Stock Market Post-holiday Hangover?

Stock-Markets / Stock Market 2017 Jul 05, 2017 - 12:22 PM GMT Good Morning!

Good Morning!

The bank-heavy Dow made a new all-time high on July 3 in light trading. It was aided and abetted by its largest holding, Goldman Sachs, up 2.42%.

This high may be called an “echo Cycle” since June 29 is exactly 8.6 years from the bottom of Wave 3 of (C) on November 21, 2008. I have seen this before in gold and crude, where we have witnessed “double tops.”

Trannies also made a new all-time high by the thinnest of margins.

BKX did not make a new high, but Monday’s action must have been discouraging to whatever shorts were left, if any.

SPX futures are mildly higher, but beneath Short-term resistance at 2435.42. The Wave 2 high in SPX was made on June 28, also confirming the “echo” Cycle.

ZeroHedge reports, “S&P futures were little changed at 2,425, ignoring the N. Korea tensions of the past two days which will likely be a major topic in the upcoming G-20 summit, as European stocks fluctuate and Asian markets advance. Crude oil fell, snapping the longest winning streak this year, as Russia said it opposed any proposal to deepen OPEC-led production cuts.”

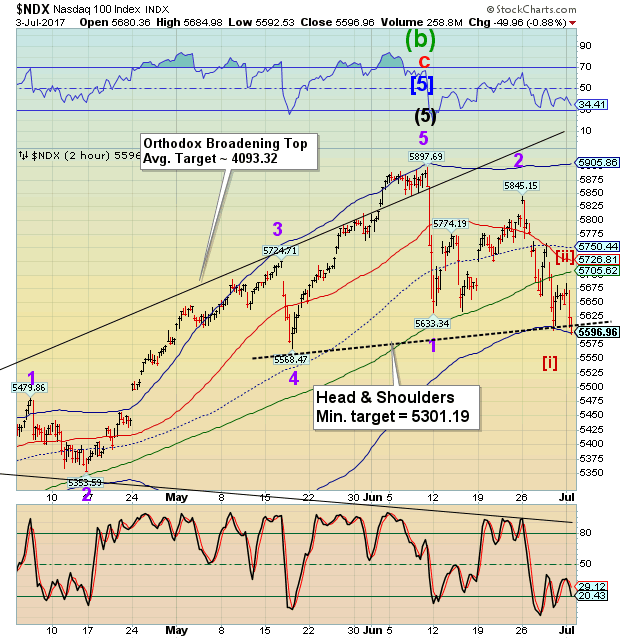

NDX fell beneath its neckline on Monday, warning us that all is not well in the markets. Its echo top was on June 26.

This morning’s NDX futures have risen back above the neckline, but it appears that the damage has been done.

VIX futures are mildly lower, but remain on the aggressive sell signal that it maintained on Monday.

Bloomberg reports, “Stock markets are a sea of green, punctuated by frothy highs as markets roll past shocks such as U.K. elections, North Korean missiles, Persian Gulf confrontations and tweet-storms from U.S. President Donald Trump. Normally, all that good market news would seem simply good, right? But a growing chorus of strategists, investors and even policy makers is fretting that there should be more downs to go along with those ups. They’re worried that what’s called volatility in the markets is too low -- and that the low readings in market measures known as fear gauges could foreshadow a giant disturbance down the road.”

TNX appears to have completed its retracement rally on Monday. This false rally is meant to throw traders off the scent of declining yields still to come.

The next Master Cycle low is due on or near July 20. It could be a doozy.

The USD continues to rise, reaching a retracement high of 96.25 this morning.

While that is happening, USD/JPY appears to be losing steam.

In the meantime, Crude Oil hit its 50-day Moving Average on Monday, meeting its retracement target and a Fib retracement value of 50%.

This morning’s crude oil futures are down, hitting a morning low of 46.13. The new Head & Shoulders structure suggests a potential 40% decline ahead in oil. The next potential Master Cycle bottom may not occur until the end of July.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.