Gold and Silver: Your Stomach Is Probably Wrenching Right Now

Commodities / Gold and Silver 2017 Jul 13, 2017 - 12:02 PM GMTBy: The_Gold_Report

Wall Street's largest firm, Goldman Sachs, is throwing in the towel on commodities, which reminds Lior Gantz, Wealth Research Group's founder, of 1998, when Merrill Lynch closed its commodities desk very close to the end of a cyclical bottom.

Wall Street's largest firm, Goldman Sachs, is throwing in the towel on commodities, which reminds Lior Gantz, Wealth Research Group's founder, of 1998, when Merrill Lynch closed its commodities desk very close to the end of a cyclical bottom.

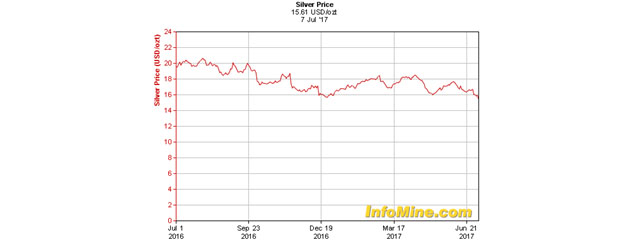

Gold is up for the year, but silver just made a 52-week-low.

This is a highly unique situation—it rarely happens.

Silver ended 2016 priced at $15.91, and it is now priced at $15.61. Gold, on the other hand, ended 2016 priced at $1,151.94 and is now priced at $1,212.46.

This puts the gold/silver ratio at 77.65, which is unusually high, but it might reach 84 before reverting back to the 65:1 range.

Historically, when silver outperforms gold, the mining shares rally, and when the latter is true, the miners are weak. We are close to an extreme right now.

What's even more unique is that for only the third time since 2000, when the commodities supercycle began, we have a brief timespan I call "The Millionaire Window," and you'll see what this is all about is our weekend article.

It's part of why I've been considering taking profits on my favorite cryptocurrencies.

Realize this: Goldman Sachs, the world's No. 1 commodities trader, is doing a nuts and bolts review of the trading desk!

Remember that CEO of Goldman, Lloyd Blankfein, started his career in the commodities business, but he is drawing closer to the industry’s prevailing consensus. Morgan Stanley, JPMorgan Chase & Co., Barclays Plc, and Deutsche Bank AG have cut back or exited commodities trading in recent years.

In 1998, Jim Rogers, arguably the best commodities trader in history, noticed that Merrill Lynch was giving up on commodities and called the bottom. As a group, commodities rose 20% per year for five consecutive years after.

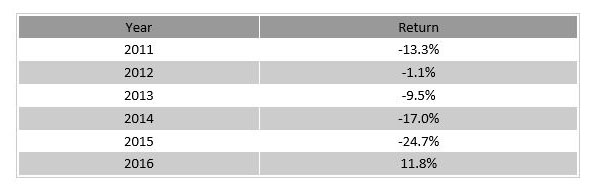

The pain doesn't end yet—the sector is down 5% this year, as well.

It's not the time to call the bottom on commodities, but we are itching closer by the day, and here's why:

1. The market is severely underpricing risk right now:

Most investors, since they don't take the time to educate themselves like we are, suffer from "rearview mirror" syndrome. This means that for the majority, what happened in the past three months is likely to occur again in the following three months. This syndrome is what makes people pile in as prices rise.

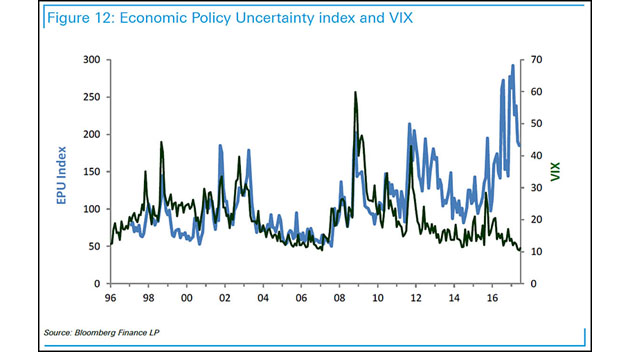

Now look at this must-see chart. In blue is the EPU, which is the Economic Policy Uncertainty Index. It's basically measuring the amount of key terms regarding challenges with the economy that everyday investors are exposed to.

In black is the VIX, which measures the fear investors feel towards downturns—it's the volatility index.

The correlation is clear, apart from a number of key periods. Examine 1998–2000 closely, when euphoria persisted and the major newspapers, like the L.A. Times, Boston Globe, USA Today, and others didn't report much on coming calamity and the markets roared.

Then check out 2011, when the "fiscal cliff" and the Greek default were all anybody was talking about, and gold peaked at $1,925 per ounce. That was a "fear bubble."

But since that time, we have undergone a "fear anti-bubble." Look at the complete disparity between the EPU and the VIX. The mainstream media has confused investors and they are now indifferent to risks.

Russia's cyber wars, a possible nuclear war with North Korea, problems in the EU and Brexit—nothing changes the point of view of investors. Risk is being tolerated, and that's why precious metals, especially silver, which is mostly industrial and only bought for investment demand when fear is excessive, are falling.

2. Central banks' lack of "success":

Since the Federal Reserve is supposed to be the all-knowing entity that gets things right at all times, when they raised rates for the first time in close to a decade back in December of 2015, the market became convinced that inflation is returning and the Fed is keeping a leash on it so it won't spiral out of control.

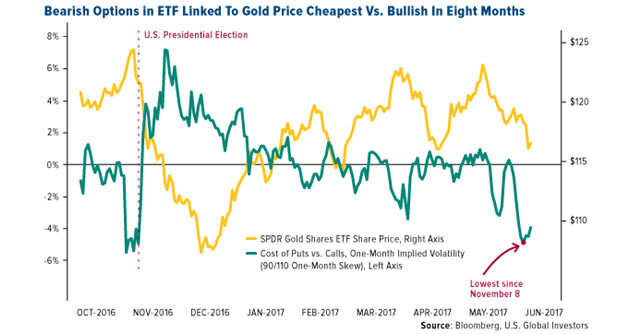

What this chart portrays, in the bottom line, is that speculators are again exiting the gold sector.

When Trump took office, investors were screaming "Trumpflation" and everyone was bullish on inflation and thinking the market would collapse.

Since no one believed Trump would win up until the votes were tallied up, the cost of puts (bearish bets) was low, and it spiked right after the results were announced. Today, Trump is in office, but the scare is gone. Being bearish doesn't cost much, and inflation is weak.

Central banks are folding up tents because they've "failed" at meeting their inflation targets, and the Fed minutes show they are more divided than ever.

Ray Dalio, founder of Bridgewater Associates, the largest hedge fund in the world by far, says that the Fed is very likely to begin committing mistakes, and that's why he sees gold as a strategic investment right now.

The research I zoned in on these past two weeks has led me to finding "The Millionaire Window," which has only happened three times thus far, and each time was proceeded by a spectacular move higher.

I'm putting the finishing touches on the research and we'll publish it this weekend. I can tell you that I sent it to three major gold-focused private wealth funds for the elite, based in the Caribbean Islands, and they were stunned—I'll leave it at that.

Lior Gantz, the founder of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by Wealth Research Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.