Gold: Are We All Dead Wrong?

Commodities / Gold and Silver 2017 Jul 03, 2017 - 09:02 AM GMTBy: The_Gold_Report

The natural resource sector is the most volatile sector to invest in, says Lior Gantz, editor of Wealth Research Group, and he discusses factors to take into consideration when investing.

The natural resource sector is the most volatile sector to invest in, says Lior Gantz, editor of Wealth Research Group, and he discusses factors to take into consideration when investing.

The fact remains that the natural resource sector is the most volatile sector we can invest in.

In your brokerage account, if you see reds and not greens, as you did between January 2016 and August, then make sure you read today's piece thoroughly.

Mining is a tough business because it is capital-intensive. The upfront costs for building a profitable mining operation are often close to $300 million for a sizable project, and it can take 10-15 years from start to finish.

The costs of prospecting, surveying, permitting, drilling, personnel, machinery, energy, legal work, and replacement of equipment are truly challenging.

There are innumerable risks along this decade or more of taking a property from the exploration level into production.

Rick Rule, who has made tens of millions of dollars in this sector, sat down with me to discuss how he really distinguished himself from countless others.

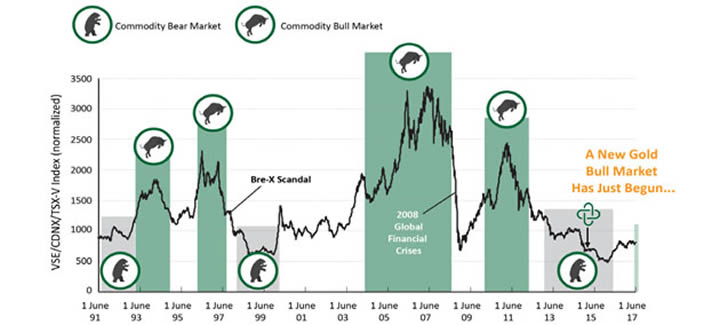

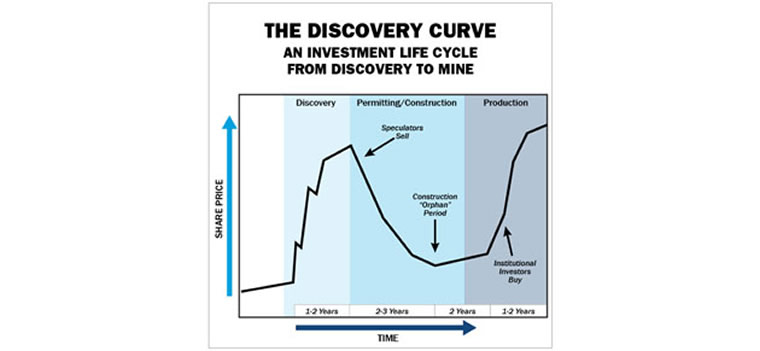

This is a simplified chart, which underscores important market characteristics:

1. Exploration is the Chief Speculation Period: For most companies, this stage is make or break.

When speculating with pure exploration companies, the idea is to keep the position size extremely conservative. Anything else is too risky. We also look for companies that are actively drilling where they've previously discovered minerals; therefore the likelihood of expanding their resource base is higher. This is especially true if 20 or 30 years have gone by since the last explorer drilled it with far inferior technologies.

2. Development and Production are Dependent upon Rising Metal Prices: Natural resource companies don't get to make one cent until they are in production and are able to do it profitably.

This can take years.

Until that time, their share prices are a speculation on whether or not they will be able to execute their plans and what the timeline is to achieving this.

It's a function of "de-risking."

What the serially successful people in this business do is ask themselves one question at all times:

A. What do I need to do next in order to manage the risk involved with my company?

The fact of the matter is that this is a ridiculously hard business, and just having a great property isn't enough.

I've seen lousy and immature management teams take a lucrative gold project and turn it into a shareholder's nightmare.

Because this business is so cyclical, it takes dedicated people—those that are in it for life and have their own funds tied up in their activities—for us, as investors, to truly be sure that we chose a company led by a winner.

When you are invested with an experienced and proven mining entrepreneur, it's always a matter of WHEN and not IF your investment will succeed.

The only variable these people can't control is the price of the commodity.

Contrary to what most analysts stress, gold's price is not mainly derived from jewelry sales, short-term political chaos, or inflation.

Since the 1971 detachment from fiat currencies, gold is mostly correlated with two factors:

* Real Interest Rates: This is the level of core inflation deducted by the 10-year Treasury yield. When this is low and declining, gold's price rises 93% of the time.

Right now, bond yields are rebounding and inflation is stable—this affects the price of gold and pressures it down.

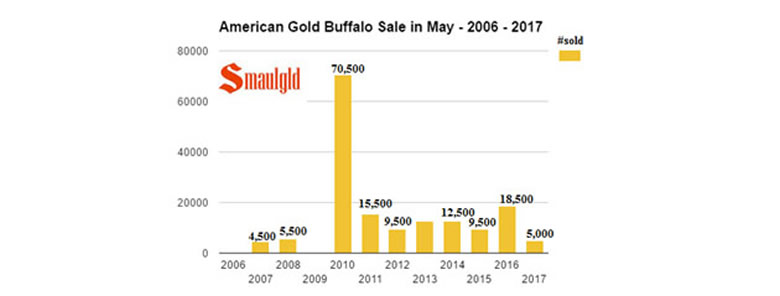

* Investment Demand: Since 1971, and especially since 1974, when gold ownership became legal again, and now with China's and India's middle class rise, what sets the price of gold the most is retail demand.

Since the election, President Trump's term has had the effect of calming the middle class and giving them confidence in the future.

They are buying stocks, specifically tech and medical ones, instead of fearing the debt burden of the U.S. government.

That's the main reason why the quality companies are performing as they are.

Remember, junior mining companies contain much less risk when commodity prices rise because large-cap companies target them for mergers and their projects are economical and make sense.

Shares of companies that burn through cash, raise money again, and burn through it again for years can be notoriously volatile. They can drop 30%-70% without any fundamental change in the stability, wherewithal, and strength of the properties or the balance sheet.

You and I don't get to play and participate in the world's most potentially lucrative sector—where 500%–1,000% returns in two to five years are common and 5,000%–10,000% gains occur with every cycle—without realizing that we must be tenacious and sophisticated ourselves.

Volatility is the King of Mind Games and They Will Always Test Your Conviction.

One simple strategy is to limit the amount of companies you own and track them closely. When you see a drop in price of 10%–20%, call or email the company and watch the news releases. If it is mostly due to the fluctuations in the price of gold or any other commodity, it's a buying opportunity.

That's why you should decide how much you want to invest in a given company and split your purchases into four to five separate occasions—you're now using volatility to your advantage and not getting clobbered by it.

Lior Gantz, an editor of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by Wealth Research Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.