Why Russia’s Slumping Grain Yields Are So Bad For Putin

Politics / Russia Jul 28, 2017 - 03:04 PM GMTBy: John_Mauldin

By Geopolitical Futures : Russia relies on wheat more than any other foodstuff as an important component of its food supply. In fact, roughly 70% of wheat produced in Russia annually is consumed domestically. From Siberia to the westernmost regions bordering Europe, wheat is a staple in most parts of the country.

By Geopolitical Futures : Russia relies on wheat more than any other foodstuff as an important component of its food supply. In fact, roughly 70% of wheat produced in Russia annually is consumed domestically. From Siberia to the westernmost regions bordering Europe, wheat is a staple in most parts of the country.

In 2016, Russia became the world’s top grain exporter with a record production of 120 million tons of wheat, according to Russian statistics agency Rosstat. But poor weather conditions have affected this year’s production.

Russia’s grain harvesting season normally starts in June, but this year, it started in July. Cold temperatures have delayed crop ripening and have slowed down field work. As a result, total output is expected to be 17% lower than was originally anticipated.

This Is Critical for Two Reasons

First, grain is an important element of Russia’s food supply, and a shortage could lead to social instability. Second, the plunging food sector and declining grain exports could have a bad effect on the economy.

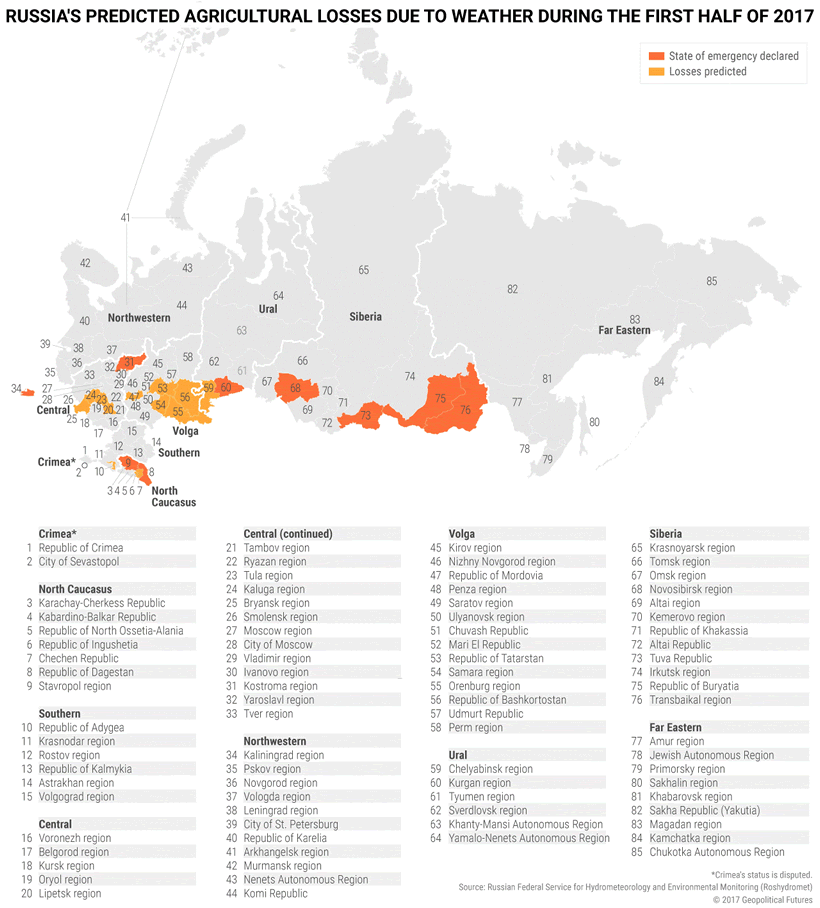

Russia anticipates that several regions will suffer weather-related agriculture losses. Several regions also declared a state of emergency because of severe weather conditions. This covers a large agricultural area, indicating both winter and spring crops may experience problems.

Food Prices Have Already Risen

It’s not yet clear how badly the agriculture sector will be affected by this year’s low yields, but the Central Bank of Russia is expecting the rate of food inflation to increase in the third quarter.

In fact, food prices have already risen. The minimum cost of a month’s worth of food per person, estimated at 4,233 rubles ($71), has increased since the beginning of the year by 14.9% on average in the country and by 16.4 % in Moscow.

As a result, in June, the consumer price index rose by 4.4% in annual terms, which is higher than the 4% inflation target set by the central bank.

The only thing worse for the Kremlin than high inflation is increasing domestic wheat prices. News of Russia’s declining grain production and the one-month delay of the harvesting season have already resulted in an increase in the export price of wheat, possibly making wheat in Russia more expensive.

The current price is closer to levels seen in 2015, when Russia implemented an export duty on wheat as the value of the ruble declined because of falling oil prices.

Grab George Friedman's Exclusive eBook, The World Explained in Maps

The World Explained in Maps reveals the panorama of geopolitical landscapes influencing today's governments and global financial systems. Don't miss this chance to prepare for the year ahead with the straight facts about every major country’s and region's current geopolitical climate. You won't find political rhetoric or media hype here.

The World Explained in Maps is an essential guide for every investor as 2017 takes shape. Get your copy now—free!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.