The Fed Has Officially “Rung the Bell” For the Stock Market Top

Stock-Markets / Stock Market 2017 Jun 29, 2017 - 05:34 PM GMTBy: Graham_Summers

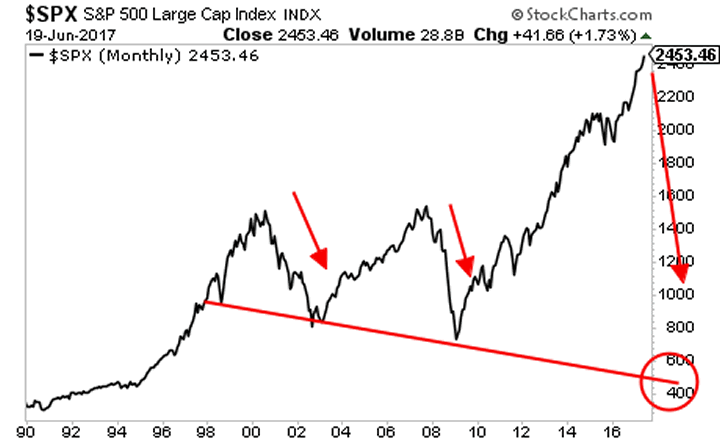

The Fed just “rang the bell” on the market top.

Fed Chair Janet Yellen’s right hand man, John Williams made the following statement yesterday:

“The stock market seems to be running pretty much on fumes,” San Francisco Federal Reserve Bank President John Williams said in an interview carried on Sydney’s ABC News affiliate and available on the internet on Tuesday. “It’s something that clearly is a risk to the U.S. economy, some correction there — it’s something we have to be prepared for to respond to if it does happen.”

Some context here: For eight years the Fed has propped up the stock market via $3.5 trillion in QE and seven years of Zero Interest Rate Policy or ZIRP. Indeed, the bull market in stocks is possibly the only real success the Fed can point to when it comes to its response to the 2008 Crisis (the real economy has lagged dramatically).

In this light, the above quote is an astonishing statement from a Fed President. And it serves as a clear signal that the Fed is willing to let the market fall and fall HARD.

A Crash is coming.

And smart investors will use it to make literal fortunes.

And smart investors will use it to make literal fortunes from it.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

We made 1,000 copies to the general public.

As I write this, only 57 are left.

To pick up one of the last remaining copies…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.