Weakening US Economy Could Ignite Rally in Gold

Commodities / Gold and Silver 2017 Jul 28, 2017 - 04:49 PM GMTBy: HAA

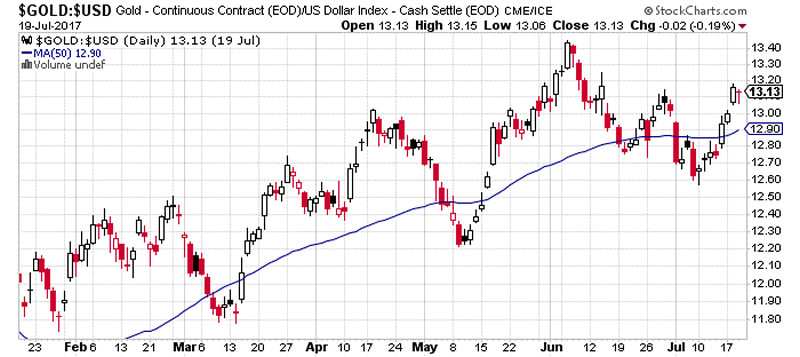

John Grandits : One possible effect of the “America First” approach the Trump Administration vowed to take was a weaker US dollar. Shortly after we wrote about this earlier this year, the dollar index began a steady march lower, retreating 7% in just five months, from 102 in March to its current level of 95.

John Grandits : One possible effect of the “America First” approach the Trump Administration vowed to take was a weaker US dollar. Shortly after we wrote about this earlier this year, the dollar index began a steady march lower, retreating 7% in just five months, from 102 in March to its current level of 95.

Not surprisingly, gold has risen almost 10% in US dollar terms during this time.

As recently as six months ago, many investors expected the dollar to continue its rally of the past few years based on stronger economic growth, via Trump’s agenda items, and tighter monetary policy by the Federal Reserve.

However, despite high expectations, so far Trump’s efforts to overhaul healthcare and reform taxes have fallen flat and have been short on substance. In addition, the continued investigation of Trump’s Russia ties has caused more investors to grow skeptical about the chances for meaningful reform, beyond unilateral executive action.

In a surprise move, the International Monetary Fund (IMF) just slashed its GDP growth forecast for the United States from 2.3% to 2.1%. It also cut its 2018 forecast from 2.5% to 2.1%. This type of revision hasn’t been seen anywhere in the world except for Brazil and South Africa, two deeply troubled economies.

The Fed has made good on two interest rate hikes so far in 2017, but based on weaker-than-forecast inflation and growth numbers, it will likely fall short of the four rate hikes it planned late last year. According to the Fed’s preferred method, Core PCE price deflator, inflation has been running well below 2%.

Economic growth, too, has been lacking—in the first quarter, it was just 1.2%, with consumer spending increasing only 0.6% year-over-year. Initial second-quarter GDP numbers are due on July 28 and may prove pivotal in the Fed’s decisions for the balance of the year. The Atlanta Fed is forecasting 2.4% growth, down significantly from the May 1 estimate of 4.3%.

But despite two rate hikes and impending balance sheet reduction, the 10-year yield has moved 15% lower since early March while the dollar has been weakening—both contrary to many forecasts at the start of 2017.

Typically, the Fed will raise rates when it thinks the economy is firing on all cylinders. But it’s becoming more evident that the Fed is now attempting to tighten policy into an economy that is weaker than in previous cycles. As exhibited by declining Treasury yields and very modest inflation, this is at odds with conventional market forces and investors’ expectations for growth.

At this point, Yellen may be forced to raise rates later this year. She needs to at least come close to the four rate hikes outlined for 2017 in order to have some ammunition if the economy falls into recession. Fed fund futures are currently putting the odds of one more rate hike at about 50%.

In the meantime, the Fed will continue to jawbone the market, a favorite tactic to influence investor behavior since it embarked on years of massive monetary accommodation to resuscitate the economy after the Financial Crisis.

However, the same way investors are growing leery of Washington’s political rhetoric, they are also putting less weight on the endless parade of speeches by voting members of the Fed—specifically, Janet Yellen, Stan Fischer, Bill Dudley, and Lael Brainard—in an effort to manipulate markets without doing anything.

Capital Goes Where Treated Best

While the dollar has been slumping and Treasury yields declining, quite the opposite is happening in Europe, where structural reform now looks more promising.

A huge rally has been underway in the euro, an indication of the demand for European assets. Also, German Bund yields have risen significantly, albeit from a low base, well out of the negative territory seen last summer.

The ECB is now about to embark on a similar adventure as the Federal Reserve is currently undergoing, normalizing monetary policy after years of quantitative easing and extremely low interest rates. Only time will tell if it has more initial success, but so far it looks promising on both the financial and political fronts.

As global investors continue to reprice expectations for structural reforms in the US and Europe, capital will continue to migrate into growth assets and safe-haven investments as an alternative to markets perceived as riskier.

A Positive Development for Gold

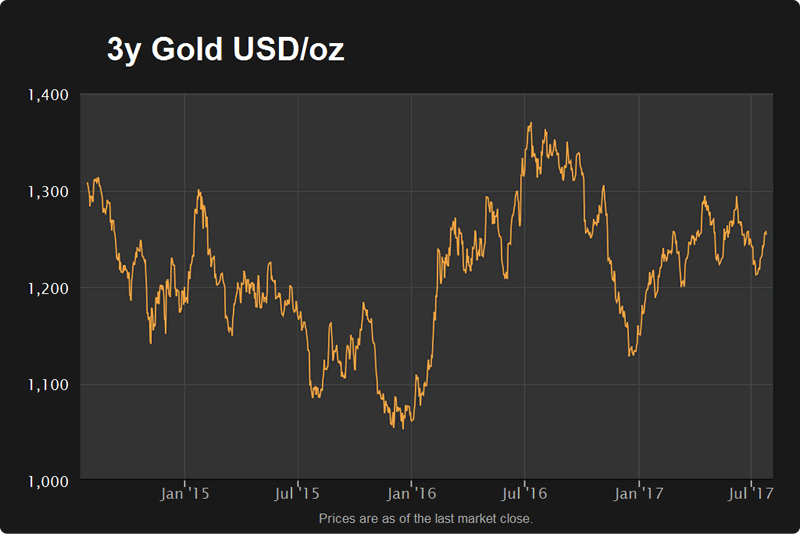

After trading as low as $1,050 per ounce in December 2015, gold has rallied over $200 to its current level of $1,255. The move higher has been filled with bouts of brief sell-offs and volatility, only to continue making “higher highs” and “lower lows,” technically a very positive development.

Source: gold price per ounce chart by Hard Assets Alliance

This has tested many investors’ patience and conviction, but those who bought on the dip have been rewarded.

As famous investor John Templeton stated, “Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell."

And there is no shortage of potential catalysts to move this rally in precious metals, both gold and silver, beyond the skepticism phase: military intervention on North Korea, government shutdown as the debt ceiling is reached in September, further implications of Trump’s collusion with Russia, and the beginning of balance sheet reduction later this year by the Fed, to name just a few.

Any one of these has the potential to make the 20% move we’ve already witnessed in gold look like peanuts. If you have not done so already, now is the time to add the ultimate hard asset to your portfolio, while pessimism is still high, and protect the wealth you’ve worked so hard to accumulate.

Get a Free Ebook on Precious Metals Investing

Right now is the perfect time to add some physical gold to your portfolio. But before you buy, make sure to do your homework first. The informative ebook, Investing in Precious Metals 101, tells you which type of gold to buy and which to stay away from… how to spot common scams and mistakes inexperienced investors fall prey to… the best storage options… why pooled accounts aren’t safe places… and more. Click here to get your free copy now.

© 2017 Copyright Hard Assets Alliance - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable,

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.