Gold And Silver – Why No Rally? Lies, Lies, And More Lies

Commodities / Gold and Silver 2017 Jul 01, 2017 - 07:28 PM GMTBy: Michael_Noonan

One thing certain of all politicians, no matter where in the world, they all lie. The US federal government, that captive political body beholding to Wall Street interests, also a subsidiary of the international bankers that controls the West and all fiat-issued currency, is one of the worst when it comes to lies and deceit, primarily because Europe can only play a poor second fiddle to federal US dictates. South America can offer no resistance, nor can South Africa.

One thing certain of all politicians, no matter where in the world, they all lie. The US federal government, that captive political body beholding to Wall Street interests, also a subsidiary of the international bankers that controls the West and all fiat-issued currency, is one of the worst when it comes to lies and deceit, primarily because Europe can only play a poor second fiddle to federal US dictates. South America can offer no resistance, nor can South Africa.

China is beginning to flex its overblown might, and Russia, while in opposition, remains under attack by the West, led by the Neocons [Nazi-types] from the US Deep State trouble makers. The only thing the federal US government does is start wars, and if there is a war going on anywhere around the globe, the US is either directly or indirectly responsible. Wars feed the [fading but still formidable] military might as a means of keeping the fiat Ponzi scheme, aka the “dollar,” alive as the [diminishing] world reserve fiat currency.

Every US administration, at least since the 16th president, Lincoln, in 1861, has been utterly deceitful to the American, indeed world-wide, public. Almost everything that comes from every administration is based on lies, lies, and more lies. Bush, the first, Clinton, Bush the second, Obama, and now Trump, have been ardent liars about everything.

The Bushes and Clinton were willing sycophants serving the interests of the elites at the expense of all Americans. “Yes, we can”-Obama was full of naive hope that quickly turned into yet another executioner for the elites, not fulfilling a single campaign promise and basing his entire presidency on selling the American interests to Wall Street and the international bankers. Obama was a sickening excuse for a president and hid his lying character from the American public.

Trump appeared to be sincere in his election acceptance speech promises, genuinely wanting to “drain the swamp,” but the swamp dwellers took over the formation of his fledgling administration, and once again, the Neocons prevailed. Trump did want to seek rapprochement with Russia, even Syria. Yet, like Obama before him, Trump did a 180 degree u-turn and turned on Putin and bombed Assad.

There has not been a single verifiable shred of evidence that Russia interfered in any part of the US elections, and recent CNN admissions that they pushed for damning and blaming Russia strictly for ratings, for any blame was a sham and baseless, was an underreported story. Trump bombed Syria and blamed Assad for purportedly gasssing his own people, yet another baseless accusation. In fact, what evidence does exist proves no such gas attack could have come from Assad forces, and did come from Western-guided attacks that were blamed on Assad.

Just last week, Trump accused Assad of planning “another” gas attack. Proof? Hell, no.

US government lies require no proof. Mere accusations, suggestions, and/or innuendo will suffice. Lies, lies, and more lies.

In addition to government lies, the bought-and-paid-for mainstream news media is even worse at lying with fake news being the backbone of most of whatever “news” gets reported. Getting back to CNN, it got worse when one of its producers stated American voters “are stupid as shit.” Unfortunately, there is some truth to that, for Americans keep believing in all the lies without questioning unnamed or unknown “sources” for most of the drivel that is presented as news, these days.

It is not any better in Europe, either. Can you imagine what the reaction would have been had any US president did what traitorous German Chancellor Merkel did to the German flag?!

Angela Merkel shows her disdain for German citizenry and their sovereignty. If it had been the de facto EU flag, she would have genuflected and kissed it at the same time. Why Germans have not thrown her out is puzzling. Maybe Germans want to give her more time to import millions more anti-German Muslims?

Surprisingly, she did not spit on it. She has been issuing lies, lies, and more lies to the German public, as has Draghi and all of the EU sycophants that sit in Brussels trying to dictate what European citizens should do, how they should behave, how they should give up their individuality/sovereignty, and bow to the dictates of the unelected EU.

There is so much more, but this surface material only gets worse when one digs into greater detail, sickeningly worse, and we have not even touched upon the sordid state of affairs in the Middle East.

What does this have to do gold and silver? Both reflect the consequences of the unending series of lies from all government, and especially international banking sources. Fake news and lies breed fake markets. Precious metals are currently, and have been for decades, a Bread and Circuses show. The reality of Supply and Demand have been suspended. For how long? For as long as the elite charade goes on.

It would not be unreasonable to say this all began with the Rothschild agenda of taking control over each nation’s money supply, starting with the creation of the Bank of England, leading up to the takeover of all Western banking, with the issuing of fiat and the disappearance of sound money, as found only in gold and silver, throughout time.

It is incontrovertible that every single fiat currency in the world has a 100% failure rate. All have disappeared, eventually. It is the existing current fiat that seems to have passed its expiration date of sensibility, and ceases to make any sense whatsoever, that has left almost all in a quandary over the timing of the “eventual” disappearance of all current fiat?

Prior failed fiats were somewhat more localized, as it were, as opposed to the centralization of all fiats worldwide by a singular entity, the BIS [Bureau of International Settlements], the central bank for all central banks. With a singular unifying control of all fiats, the game can go on for much longer than anyone can imagine. Many had imagined the “game” would have ended years ago and are now changing to maybe sometime by the end of this year?

Why should this year be any different? So far, it has not been any different, and those in power are not about to give up any of their power, along with the riches it bestows. The rotten-to-the-core central banking system has been exposed for the fraud that it always has been, at least to those who pay even the slightest attention to what goes on in the quagmire called a banking system. The bankers cannot, and indeed will not, allow the system to fail. For as long as sense fails the public that refuses to object to being financially stripped by the banking system, expect more of the same. Well, not more, expect worse for it will get and is getting worse with each passing month.

Gold and silver are the nemeses for the existence of all bankers and their fiat issues. At some point, and that point does not appear on the foreseeable horizon, like all fiats, the current system will fail, and gold and silver will reward their holders, [physical not paper in any form]. If we knew when, we would say. Alas, we cannot say for we do not know. All we can do is follow price history as the best guide to reveal what the money hands are doing.

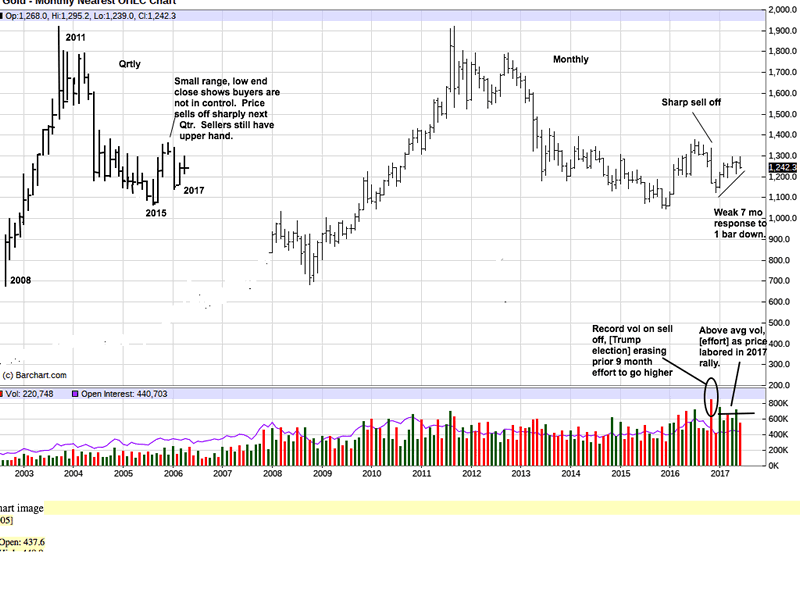

It is our position that those who control the markets best define that control in the higher time frame charts. Why? Because the elites/globalists plan their moves over decade[s] time spans. There are not concerned with what goes on from week to week, and even less concerned with what goes on on a daily basis. The details do not matter. What matters are the changes planned to develop over time, so as not to alarm the populace, who might otherwise be shocked into taking resistant action[s].

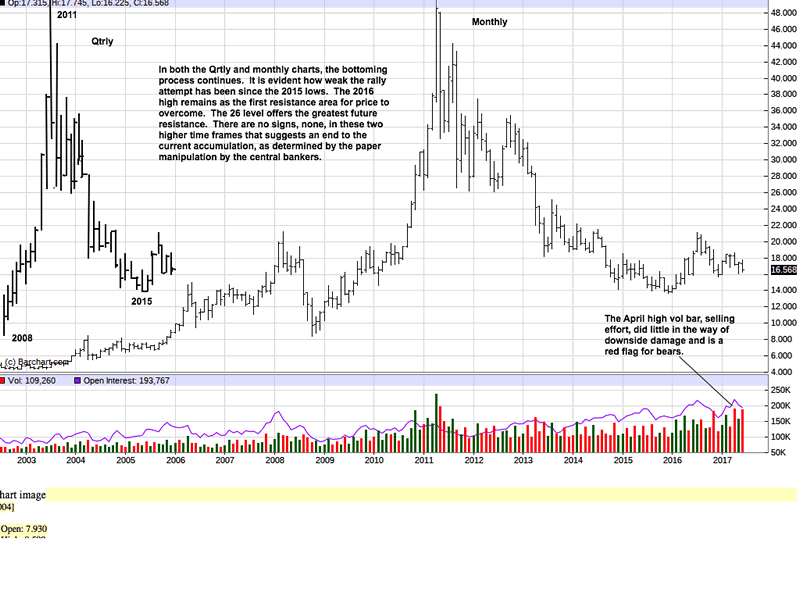

With the globalists, the Boiling Frog analogy always applies, and they apply it well. Since the waterfall effect in PMs after the surprise Trump election, the attempt to rally back has been weaker than the decline. This always holds true in bear or decking markets. This can be seen in both charts, and more clearly on the monthly.

There does not appear to be any hint of a change in the ongoing downside pressure for gold and silver.

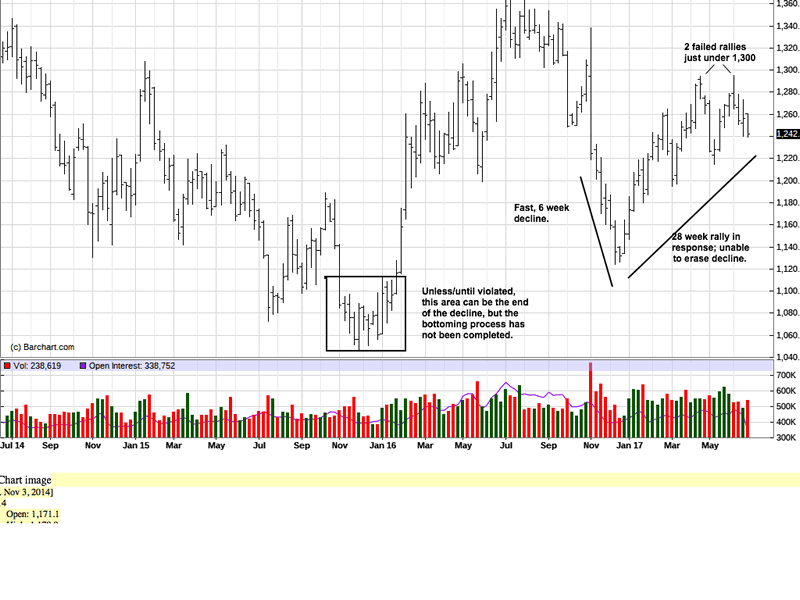

There are reasons to accept the late 2015 low as the end of the decline in gold [silver, as well]. December 2016 formed a higher low, but confirmation of a change in trend will only come after a higher high above 1300 from 2016, as seen in this weekly chart. Since the month and a half decline at the end of 2016, it has been seven months of rally effort that has been unable to retrace the entire decline. This is a sign of a weak market, and supports the weakness found in the Qtrly and monthly charts.

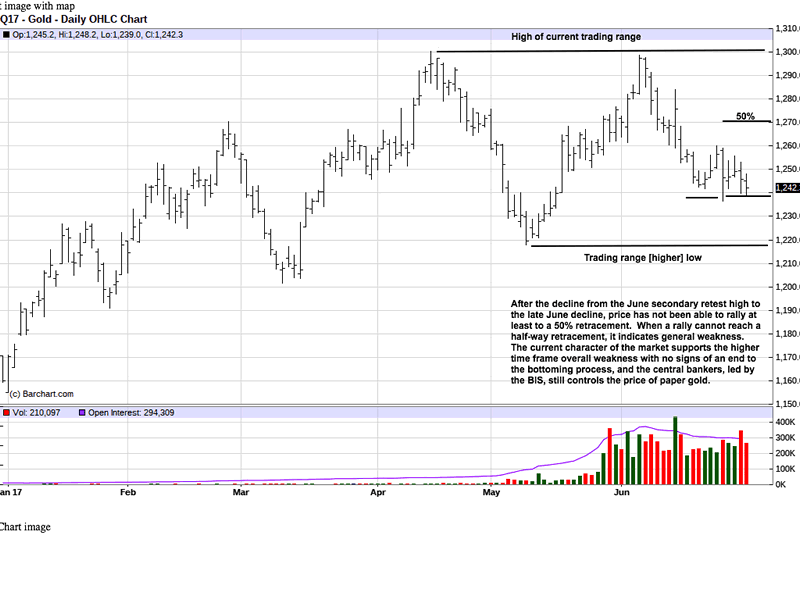

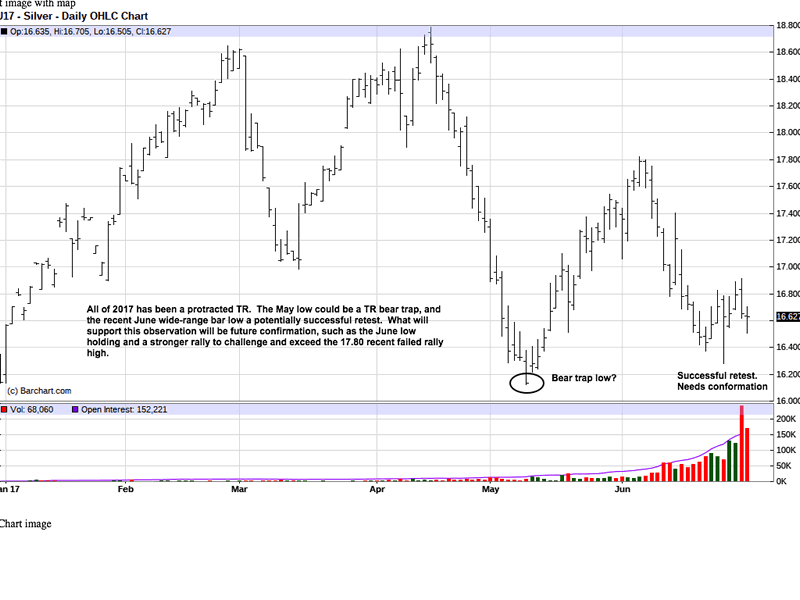

We made chart comments on the daily, but the overriding factor is the existence of an ongoing TR [trading range], and the level of knowledge is weakest when price is in a TR because rallies fail and declines hold within the range. Nothing much in the way of encouragement to see here.

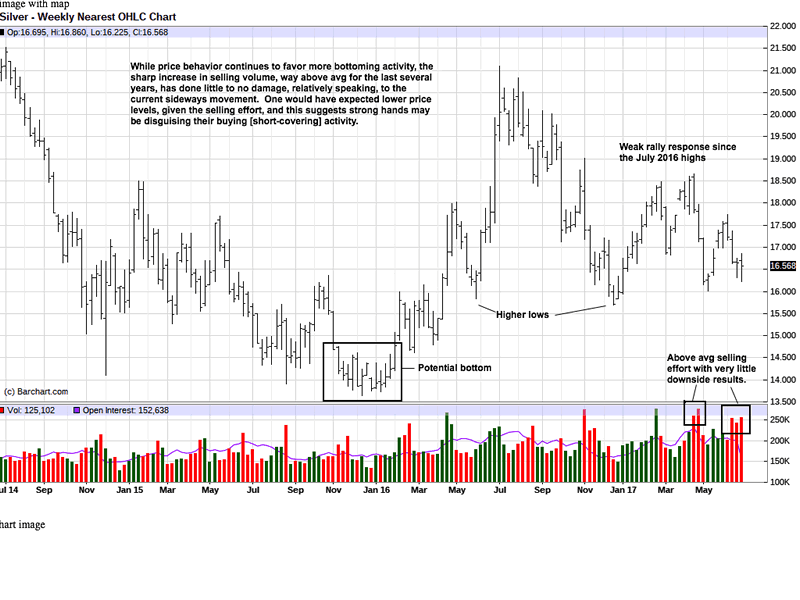

Silver remains the weaker PM. The gold silver ratio, having reached 66:1, is now back to around 75:1, indicating a poorer performance in silver relative to gold. From the 2011 high to the 2015 low, silver continues to languish nearer the lows, unable to mount a stronger retracement off those lows. As in gold, there is no evidence of any positive change for this market.

The only interesting aspect of silver is the volume behavior. In the past few months, downside volume has been way above average, yet there has been no giving way of the December 2016 low. In a truly weak market, the December low should not have held.

Our conclusion is that we are seeing the possibility of strong money [central banks] covering shorts, which is a form of buying. The negative volume not giving way is a possible reading of what smart money is doing while trying to hide their plan[s].

Price and volume are facts. They do not lie, but they can be misconstrued, which may be the case, as described, and a subtle bullish point of view.

If we are to see change, it will first show up on the smaller time frame, such as the daily chart. Given the volume read from the weekly, it would give credence to the possibility of a bear trap [still within a TR] low, and a possibly successful retest, last week. What happens now is that the market must hold the June low and continue to improve in any rally attempts. Still NMT [needs more time].

We do not support trading from the short side of the paper market, so as not to support the downside manipulation efforts. We still fully support buying physical gold and silver, even if the buying is still too early. At some point, reality will creep in, and these markets will go substantially higher. Unfortunately, it could take substantially more time.

“Better a year [or more, now] early than a day late’ may be a rationalization for the ongoing accumulation of the physical metals, but holding gold and silver still yields the benefit of no third-party counter risk, highly relevant in today’s banker confiscation appetite environment, and it protects against the current and never-ending erosion of inflation through increased costs of almost everything, except gold and silver.

The globalists are accumulating as much gold and silver as they can, without saying so.

They want everyone to get tired of no meaningful appreciation in PMs, and even keeping them in a declining posture. Do not fall for their lies, lies, and more lies.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2017 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.