Charts Show Why Emerging Markets Will Be an Essential Part of Your Portfolio Going Forward

Stock-Markets / Emerging Markets Jun 27, 2017 - 01:09 PM GMTBy: John_Mauldin

BY STEPHEN MCBRIDE : A major theme at the 2017 Strategic Investment Conference was the shift in economic power from developed markets to emerging markets (EMs).

BY STEPHEN MCBRIDE : A major theme at the 2017 Strategic Investment Conference was the shift in economic power from developed markets to emerging markets (EMs).

For example, in 1960, the combined GDP of China and India made up only 5% of global GDP; today, it’s 30%.

In 1970, the G7 bloc made up half of global trade; now it makes up just 30%. It’s no wonder emerging markets are growing at almost three times the rate as the G7.

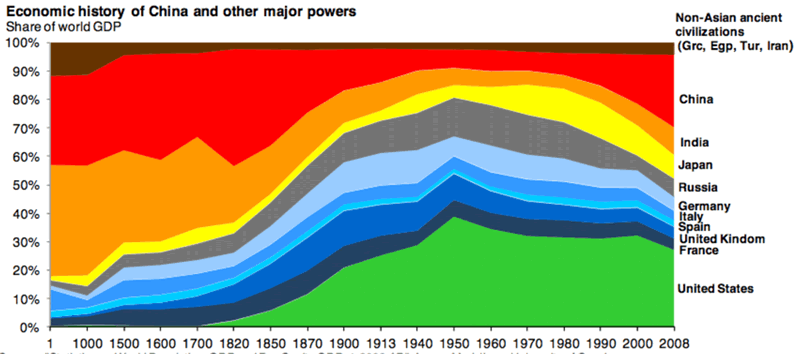

The Rise of China and India

This chart from JP Morgan shows the re-emergence of China and India over the last four decades.

Source: Michael Cembalest, JP Morgan

With major economic changes now underway in both nations, they are likely to play an increasingly larger role in the world going forward.

Here’s a look at some of the biggest developments in EMs and their wide-ranging implications for investors.

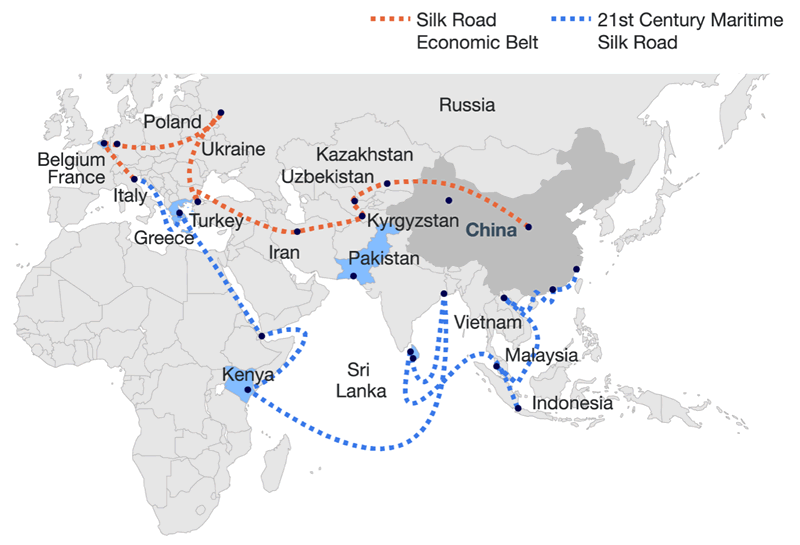

One Belt, One Road

Dubbed “the new Silk Road,” One Belt, One Road aims to create the world’s largest platform for economic cooperation between China and the rest of the world.

It's an infrastructure project unlike anything we have ever seen.

Source: McKinsey Global Research

As founder and CIO of Morgan Creek Capital Management Mark Yusko quipped at SIC 2017, “One Belt, One Road, Multiple Bull Markets.”

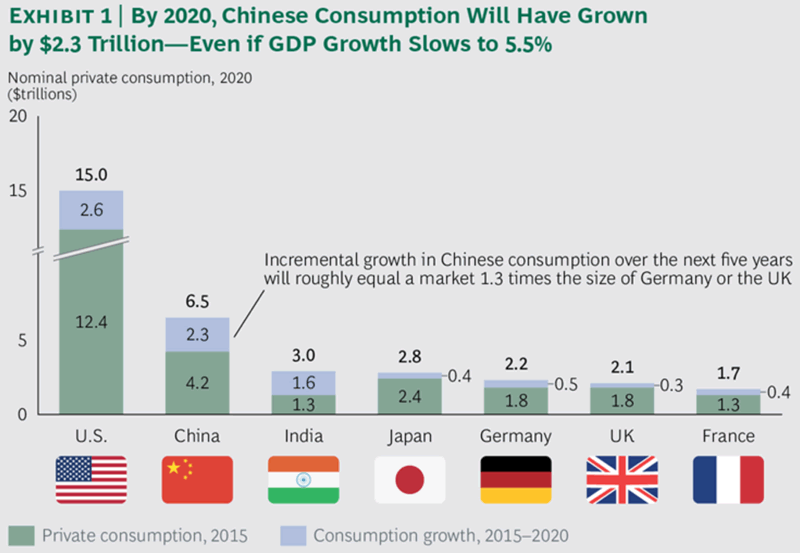

China’s Growing Middle Class

The American consumer still drives the global economy, but that baton will likely be passed to China’s middle class sometime this century.

According to McKinsey, just 4% of China’s urban population was considered middle class in 2000. By 2020, 76% will be—a 19-fold increase. And with more spending power comes greater consumption.

Boston Consulting Group projects China’s total consumption will increase by 55% to $6.5 trillion by 2020.

Source: Economist Intelligence Unit, BCG Analysis, WebForum.org

That’s more than the UK, Germany, and France combined.

India’s Banks

One of India’s massive barriers to growth has been the volume of non-performing loans in its banking system. It has risen fourfold since 2009.

Much was made of President Modi’s move to demonetize the country in December.

However, taking 85% of the currency out of circulation did achieve something very important. It recapitalized India’s banks. Since demonetization, over $80 billion has flowed into the banking system.

With an exploding population now accounting for over 17% of the global total, the set-up in India looks very bullish.

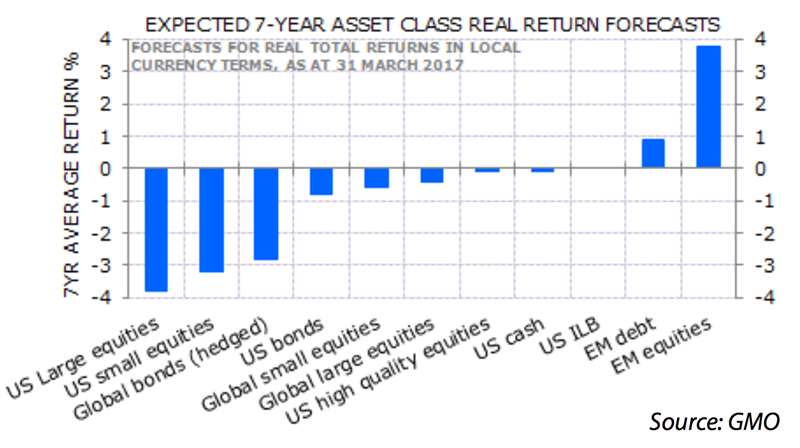

EMs Will Overtake US Equities

With these massive bullish developments, there’s little doubt EM assets will play a key role in your portfolio going forward.

And despite growing at twice the speed of US equities, EM assets are still very cheap relative to developed markets today.

Asset management firm GMO projects that returns for US equites and bonds will be negative over the coming years… while EMs will continue to generate profits.

However, these aren’t only projected results. Since the beginning of 2017, the MSCI Emerging Market Index has outperformed the S&P 500 by 154%.

Download a Bundle of Exclusive Content from the Sold-Out 2017 Strategic Investment Conference

Get access to exclusive interviews with John Mauldin, Neil Howe and Pippa Malmgren from SIC, an ebook from renowned geopolitical expert George Friedman and bonus SIC 2017 content…

Claim your SIC 2017 bundle now!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.