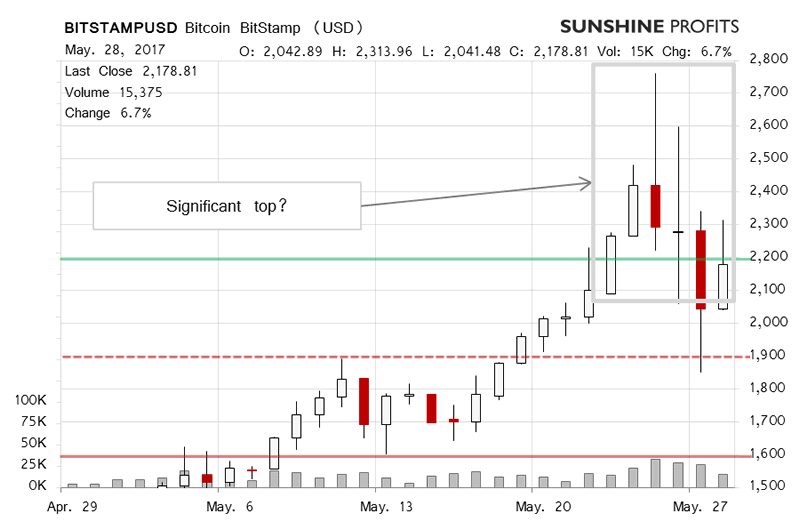

On BitStamp, we saw a move down from the recent all-time high and then a rebound from this depreciation. In our previous alert, we wrote:

As it turned out, we saw new all-time highs. The move took place on elevated but not spectacular volume. One one hand, we have a lot of momentum on the bullish side. On the other, the current action seems “crazy.” This means that Bitcoin has gone up very fast and very far. Such an environment has “depreciation” spelled all over it. But we haven’t seen a convincing sign of weakness yet.

What we previously wrote remains up to date also today. If anything, the situation only becomes more crazy. The current move bears all the hallmarks of a top. This is even more visible from the long-term perspective.

The move up really was to strong for such a limited period of time and a correction was long overdue. We actually saw one but the extent of the depreciation has been relatively weak, at least compared with previous important tops. At the moment of writing these words (around 8:00a.m. ET), Bitcoin is above $2,200 and even though this might seems like a long way from the top at over $2,750, it actually is well withing the magnitude of a move we might expect after a period of significant appreciation. In reality, the move down is not really strong in terms of price or volume. Quite importantly, Bitcoin is already obove the 38.2% Fibonacci retracement level based on the whole recent rally to the all-time high.

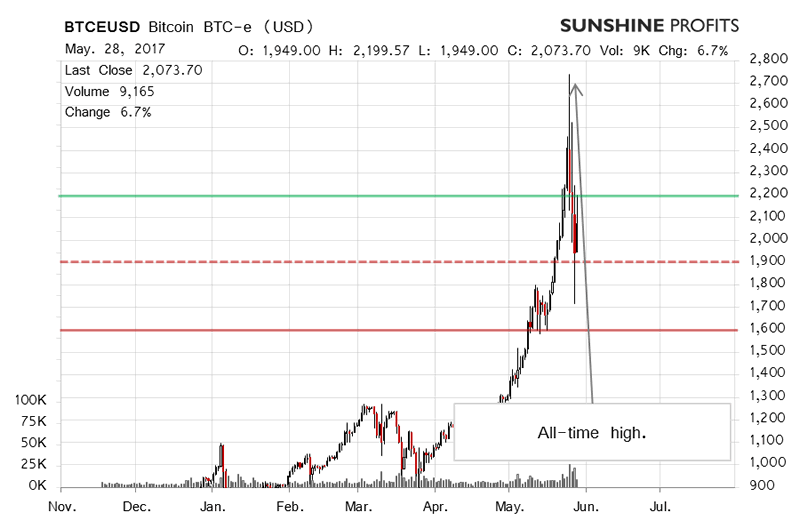

On the long-term BTC-e chart the recent meteoric rise of Bitcoin is clearly visible and so is the correction. In our previous remarks, we stated:

Bitcoin is now even further up than the chart suggests. At the moment of writing (...), Bitcoin is above $2,700, having already gone above $2,750 and back. The volatility is relatively high but not really high enough to suggest a top, at least by previous major tops’ standards. This means that we might still see some appreciation. Our take here is that a major top might be in within days, or even hours. Once we see a confirmation of a move down, we might have a top on our hands.

Right now, it seems that we might have a very important top behind us, however, the reasons we mentioned earlier in today’s commentary make this conclusion a lot less powerful than it might otherwise be. We see Bitcoin above the 38.2% retracement level and this calls an immediate move down into question. Make no mistake, the situation remains bearish as we might just be after the most important top in years, if not the most important top in the history of Bitcoin. However, to see the situation as bearish enough to consider hypothetical positions, we have to see an important catalyst and right now, we have only seen a correction from the top. Further depreciation might change the situation drastically, so stay tuned.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.