How The Smart Money Is Playing The Lithium Boom

Commodities / Lithium Jun 12, 2017 - 02:08 PM GMTBy: OilPrice_Com

Lithium is the hottest commodity on the planet right now, and investors trying to profit from it don’t understand how to invest in it.

Lithium is the hottest commodity on the planet right now, and investors trying to profit from it don’t understand how to invest in it.

MOST ARE MAKING A CRITICAL MISTAKE and investing in the wrong companies.

That’s because, in this game, lithium GRADE is the key to profitability.

Why? First, lithium...

Lithium is the most important component of electric vehicles, high-energy batteries, power storage, a vast menu of consumer electronics—and even Nirvana-reaching drugs.

Even today’s hyper-growth EV industry is just the tip of the iceberg compared with where it's headed to. Bloomberg New Energy Finance predicts that 35% of all new vehicle sales by 2040 will be EVs, equivalent to 100 million units every year.

Tesla’s “halo effect” will make astute investors lifetime riches because that's 100 times greater than current production.

All that growth will present some serious supply chain challenges. But in this massive opportunity, the key to everything is GRADE. Not all lithium is equal.

The majors can increase production, but only to a certain degree--and not nearly fast enough to meet growing demand. If you are looking for outsized gains on your lithium investment, you need to expand your horizon to new entrants with high-quality reserves.

The #1 secret to hitting a homerun with lithium is watching the grade. And for this, follow the lead of China, which has turned its attention to Chile—one of the world’s richest sources of high-grade, low-cost lithium.

And … one little-known miner is perfectly positioned to take advantage of this space while China, Tesla and everyone else battle it out—Bearing Resources (TSX.V:BRZ; OTCQB:BRGRF).

This pure-play junior miner has just acquired a world-class resource and the second-largest lithium project in the world—IN CHILE.

They’ve already undertaken a $7-million exploration program that hit pay dirt. The drilling campaign hit on every single hole—in high-grade brine. In fact, it’s one of the highest-grade projects in the world—second only to the Salar de Atacama, which, right now, produces 100 percent of Chile’s lithium.

With drilling virtually complete, all that is left to do is a definitive feasibility study, which is a construction decision due out in early 2018. They have a free carry through all of this, so no worries about having to raise any extra money or dilute existing shareholders by issuing more shares.

This is the find that will ultimately define CEO Jeremy Poirer's illustrious career.

Here are 5 reasons to watch Bearing Resources Ltd. (TSX.V:BRZ; OTCQB:BRGRF) very closely:

#1 Grade is King, Grade is King, Grade is King

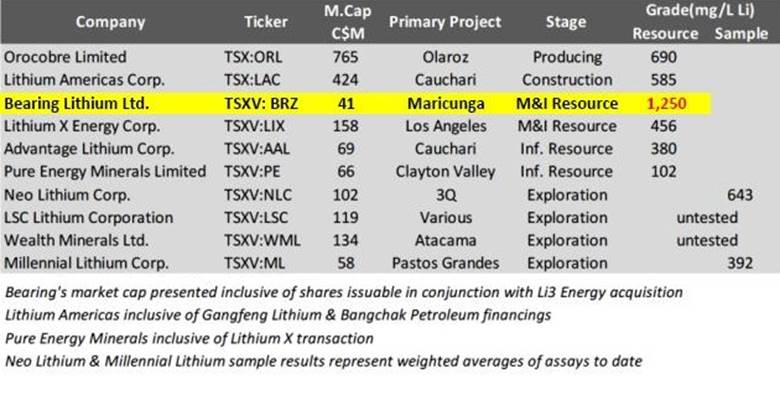

Featuring extra-high-grade brine, Bearing’s newest resource is the highest grade undeveloped lithium brine resource in the world, bar none.

With the exception of the Salar de Atacama, none of the developed fields even come close in sheer purity and abundance of Lithium in its brine deposits.

The project resulted in the highest grade of lithium anywhere outside of the Salar de Atacama, with average grade of 1,250 parts per million.

The company drilled 18 holes, performing pumping tests, float tests and building evaporation ponds... and then hit ‘white petroleum’—hard. The drilling campaign hit on every single hole, some of which were all drill holes targeting 200 meters. One of the holes was 360 meters and still bottomed in high-grade brine.

And a grade of 1,250 parts per million … that's 2-4 times higher than any Argentinian project grades. The new reserve is expected to be completed sometime in July, and it’s expected to double the company’s current reserves.

High-grade lithium producers are where EVERY EV manufacturer will be looking as they seek to keep battery production costs low.

Watch what’s been happening in China: Prices of battery-grade lithium in China, the biggest Li-ion battery producer, surged above $20,000 per tonne in 2016--much higher than the global average.

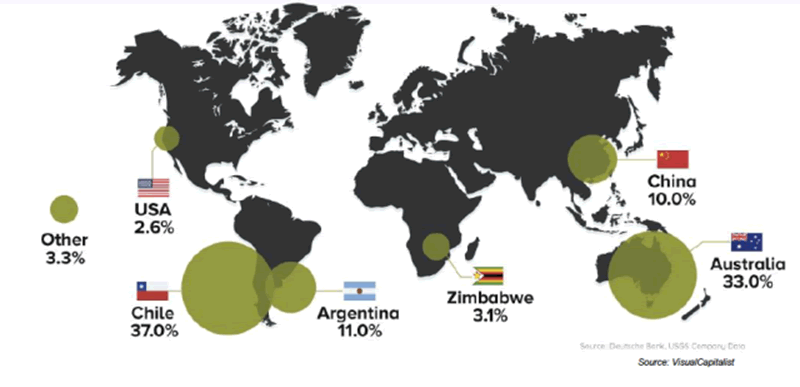

Now, China has traditionally sourced its lithium from Australia, but increasing competition in the EV space and falling prices of EVs has forced it to look elsewhere for cheaper sources. Again, we head back to Chile—a true lithium powerhouse and the largest producer in the world.

And, unlike in Australia where the metal is extracted from hard-rock mines, Chilean lithium is mined from brines located just below easily accessible salt flats. The Atacama salt flat in Chile is the source of 37 percent of the world's entire lithium production.

Chinese and Korean investors are already engaged in advanced talks with the Chilean government to open up a huge $2 billion Lithium battery plant to feed on the country's rich lithium reserves. This could kick off an even more ferocious scramble for the precious metal--especially if China starts hoarding and puts further pressure on already constrained supplies.

So, it’s not surprising that stocks of publicly-listed lithium mining companies in Chile have been outperforming their counterparts from other countries.

Company |

Country of Origin |

Year-to-Date Change |

12-Month Change |

Sociedad Quimica y Minera de Chile |

Chile |

25.8 percent |

64.1 percent |

Red River Resources Ltd. |

Australia |

3 percent |

55.6 percent |

Altura Mining Ltd. |

Australia |

4.5 percent |

-36.36 |

Lithium X Energy Corp. |

Canada |

4.6 percent |

-8.9 percent |

#2 Low Costs, High Flow Rates

Not only is the resource high grade... but it’s LOW COST, thanks to the high quality of the resource and proximity to critical infrastructure. Most Lithium mines are located in the outback, which increases mining and operational costs significantly.

Luckily for investors, this project is adjacent to an International Highway, and is adequately supplied with grid power. Flow rates from pump testing at the new project rank among the highest values reported in South America, which will help to keep costs even lower... and profits high.

Low production costs are extremely important for EV manufacturers, now more than ever.

Batteries and powertrains account for the biggest chunk of EV manufacturing costs. The high cost of these line items is the #1 Reason why EVs have remained pricier than they could be. But advancements in battery technology have helped bring costs down--so much so that Tesla can now afford to offer the Model 3 for just $35,000, or half the price of an entry-level Model S.

EV manufacturers are keen to keep lowering their production costs in a bid to quickly grow their addressable markets. Economically recoverable lithium deposits are quite limited, and low-cost lithium producers like Bearing Resources (TSX.V:BRZ; OTCQB:BRGRF) will be highly sought after.

#3 Chile: World's Richest Lithium Venue

Chile is home to the world's largest and richest Lithium deposits...the salt pans of the formidable Atacama Desert. This is a 600-mile-long strip of land sandwiched between the snow-capped Andes and the Pacific Ocean.

The Atacama Desert is the world's driest non-polar desert...yet these inhospitable conditions make it one of the best places on earth to extract Lithium.

While lithium may be Chile’s ‘white petroleum’, and the country may be the ‘Saudi Arabia of Lithium’, getting your hands-on concessions and permits isn’t easy.

The Chilean government is very stingy when it comes to issuing lithium-mining permits and concessions, so it’s typically a rough venue to get started in. But not for Bearing Resources.

Bearing already has grandfathered concessions - which gives the company a major head start over competitors who are trying to come in later to this game.

#4 Lithium Legends with Powerful Partners

Bearing (TSX.V:BRZ; OTCQB:BRGRF) has a world-class team with a proven track record, and some partnerships that pack real power in Chile and on the lithium supply scene in general.

Posco, one of the world's largest steel companies, has already sunk $18 million into Li3 Energy, the company Bearing is acquiring, and it has brought its proprietary lithium technology to the table to make this one of the most potentially profitable lithium projects in the world. This lithium tech has been successfully tested at an impressive 88 percent recovery rate--DOUBLE the industry standard of 40 percent-60 percent.

And.... company CEO, Jeremy Poirer, is a proven winner, having successfully negotiated major supply deals with Pure Energy and... TESLA.

When it comes to relationships, this company has them in all the high places.

#5 Major Announcement Coming Soon...

Bearing (TSX.V:BRZ; OTCQB:BRGRF) is on track to close the acquisition of a new project in short order, which it will duly announce to investors.

Again, grade is king, and with world class partners and advanced production methods, Bearing is slated to become the lowest-cost producer in the industry. This is a potential near-term production timeline... Other lithium projects aren’t anywhere close to production, meaning Bearing is virtually guaranteed a nice pipeline of customers.

Bearing also has a strong cash position and money in the bank—that means that what is basically a $20M market cap company is sitting on super major property.

We need a huge Lithium supply ramp—YESTERDAY.

Near-future demand is so overwhelming that we are in real danger of massive deficits. Current global Lithium-ion cell production can only supply 900,000-1 million electric vehicles.

Tesla is on course to kick off production of its first mass-produced vehicle--the Model 3-- in July, and has already amassed 373,000 reservations. That's five times the company's 2016 sales.

Tesla has a goal to produce 500,000 Model 3s per year by the end of 2018, and could hit a million units as early as 2020. The company also sells home and industrial energy products, including Powerwalls. About 51Kg of Lithium goes into each Model S, while each Powerwall 2.0 unit packs 10Kgs of the metal.

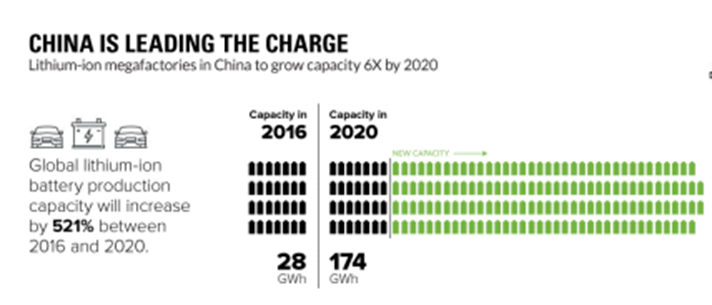

Global production will ramp up more than 500 percent between 2016 and 2020, with China doing much of the heavy-lifting.

Source: Visual Capitalist

By 2025, the battery market alone will be twice as big as today's entire lithium market—and then overwhelming becomes … well, even more overwhelming.

Therein, of course, lies the massive opportunity, but it’s not a blanket opportunity: Grade determines who gets rich in this energy revolution. Chile got it, and Bearing is right there.

By. James Burgess

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Oilprice.com only and are subject to change without notice. Oilprice.com assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. All content contained herein is subject to the terms and conditions set forth in the original article posted on Oilprice.com and subject to the terms and conditions therein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.