Yellen Goes on Record: The Fed’s Pulling the Plug This Year

Stock-Markets / Financial Markets 2017 Jul 10, 2017 - 04:06 PM GMTBy: Graham_Summers

The Fed keeps ringing bells to signal the top, but the markets aren’t listening.

Janet Yellen is set to present the Fed’s Monetary Report to Congress this week. Her remarks have already been posted online.

The results aren’t pretty.

Valuation pressures across a range of assets and several indicators of investor risk appetite have increased further since mid-February…

The Committee currently expects to begin implementing the balance sheet normalization program this year provided that the economy evolves broadly as anticipated…

Source: Federal Reserve

Firstly, Yellen is CLEARLY warning that the Fed sees bubbles in the system. For a Fed Chair to specifically cite “valuation pressures” in the markets is simply incredible… particularly when you consider that the Fed has been actively propping up stocks for the better part of eight years.

Secondly, Yellen reiterates the Fed’s intention to begin normalizing its balance sheet this year. This is an absolute game changer for the markets as it marks the first time in a DECADE that that FEd will be actively withdrawing liquidity from the system.

What does all of this mean?

The Fed is getting ready to pull the plug on the markets.

What does that mean for stocks?

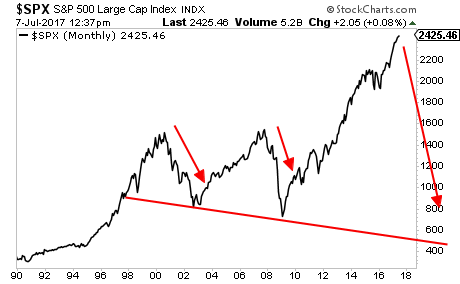

We’re going to have the 3rd and worst crisis in 20 years.

A Crash is coming…

And smart investors will use it to make literal fortunes.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

We made 1,000 copies to the general public.

As I write this, only 29 are left.

To pick up one of the last remaining copies…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.