GDXJ Gold Stocks Massacre: The Aftermath

Commodities / Gold and Silver Stocks 2017 Jun 20, 2017 - 12:25 PM GMTBy: The_Gold_Report

Veteran investor Bill Gross' investment strategy offers lessons to all investors, says Lior Gantz, editor of Wealth Research Group.

Veteran investor Bill Gross' investment strategy offers lessons to all investors, says Lior Gantz, editor of Wealth Research Group.

GDXJ Rebalance

PIMCO (Pacific Investment Management Company) is the largest American-based, private investment company focused on bonds.

As of its last filing, it had over $1.51 trillion in assets under management—that is significant, and the man who founded the company, Bill Gross, has a lot to do with it.

I first learned about him through his speeches and through conferences he had been a keynote speaker at, and his humble demeanor inspired me to make changes of my own.

Bill started his investment career by chance, while on a hospital bed where he was recovering from a medical issue, and because of the many leisure hours this had provided him with, he learned the game of poker through books.

At 73, he is now worth $2.4 billion, and his philanthropy has been very generous.

What Bill learned is what many of the greats have perfected, which is a strategy I coined as "Chameleon Investing."

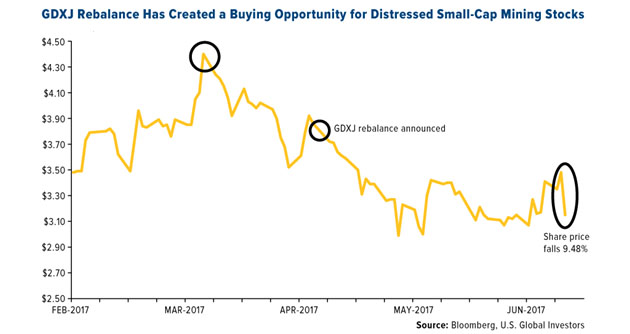

This is one of a few examples of how short selling, forced liquidation, and naïve panic from amateurs brings down the price of shares of components of the GDXJ (VanEck Vectors Junior Gold Miners ETF). This is why having a Watch List is essential.

Bill Gross and ultimate commodities investor Jim Rogers have realized—Bill from playing Poker and Jim from launching his Quantum Fund right when Nixon set gold loose—that in the markets, you have to ambush your prey by sitting quietly and waiting, just like the chameleon does.

Bill understood that he only had to bet big, and I mean really big, when the cards he was dealt were unbelievably favorable, and he needed to fold the rest of the time.

Rogers has done the same. His greatest "Chameleon" quote comes from the must-read book "The Market Wizards," where he says: "I just wait until there is money lying in the corner and all I have to do is go over there and pick it up. I do nothing in the meantime. You should sit there until you find something."

This is "Chameleon" investing: sitting, waiting, patiently allowing the other participants of the stock market to bring you the fattest prey, and only then going for that kill.

That moment has just arrived for junior resource investors.

Wealth Research Group is now in the midst of a 10-day marathon where we're going through the entire GDXJ components sell-off and speaking to the management teams of companies whose shares were liquidated, with the purpose of finding just one company.

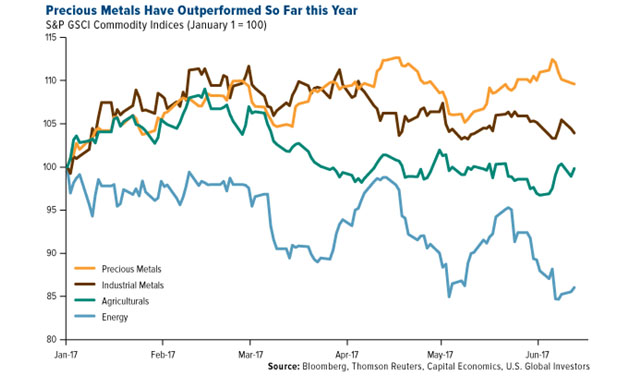

Precious metals are outperforming other commodities, which is the first sign of a renewed bull market.

I am not totally convinced or excited yet, though, which is why now is the best time to prepare by studying what works for junior mining stocks.

The debt burdens are putting a major cap on growth. We are in a neutral world that is only capable of slow growth when interest rates are severely low and artificially kept that way.

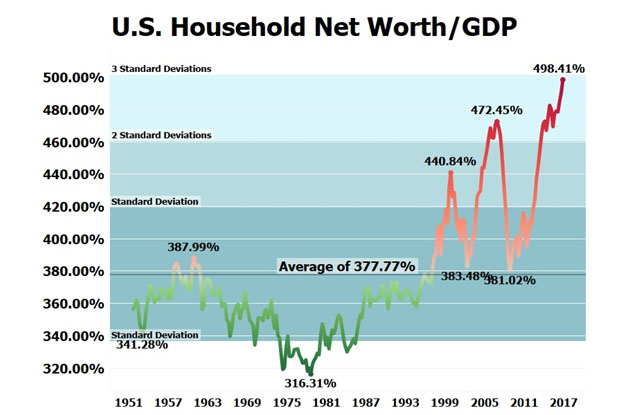

This is what the Fed wanted to achieve—the "Wealth Effect."

The net worth of households in America is at a record high of $94.835 trillion, but as you can clearly see, the GDP is not even close to justifying the worth of the people who are responsible for it.

We are floating on a giant mattress of debt, and the springs can honestly break at any moment.

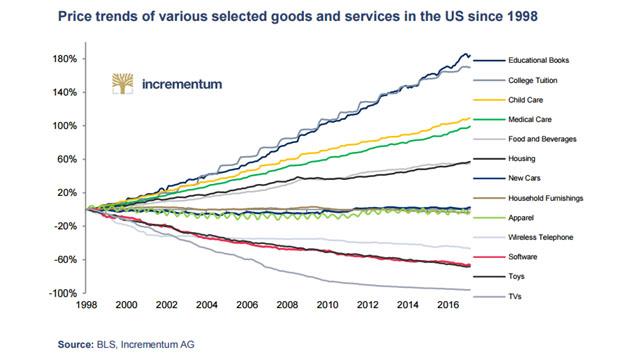

So long as they don't, what we experience is stagflation, which is a low inflation rate overall but a massive rise in prices with specific items.

So long as stagflation persists, the gold price will continue to trend higher, but only moderately.

For the junior equities to explode, gold must be above $1,300, and that will not happen without higher inflation rates.

Now, judging from this, my strategy has been to totally avoid the ETFs that track gold and silver juniors, especially the leveraged ones, and focus on the quality companies while using technical weaknesses to short the gold index as a group (DUST).

This has allowed me to scoop up and build a powerful portfolio while taking advantage of the sideways action since August and for the time being, I’ve been enjoying fat (but small) profits from cryptocurrencies.

Now, there's only one piece of the puzzle left: I want to position with the company that has the biggest upside potential in times of rising gold prices, and I will find it this week.

The massacre has made companies trade for generationally low multiples, and when inflation picks up again, if your chessboard is ready for the final move, the game is yours.

Lior Gantz, an editor of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by Wealth Research Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.