Cryptocurrency Bloodbath! Sell Everything We Were Totally Wrong!

Currencies / Bitcoin Jul 12, 2017 - 09:26 AM GMTBy: Jeff_Berwick

Cryptocurrency Bloodbath!

Cryptocurrency Bloodbath!

Just kidding.

The cryptocurrencies have taken a big hit in the last few weeks, however, just as we said they would.

In that article I said how we had been telling subscribers to take profits on all cryptocurrencies, especially the altcoins, and Ethereum. Another call that turned out to be very prescient.

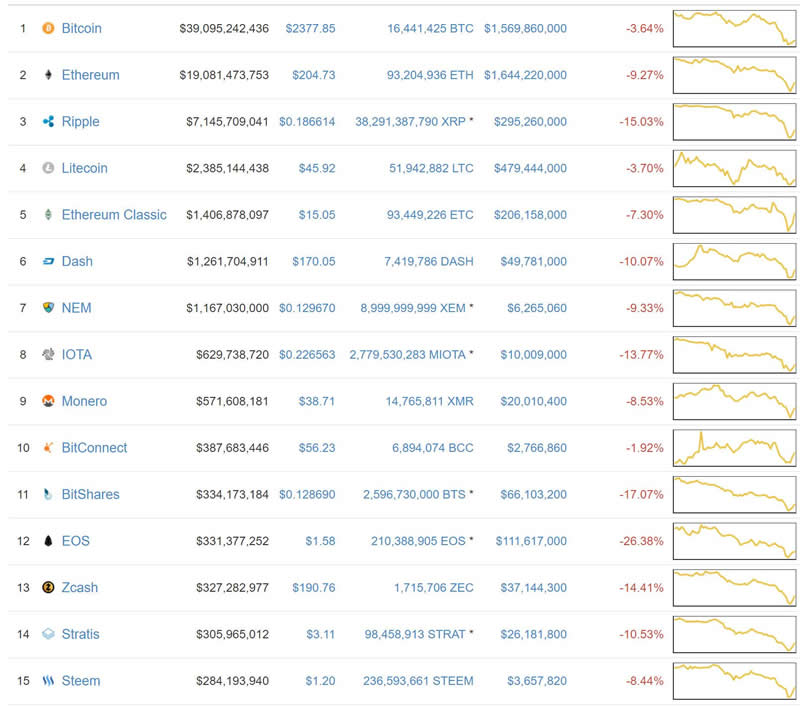

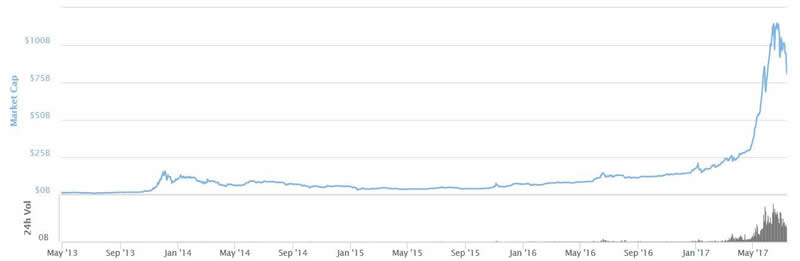

The total market cap of all cryptocurrencies, including bitcoin, hit a high of $112 billion on June 11th and is currently near $82 billion for a loss of 27% in the last month.

For this reason, many newsletter writers don’t even tell people to ever sell.

But, I wrote about this exact thing to subscribers recently.

In a recent newsletter to subscribers (subscribe here) I wrote:

BUY OR SELL CRYPTOS?

"I have seen a number of subscribers posting in the private TDV Facebook Group that they are beginning to give up on gold and silver and are thinking of selling and buying some of these high flying cryptos.

That would be the opposite of what I would advise at this moment in time... and I touched on this in the last

Dispatch too.

To sell gold and silver to buy cryptos right now would be the worst time in the history of the world to do it. I don’t say that just because gold and silver have been slumping lately... but because the cryptocurrencies have gone parabolic.

It is hard to imagine them continuing to make massive gains much longer without a serious pullback first.

Here has been my buying and selling strategy on bitcoin for years. The selling strategy is simple: I never sell.

The buying strategy I’ve had is to keep buying more every month. But I buy much less and even stop buying altogether when bitcoin has increased by too much, too fast. For example, when it went over $1,000 in 2015 I was not buying.

When it hit $250 in 2015 I was buying as much as I could.

And the same strategy goes for the altcoins. And I suggest you do something similar. The cryptocurrencies are going to be massive. We haven’t even started yet. But it will take time and there will be plenty of ups and downs along the way.

So, if you want to buy more, wait at least for the next “down”... where bitcoin falls $300+ for whatever reason. It’ll happen. It happens all the time.

So, don’t get too caught up with the crowd at times like these. The cryptos will have their pullbacks and we’ll

be here to give you the best advice on when to buy and which ones to buy at that time.

As you can see from our gains above... we’ve got a pretty good track record!"

Conclusion

We had many new subscribers in the last few weeks get very angry at us for not advising them to buy any cryptocurrencies.

Some of them were telling us that they were going to invest everything they’ve got into cryptocurrencies because they will never go down in price again!

Yes, some people really said that. That’s a big part of the reason we knew the cryptos would soon have a large pullback… when a lot of people begin to think that we have reached a new paradigm and a certain asset will never go down in price ever again… that’s when you sell some!

This isn’t to say that we think the cryptocurrency market is over. Not at all. In fact, in many ways it is just beginning!

And I hope many of our subscribers took our advice and are getting ready to buy back into the market when a bottom looks close to being reached. It’s not quite there yet.

We’ll be letting subscribers know in our next edition of our newsletter coming out in the next week or so. And, in the next few days I’ll be letting subscribers know about a new crypto that hardly anyone knows about yet that I think is an “Ethereum killer”.

We recommended Ethereum at $2 to subscribers last year and, interestingly, came out and said Ethereum was a sell near $400… it has since fallen to $200. So our track record has been ridiculously good.

You can get access to all this information by subscribing here.

And if you still don’t understand cryptocurrencies or why they are changing the world, check out my free four video webinar here.

On major down days like today many people feel really bad. We, and our subscribers, are loving it as we took profits and are ready to deploy that capital at lower levels.

It’s called buy low, sell high… and it’s a lot harder to do than it sounds. But stick with us at The Dollar Vigilante where we have the best record in cryptocurrencies in the world and have been covering them since 2011 and made 100,000%+ gains since.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.