Shrinkflation In UK – Real Inflation Much Higher Than Reported

Economics / Inflation Jun 28, 2017 - 12:49 PM GMTBy: GoldCore

Shrinkflation – Real inflation much higher than reported and realised

Shrinkflation – Real inflation much higher than reported and realised- Shrinkflation is taking hold in consumer sector

- Important consumer, financial, monetary and economic issue being largely ignored by financial analysts, financial advisers, economists, central banks and the media.

- Food becoming more expensive as consumers get less for price paid

- A form of stealth inflation, few can avoid it

- Brexit is the scapegoat for shrinkflation by the media and companies

- Consumers blame retailers rather than central banks

- Gold hedge has doubled in value since 2007

Editor: Mark O’Byrne

Shrinkflation: no one left untouched

600 new words entered our official lexicon this week as the Oxford English Dictionary announced the latest new additions to their online records.

One of the words reportedly up for consideration was shrinkflation. It did not make the final cut and as a result continues to be defined by the authority as ‘a portmanteau, made from combining shrink: ‘to become or make smaller in size’, with the economic sense of inflation: ‘a general increase in prices and fall in the purchasing value of money’.

In order for a word to be accepted into the OED it must have been in use for at least five years. But the latest list suggests that this isn’t the case and exceptions can be made. The inclusion of ‘superbrat’, a word which is usually associated with the behaviour of John McEnroe in the 1970s, actually dates back to the the 1950s.

Yet, shrinkflation continues to elude the world’s authority on the English language. This seems bizarre to us given both the word and the phenomenon and something consumers have been experiencing for a number of years.

Although it is understandable in the context of an important consumer, financial and economic issue which is being largely ignored by financial analysts, financial advisers, economists and the media.

We first covered the shrinkflation phenomenon back in 2014 when we reported how Dr. Philippa Malmgren had highlighted this ‘shrinkflation’ trend in a new book.

Shrinkflation: a new phenomenon?

As we mentioned last week, shrinkflation is a phenomenon that is not unique to the current financial crisis. In 1916 The Seattle Star ran a front-page story on the issue, ‘“[Inspectors] went from bakery to bakery Thursday checking up on the bread situation…And here is what they found: ten-cent loaves of bread have shrunk from 32 ounces to 22 ounces, and standard 5-cent loaves, that used to weigh 16 ounces, now average 11 ounces.”

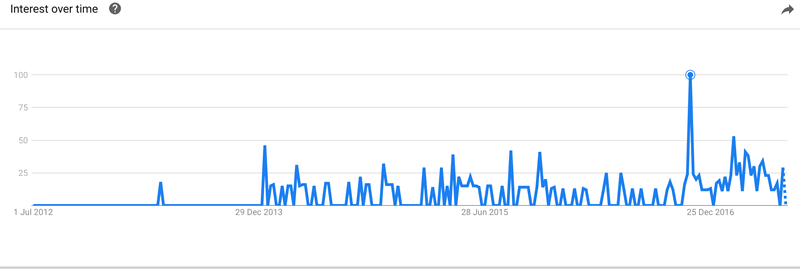

Search Graph for Shrinkflation (Google)

Granted, back in 1916 the word ‘shrinkflation’ was not in use but it had a place firmly in the economy. Use of the word shrinkflation has been picking up pace since at least 2012. We can see this by the examining the search history for the phrase on Google.

You can clearly see a peak in the search for the term in November 2016. It was at this point when news of the newly designed Toblerone hit the British newspapers. Mondelez, Toblerone’s manufacturers had announced they would be reducing the bars from 170 grams to 150 grams in the UK which would affect the shape.

Mondelez’s justification for the change was due to an uptick in ‘many ingredients’ prices’, the company specifically blamed the drop of the euro against the Swiss franc in January, and an increase in cocoa prices over the last three years.

It’s not just Toblerone fans who are feeling the pinch on chocolate bars. Creme Eggs and Quality Street (other British high street favourites) have been shrinking, with price remaining the same.

Other household items and food prices have also been affected.

Brexit is the scapegoat

Even though we can go back nearly 100 years to witness shrinkflation and see evidence of it in our household items and online searches, it is only in the last year that manufacturers and the media have managed to find a reason for its existence.

Brexit is being blamed – as it is being blamed for a number of woes being experienced in the UK at present.

Brexit seems to be bearing the brunt of the blame for the recent shrinkages, thanks to the impact of the referendum of the price of sterling. You don’t need to have a PhD in economics to understand the effect this has on prices.

12 months since the vote sterling is still weak, it is 15% down against the US dollar, and 14% against the euro. Things are expected to get worse, with HSBC analysts expecting the pound to hit parity with the euro by the end of the year.

There is little doubt that a weak currency will impact the cost of raw goods and materials which make up chocolate bars and other items. However shrinkflation existed even when the pound was strong.

No sign of easing up

In 2015 the Irish Times reported on this very topic and referred to a 2014 Which? survey:

Aunt Bessie’s Homestyle Chips were reduced in size from 750g to 700g, while a box of Surf with Essential Oils washing powder fell in size from 2kg to 1.61kg. In 2014 there was 750g of mixed vegetables in a Birds Eye Select bag; today it is 690g. Cif Actifizz Multi-Purpose Lemon Spray and Domestos Spray Bleach Multipurpose Cleaner were reduced in size from 750ml last year to 700ml today…

‘The shrinkage does not end there. In previous years, Which? has recorded one- litre tubs of Carte D’Or ice cream turning into 900ml tubs, while a litre of Innocent smoothies became 900ml. Magnum ice creams, which used to be 360ml, are now 330ml, and the size of a bar of Imperial Leather soap fell from 125g to 100g, a reduction of 20 per cent…

‘The list goes on. A packet of 48 Persil washing tablets turned into a packet of 40, a decline of 16.6 per cent, while 56 Pampers Baby Wipes used to be a packet of 63, an 11.1 per cent reduction.’

This was well before the EU referendum. It was impossible to blame a weak currency, instead this was and remains all about the impact of real inflation on consumer prices. This is despite having been told for years that inflation was very low.

Inflation expectations are relatively low amongst households in the UK, EU and U.S.

Only now are we beginning to see both officials and individuals wake up to the presence of inflation in the UK. In May consumer prices accelerated faster than BoE expectations. They hit a four-year high of 2.9% and are expected to exceed 3% in the coming months.

In the UK, there are some concerns and dissent has increased in the BoE’s monetary policy committee (MPC) over the suitability of its record low interest rate policy in regard to rising inflationary pressures. It has been some time since we have seen any sign of concern regarding inflationary issues, from members of the MPC.

Meanwhile in households it looks like it has taken the appearance of a chocolate bar to drive the message home that businesses are experiencing price pressures. Unfortunately this has merely come out as anger towards companies rather than the central banks and governments who are ultimately responsible for this inflationary issue.

Unjust for consumers or time to take responsibility?

Which? magazine and consumer action groups have tried to bring retailers to account for what are considered to be misleading practices.

In Ireland, the Consumer Association’s Chief Executive stated

“I don’t know if we can say consumers are being deliberately misled but they are being put in a position where it becomes very difficult to make informed decisions.”

“I think the worst example of this is the widespread shrinking of products. The content gets smaller but the price and the packaging stays the same. These are price increases by stealth, and by any measure inflation of this nature is abnormal in the current environment. I think they are appalling.”

As we have seen with quantitative easing, bank bailouts and the overall financial crisis consumers seem to be relatively disinterested in fighting back against these practices that ultimately cost them more.

A YouGov survey found that 46 per cent those polled would prefer to pay more for an item than see it shrink. Yet 36 per cent said they’d be satisfied if the pack got smaller, but the price stayed the same.

The same survey run by YouGov Portion Sizes and Health found that firms risk losing over a third of their customer base if they cut pack sizes by 15 per cent.

While there is uproar on Facebook pages about this topic, the concerns of some consumers are not being voiced by politicians, economists, central bankers or the media.

Depite the zeitgeist of the moment, this isn’t about retailers taking advantage of consumers. Shrinkflation is a very serious byproduct of a practice which has been going on for many years now.

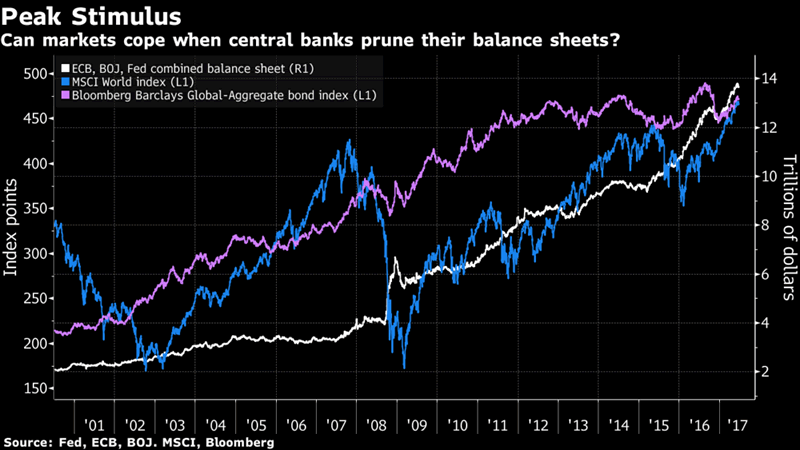

Shrinkflation is just inflation in stealth mode and is the consequence of currency debasement on a scale that the world has never seen before.

It brings the economy’s problems literally to the kitchen table.

We are finally at a point where those who have so far been apparently untouched by the financial crisis i.e. the middle classes who still have jobs, they have seen their homes increase in value and they still go abroad twice a year, are beginning to see their cost of living increase.

As are the working classes, pensioners and those on low salaries or fixed incomes.

They will soon recognise that no one is left unharmed by the monetary and economic policies which followed the financial crisis.

Easy monetary policy is wealth ignorant. It gives little regard to how you spend your money and where you hold your cash. That’s why savers have to make room for those real assets which cannot be shrunk down and magicked away.

Investments such as gold and silver by their very nature are immune to the shrinkflation effect and are an important hedge against it.

Next time you’re considering that bar of Toblerone at the supermarket checkout, just imagine how much is missing compared to when you would have bought with the proceeds of your first payslip.

Then consider how much a bar of gold would have changed since then, the fact is that it hasn’t. You would still have the same sized bar, with the same gold content and it is worth a lot more now.

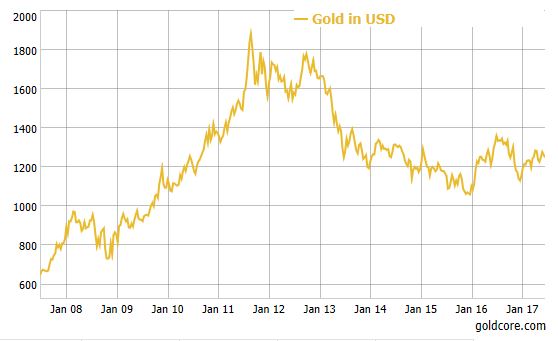

Gold in USD – 10 Years

Gold is twice the price it was before the crisis in 2007. While many household goods and products are higher in price or the same price but a much smaller size.

Shrinkflation is happening and real inflation is much higher than is being reported or people realise.

Your purchasing power and your wealth can be preserved from the ravages of shrinkflation, just don’t expect it to happen courtesy of central banks and governments.

Gold Prices (LBMA AM)

28 Jun: USD 1,251.60, GBP 976.25 & EUR 1,101.91 per ounce

27 Jun: USD 1,250.40, GBP 980.31 & EUR 1,111.36 per ounce

26 Jun: USD 1,240.85, GBP 975.56 & EUR 1,109.32 per ounce

23 Jun: USD 1,256.30, GBP 987.70 & EUR 1,125.27 per ounce

22 Jun: USD 1,251.40, GBP 988.36 & EUR 1,120.13 per ounce

21 Jun: USD 1,247.05, GBP 989.04 & EUR 1,118.98 per ounce

20 Jun: USD 1,246.50, GBP 981.99 & EUR 1,117.24 per ounce

Silver Prices (LBMA)

28 Jun: USD 16.78, GBP 13.08 & EUR 14.78 per ounce

27 Jun: USD 16.66, GBP 13.07 & EUR 14.79 per ounce

26 Jun: USD 16.53, GBP 12.98 & EUR 14.79 per ounce

23 Jun: USD 16.71, GBP 13.12 & EUR 14.97 per ounce

22 Jun: USD 16.58, GBP 13.09 & EUR 14.85 per ounce

21 Jun: USD 16.51, GBP 13.03 & EUR 14.81 per ounce

20 Jun: USD 16.59, GBP 13.10 & EUR 14.88 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.