Commercial Property Market Is Inflated and May Burst Again

Housing-Market / European Housing Jul 24, 2017 - 04:06 PM GMTBy: GoldCore

by David McWilliams : Dublin property investors had better hope that Brexit happens soon.

by David McWilliams : Dublin property investors had better hope that Brexit happens soon.

They should also hope that it’s not just a ‘hard’ Brexit, but a granite Brexit — a Brexit that’s as hard as possible. They should be betting on the buffoonery of Boris Johnson, down on both knees praying for a massive barney between Davis and Barnier.

A granite Brexit might prompt the migration of hundreds of corporate refugees from isolated London to the freewheeling safe haven of Dublin. If Brexit doesn’t drive a massive uptake in demand for prime property, we are in for a massive wobble in our inflated commercial property market.

Before we remind ourselves how this property story goes, let’s have a look at the facts: the glossy brochures are back, stockbrokers are packaging all sorts of property-related products to “investors”, the price of ad space in the property porn sections of the press is surging and of course the skyline is full of cranes and Armagh flags.

CBRE – a property-flogging outfit – tells us there are currently 31 office schemes under construction in Dublin, which is more than 380,000sqm in the pipeline. They tell us that more than 30% of this stock is already let. It also gushes that 44% of the office stock due for completion before the end of this year has already been pre-let. Meanwhile, agents tell us that prime office rents in the Dublin market stand at approximately €673 sqm.

It looks like things couldn’t be healthier.

Office take-up in Dublin surged 101,000sqm in the past three months, bringing total take-up in the first half of this year to more than 150,000 sqm. That’s a lot of space. 81 individual large office lettings were signed in Dublin since March (45 to Irish companies; 18 to US firms and 11 to the Brits). This is more than double the figure for the period from January to March.

The market is tight, hence all the building. The vacancy rate in the city centre is only 4.5% and yields for investors are stable at 4.6%. This is only because rents have been surging to keep up with the soaring prices.

Before we get carried away, remember rents are a cost and Ireland is competing with other European countries, so let’s compare our prices, not with some of Europe’s poorest countries, but why not with its richest, Germany? This will give a bit of perspective.

Comparing our prices with similar rents in Germany, we see that Dublin is already massively more expensive. Prime rents in Frankfurt are €474 sqm per annum. Remember Dublin is charging €673 sqm. The difference — €199 per annum — means that Dublin is 42% more expensive than Germany’s most expensive city. Once you start comparing other German cities, the extent of Ireland’s commercial property rip-off becomes more evident. Take Munich, capital city of Germany’s richest province Bavaria. Prime rents in Munich are €420 sqm per annum. In Hamburg, Germany’s sophisticated northern powerhouse, prime rents are €312 sqm per annum, while in Dusseldorf, the cross-road of Europe, prime real estate will set you back €318 sqm per annum – less than half of what it costs you in Dublin.

In all German markets, vacancy rates are higher so that means there’s much more choice.

When the price of something as basic as office space is profoundly more expensive in a country that has a much lower economic footprint, much smaller population and less rich capital base, you should worry.

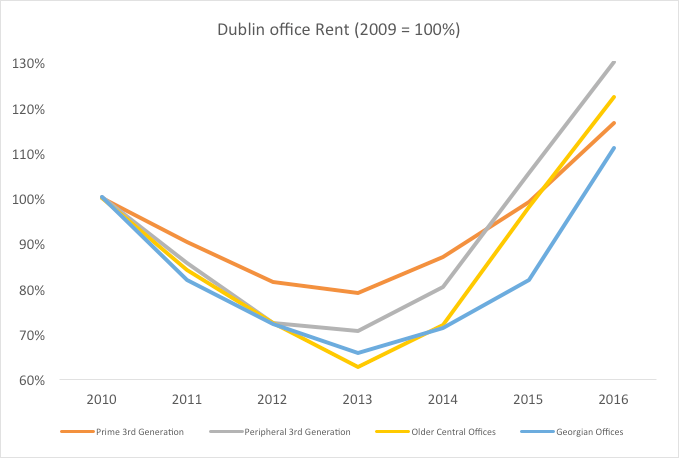

The rebound in the Dublin commercial property market has been significant… (see chart above)

…

Meanwhile the foreign investors have got out with their profit and the Irish are left thinking they can get rich by selling Ireland to each other.

Wait, haven’t we seen this before? Maybe Brexit will ensure a happy ending this time?

Dublin’s Commercial Market Praying for a Granite-Brexit – Read in full here

Gold Prices (LBMA AM)

24 Jul: USD 1,255.85, GBP 962.99 & EUR 1,077.64 per ounce

21 Jul: USD 1,247.25, GBP 958.89 & EUR 1,071.39 per ounce

20 Jul: USD 1,236.55, GBP 953.63 & EUR 1,075.06 per ounce

19 Jul: USD 1,239.85, GBP 950.84 & EUR 1,074.83 per ounce

18 Jul: USD 1,237.10, GBP 949.47 & EUR 1,071.82 per ounce

17 Jul: USD 1,229.85, GBP 940.71 & EUR 1,074.03 per ounce

14 Jul: USD 1,218.95, GBP 940.54 & EUR 1,067.92 per ounce

Silver Prices (LBMA)

24 Jul: USD 16.50, GBP 12.66 & EUR 14.17 per ounce

21 Jul: USD 16.43, GBP 12.63 & EUR 14.11 per ounce

20 Jul: USD 16.18, GBP 12.50 & EUR 14.07 per ounce

19 Jul: USD 16.23, GBP 12.44 & EUR 14.08 per ounce

18 Jul: USD 16.17, GBP 12.41 & EUR 13.99 per ounce

17 Jul: USD 16.07, GBP 12.30 & EUR 14.02 per ounce

14 Jul: USD 15.71, GBP 12.11 & EUR 13.76 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.