Trump’s Trade Policies Are Provoking A Global Trade War— How to Hedge Your Portfolio

Politics / Global Economy Jul 14, 2017 - 12:17 PM GMTBy: John_Mauldin

BY PATRICK WATSON :Removing barriers to international trade has both upside and downside. Donald Trump is now president in part because he focused on the downside: lost US jobs, closed factories, blighted communities.

BY PATRICK WATSON :Removing barriers to international trade has both upside and downside. Donald Trump is now president in part because he focused on the downside: lost US jobs, closed factories, blighted communities.

Even more important, he's fundamentally changing the way government looks at trade policy.

Trade negotiations have long had the implicit goal of promoting peace. It’s a fact that nations with active business relationships rarely attack each other, though the security aspect used to stay mostly unspoken.

Not anymore.

Trump has made it clear that he sees trade and defense as two sides of the same coin… and he’s explicitly demanding trade concessions in exchange for military protection.

Since the president has extensive power over trade policy, foreign governments will have to adapt—as will many within our own government.

We don’t yet know if his new approach will succeed. We do know that Trump intends to try it. For proof, just read his tweets.

Window to Thought

Many people wish Trump would stop tweeting already.

I disagree, not because I like his ideas but because I like having this window into his thoughts. It lets us see policy developing from the inside, and almost in real time.

The president often talks about both trade and defense—sometimes in the same tweet.

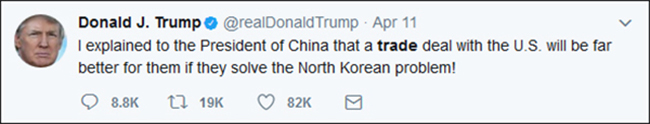

For example, here’s one from April, right after the Mar-a-Lago meeting with Chinese President Xi Jinping:

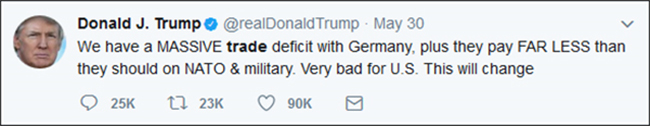

Here’s another one from May, when Trump had Germany on his mind, again killing two birds with one stone:

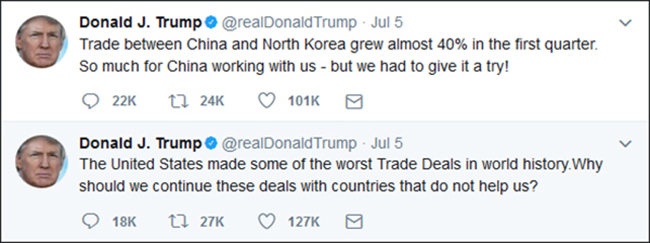

More recently, President Trump fired off these two tweets just seven minutes apart:

Of course, any president should promote US interests and deal with national-security threats. But misunderstandings in both policy areas can have extremely negative consequences—economic and otherwise.

We’d all best hope he does this right.

How to Capitalize—Or Hedge

Back in November, right after the election, I showed some of the ways national-security concerns had already set off a low-key trade war. With Trump’s trade policies, it’s not unlikely that it will break out into something bigger.

Here’s the strategy to capitalize on these trade trends.

Point 1: Even pre-Trump, broader forces were already slowing down—and in some ways reversing—globalization’s progress. This will continue no matter what Trump does.

Point 2: As we’ve seen after last week’s G-20 summit, President Trump’s linkage of trade and national security is clearly not playing well in foreign capitals. Any new US trade barriers will draw furious responses. That’s how trade wars begin.

Point 3: The US economy is better equipped to survive a trade war than many others. We have a large population, a diversified industry, and abundant energy supplies.

Point 4: US stocks are a different matter. Most large-cap companies heavily depend on export sales, imported raw materials, or both. A trade war will hit their bottom lines hard.

Point 5: The companies most likely to prosper in a trade war are those with primarily US supply chains and customers.

I use “prosper” in a relative sense here. If we dive into a full-on trade war with governments slapping tariffs on each other, very few businesses will win. But some will have much better odds than others.

Subscribe to Connecting the Dots—and Get a Glimpse of the Future

We live in an era of rapid change… and only those who see and understand the shifting market, economic, and political trends can make wise investment decisions. Macroeconomic forecaster Patrick Watson spots the trends and spells what they mean every week in the free e-letter, Connecting the Dots. Subscribe now for his seasoned insight into the surprising forces driving global markets.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.