Dow 50,000, Then a Colossal Stock Market Crash

Stock-Markets / Stock Market 2017 Jul 04, 2017 - 09:37 AM GMTBy: The_Gold_Report

The markets are heading higher, says Tom Beck, founder of Portfolio Wealth Global, who explains why and discusses the actions that he is taking.

The markets are heading higher, says Tom Beck, founder of Portfolio Wealth Global, who explains why and discusses the actions that he is taking.

Portfolio Wealth Global wants to show you today why stocks are in the final innings of a "blow-off top" set-up and why the "blow-off top" has begun for all major indices—it is global.

We all know why stocks are soaring even though the fundamentals don't justify these valuations. It is a combination of:

- Low to negative interest rates.

- Central banks buying stocks and guaranteeing asset purchases with stimulus.

- The end of the bond bull market.

This is why we will see stocks keep charging higher for another three or four quarters before people start losing their pants again. Some stocks are still cheap.

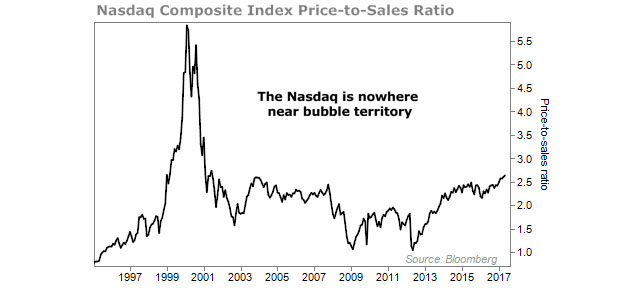

The NASDAQ soared during the last "blow-off top," and tech stocks are leading the way again today.

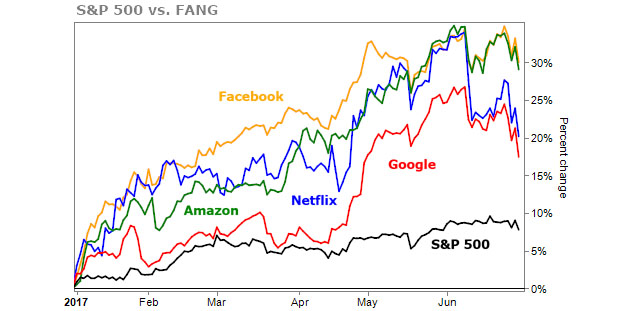

The overall S&P 500 ended 2015 with a small 1% gain. FANG (Facebook, Amazon/Apple, Netflix and Google) stocks ended the year up 83% on average, and they're showing the same great performance so far in 2017.

The S&P 500 is having a great year—up almost 10% so far, but FANG stocks have more than tripled that return. They're up more than 30% on average in 2017.

Now, there's a major shift in the speed at which we're approaching this super-bubble.

The "blow-off top" that's happening in the U.S. is crossing borders for the first time in eight years.

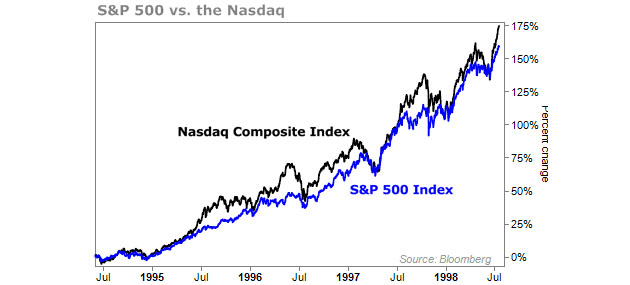

The chart below is the S&P 500 compared with the NASDAQ during the last major stocks bubble.

As you can see, these indexes tracked each other with near-identical performance for most of the 1990s.

But that changed in mid-1998.

This, of course, is when the "blow-off top" stage began. The NASDAQ began to outperform and ended up crushing the S&P 500's return over the next 18 months.

What the most accomplished fund manager of them all, Mr. Peter Lynch, has taught us is that stocks can run higher and longer than anything we can envision because markets are driven by fear and greed, rather than pure logic.

I've seen this happen many times before.

This performance is, of course, what is keeping investors away from commodity companies for the time being.

This allows us to accumulate our positions on the cheap at the moment, and when the crowd follows, it will be like January-August of 2016 all over again, but this time the move will last much longer.

Before we get to enjoy the most lucrative commodities bull market of our lifetimes, we will see this global super-cycle in stock prices reach epic proportions.

Portfolio Wealth Global sees the potential of Dow Jones hitting 50,000, but we aren't planning to participate in the party.

I've been pounding the table on stocks since 2009, and now is certainly not the time to position with new money, but instead to reap the rewards of getting in early when the panic shouts of 2008 were in the air.

I launched our free newsletter in the summer of 2016 because I realized that the potential for investors to make grave mistakes are imminent, which often take a decade to correct, and I think they've only grown since then.

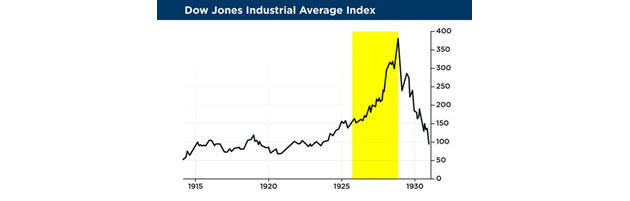

This is how this will end, but not yet.

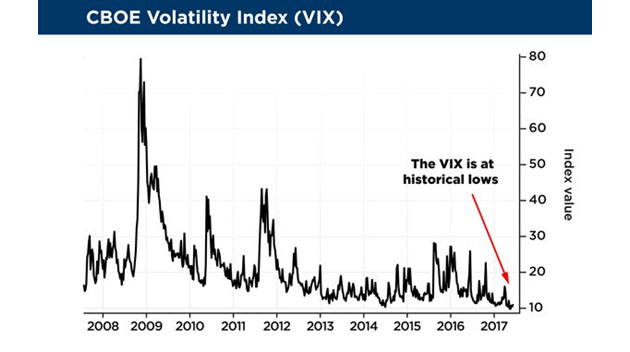

You'll start to see the crash once investors' confidence and the "fear gauge," the VIX [CBOE Volatility Index], trades over 25. Today, it's nowhere close to that.

The fact is that the middle class is back in the game, and they're chasing prices (as usual).

Warren Buffett's favorite overpriced/underpriced indicator is flashing the sell signal, but the bubble will persist.

I'm personally cashing up and taking profits on some post-recession winners.

The way Portfolio Wealth Global will trade the "blow-off top" is by making a sophisticated set-up that will be incredibly profitable for all of us.

I'll show our PWG's subscribers exactly how in the coming weeks.

Tom Beck is founder of Portfolio Wealth Global. Known as one of the first millennial millionaires in the United States, Beck is a relentless idea machine. After retiring two years ago at age 33, he's officially come out of retirement to head up Portfolio Wealth Global. He brings a vision of setting a new record for millionaires with his seven-year plan to accelerate any subscribers' net worth who will commit to the income lifestyle. Beck delivers new ideas on the marketplace that were once only available to the rich. Traveling the world, he's invested in over a dozen countries, including real estate.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Tom Beck and not of Streetwise Reports or its officers. Tom Beck is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Tom Beck was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by Portfolio Wealth Global

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.