A Crash is Coming.... Last Time This Happened Was Spring 2008

Stock-Markets / Financial Crash Jul 07, 2017 - 01:13 PM GMTBy: Graham_Summers

Perhaps the single most accurate predictor of the economy has rolled over into recession territory.

Perhaps the single most accurate predictor of the economy has rolled over into recession territory.

I’m talking about tax revenues.

GDP growth, unemployment data, ISM surveys… all of these can and are massaged by statisticians to create a rosier picture of the economy than reality. By way of example, we recently noted that 95% of all net job growth since 2008 was in fact created via an accounting gimmick. In reality, the jobs were never created at all.

Tax revenues, particularly corporate tax revenues, are very difficult to fake. Either the money came in the door, or it did not.

If the economy is booming, corporate tax revenues rise as companies generate greater revenue/income, resulting in them paying more in taxes. And if the economy is rolling over, corporate tax revenues plunge as companies close up shop and stop paying taxes.

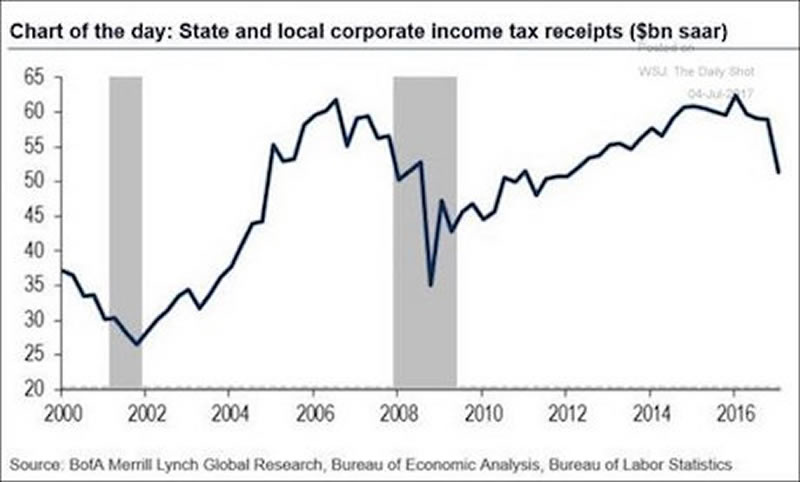

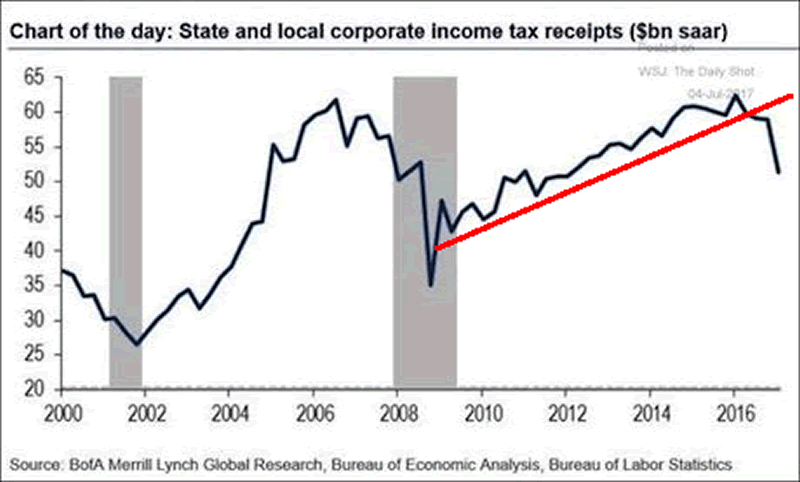

On that note, take a look at the chart below.

Source: WSJ

As you can see, state and local corporate tax revenues have rolled over in a massive way. If we were to analyze this chart like a stock, you’d see the “uptrend” of growth was completely broken.

Why does this matter?

Because it serves as a clear signal that the US economy is rolling over in a big way. Indeed, the last time we saw state and local corporate tax revenues roll over like this was in late 2007/ early 2008.

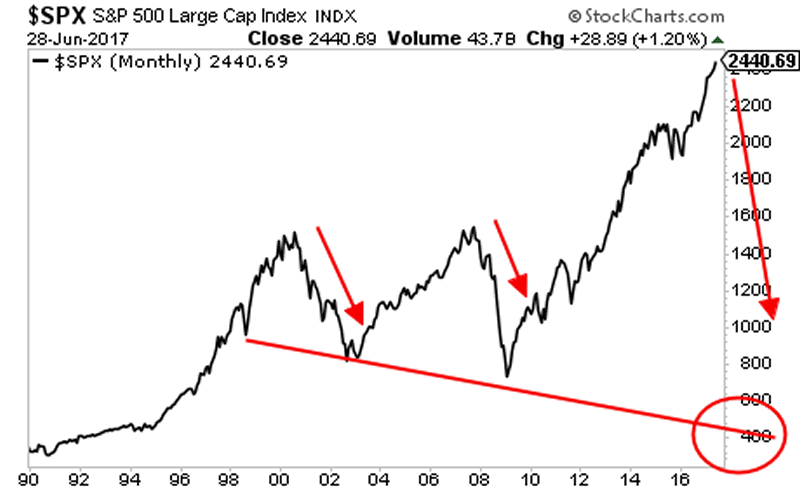

We all know what happened to stocks after that. The only difference between then and now is the 2017 stock market bubble is even larger.

A Crash is coming…

And smart investors will use it to make literal fortunes.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

We made 1,000 copies to the general public.

As I write this, only 35 are left.

To pick up one of the last remaining copies…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.