UK General Election 2017 Spread Betting Arbitrage to Lock in Risk Less Profits!

ElectionOracle / Spread Betting Jun 06, 2017 - 07:37 PM GMTBy: Nadeem_Walayat

With the opinion polls all over the as illustrated by the pollster based Conservative Party seats forecasts wide range from 304 (YouGov) to 380 . The spread betting markets are throwing up a disparate range of possibilities to arbitrage between the different quotes across a range of spread bet market makers.

With the opinion polls all over the as illustrated by the pollster based Conservative Party seats forecasts wide range from 304 (YouGov) to 380 . The spread betting markets are throwing up a disparate range of possibilities to arbitrage between the different quotes across a range of spread bet market makers.

Firstly a reminder of my forecast conclusion for the Tories to win on 358 seats as the following video illustrates:

So on the basis of my forecast conclusion and with 2 full days to go until the polls close my search has been on for spread and exchange betting market opportunities where the focus of this article will be one of locking in arbitrage opportunities i.e. profit without risk as one is both buying and selling the same market and pocketing the difference between spread betting market makers, after allowing for the bid / offer spreads!

FIRSTLY, understand that gambling is a high HIGH RISK activity and losses can exceed deposits. So if you don't have the stomach to take a loss then DO NOT TRADE OR BET!

As my primary UK election forecast expectation is for the Tories to win the election on 358 seats, a 66 seat majority.

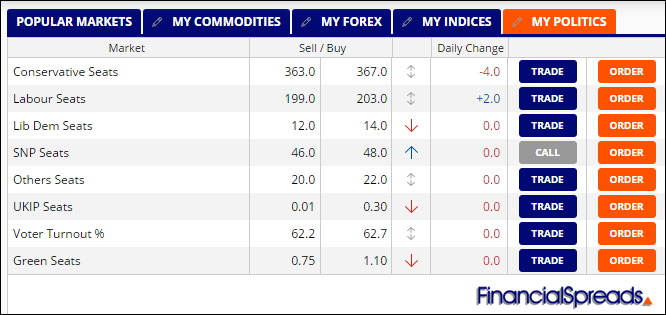

Recent prices quoted by the spread better Financial Spreads are :

(losses can exceed deposits)

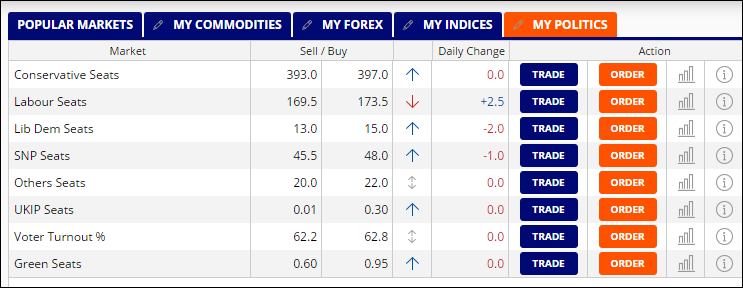

Therefore the Tories are currently trading at 365 against my forecast of 358, which at the moment does not present much of an spread betting opportunity. However market volatility is very high i.e. here are the spread betting prices from just a couple of weeks ago :

And the following graph further illustrates Conservative seats market volatility :

UK Election Spread Bet Risk less Arbitrage Opportunities

However, there are also risk less profit opportunities when comparing prices across spread betting market makers, for instance here are the current quotes from three spread betters at the same time.

Conservative seats: 365 - 369

Labour seats: 199.5 – 203.5

Conservative seats: 355 - 361

Labour seats: 208 - 213

Conservative seats: 357 - 363

Labour seats: 206 - 212

So here the arbitrage could be to BUY IG Conservative seats at 361 and SELL Financial Spreads at 365 for a risk free locked in profit of 4 points per amount bet. i.e. £100 per seat would convert into a risk less arbitrage locked in profit of £400! No matter what the result of the election turns out to be!

Or BUY Labour at 203.5 Financial Spreads and SHORT Labour at 208 IG thus locking in 4.5 points.

Thus profiting by locking in profits from the difference in the price of seats quoted between spread bet market makers.

And is usually the case for such events such as elections is to expect increased market price volatility that is likely to result in many short-term arbitrage opportunities as we countdown to the election result!

Therefore I expect volatility in the wake of for instance YouGov's crazy polls to deliver market opportunities both in the countdown and in the immediate aftermath of the UK General election result, just as occurred during the US Presidential Election and the EU Referendum.

So it could be worth keeping a very close eye on the spread betters for significant deviations both from my forecast and form one another's prices for arbitrage opportunities. Again do remember that betting is high risk and losses can exceed deposits, so if you cannot stomach a loss then DON'T BET!

Ensure you are subscribed to my always free newsletter for my latest analysis and to our youtube channel for videos in the BrExit War series.

By Nadeem Walayat

Copyright © 2005-2017 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.