Gold And Silver – Value Remains Irrelevant To Price

Commodities / Gold and Silver 2017 Jul 30, 2017 - 01:56 PM GMTBy: Michael_Noonan

Value is subjective, reflective of one’s feelings or opinions. In the minds of those who value gold, throughout the ages and around the world, this precious metal is deemed to have an intrinsic value superior to most other assets. The well-used adjective, intrinsic, is also subjective, construed as essential, belonging naturally in its association with gold. In the end, “intrinsic value” is elusive, a figment of one’s mind.

Value is subjective, reflective of one’s feelings or opinions. In the minds of those who value gold, throughout the ages and around the world, this precious metal is deemed to have an intrinsic value superior to most other assets. The well-used adjective, intrinsic, is also subjective, construed as essential, belonging naturally in its association with gold. In the end, “intrinsic value” is elusive, a figment of one’s mind.

There are many, and we fall in this camp, who associate gold with an inherent preservation of wealth. This has been true throughout history but with intervening failures during some time frames. Failure may not be the most apt expression, but many detractors are happy to point out those times when gold did not retain its status as a wealth preserver, and in fact, losses were on the table for many who paid a price higher than for what their gold was sold. It happens. The net result of gold being a wealth preserver holds true, but with periodic, and some times substantial, yet temporary, reversals. This time will be no different.

Price is objective, not dependent upon one’s feelings or opinions for price is an actual number. The subjective value of gold is somewhat intertwined with the objective price of gold through the natural laws of Supply and Demand. The latter are a function of what is available [Demand], in relation to the desire to have what exists [Supply], The desire to acquire can be greater or less than what is available, and that is what eventually determines price.

The natural laws of Supply and Demand have been usurped by the elites in their fervent determination to have a One World Order where the globalists are in charge of everyone and everything. The United Nations is the political arm of the globalists, while the Bank for International Settlements [BIS] and the International Monetary Fund [IMF] are the controlling financial entities used to dominate sovereign countries, dictating policies and controlling [enslaving through debt] the masses.

The globalists have been manipulating the price of gold since the formation of the US Federal Reserve in 1913. The formation of the Bretton Woods System, established in 1944, which is also when the IMF was created, led to an international basis for exchanging the currency of one country for any other, and the closing of the gold window by Nixon in 1971 were pivotal events that led up to massive and ongoing manipulation of gold by the central bankers of the world.

The run-up in the price for both gold and silver in 2011 was a precursor of the actual demand for the physical metals. They represent sound money, and the globalists would not tolerate any competition for their paper fiat Ponzi scheme of creating money out of thin air and demanding interest for the “privilege” of its use. This is the primary reason why both gold and silver have been “beaten down,” as it were, to current levels over the past 6 to 7 years.

Drive down the price of both metals and tire out the public from any desire to own a declining “price” asset. This has been the ongoing objective of the globalists in order to corral everyone into their digital web of financial control from which there will be no escape. There is a similar Ponzi scheme going on in the stock market which continues to defy the laws of Supply and Demand, and gravity, as well.

The globalists have destroyed the middle class and elderly savers by driving interest rates to zero, and negative in some parts of the world. With no way to earn a return on one’s savings, people have been forced into paper stocks, around the world, chasing some kind of return on their money assets [while exposing themselves to tremendous loss of capital when the markets go south with “unexpected” impunity.] The unexpected part is only for those who fail to use business and financial sense, aka lemmings.

Debt around the world is in the trillions and has never been higher at any time in history. Even worse, financial derivatives is 10 to 100 times greater [owned by financial banks, for the most part], with no hope of ever being able to control them once market reverse to the downside. The globalists have created so much debt to save the totally bankrupt banking system.

Financial Armageddon is waiting in the wings. At some point, it will be unable to be controlled and financial disaster will prevail around the world. At that point, the price of gold will no longer be in control, and it will become subservient to the value of both gold and silver. The question all have been asking, especially those owning and holding either or both gold and silver, is when will price begin to reflect reality?

Reality, as most sane people would define it, does not exist while the globalists are financially in charge, and in charge they are. The war on cash is another example of how the bankers are preparing to financially fleece as many people as possible. Control over how much of their own money one can withdraw from a bank has been in place for several years, now. The destruction of the “dollar” [and the United States], continues unabated. All of the signs are there.

Who will survive? One group will be the owners of physical gold and silver. Of course, they will be subject to confiscation, theft, and government control, among others. That will be a small price to pay for having preserved, and more than likely greatly enhanced the value of their holdings. Trade and barter have always existed, and the demand for concrete, as opposed to paper or digital [non]-“assets” ensure value will prevail.

When will that process begin? [That never-ending question that has no viable answer.]

It will not happen one day sooner than when it begins, and that is not as nonsensical as it may seem. Many holders of the physical may feel like the Greek mythological Sisyphus for the past several years. Unfortunately, the duration of globalist control does not appear to be ending any time soon. How do we know at least that?

To the charts…

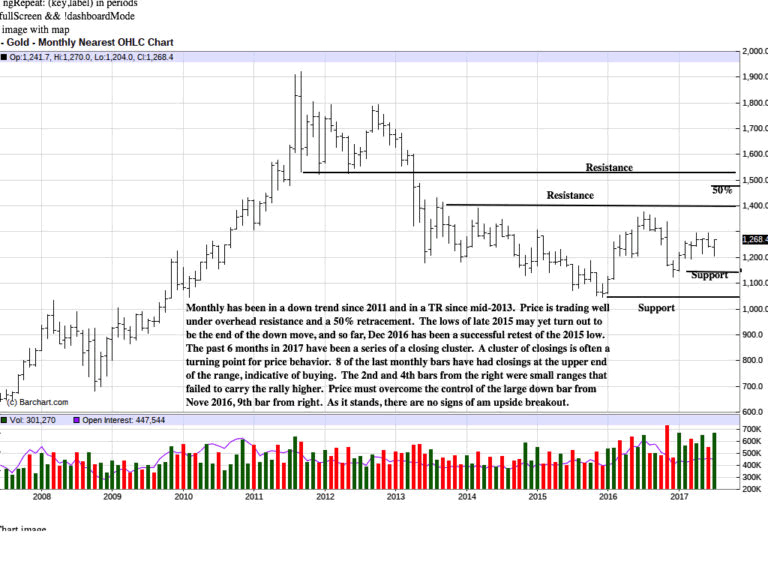

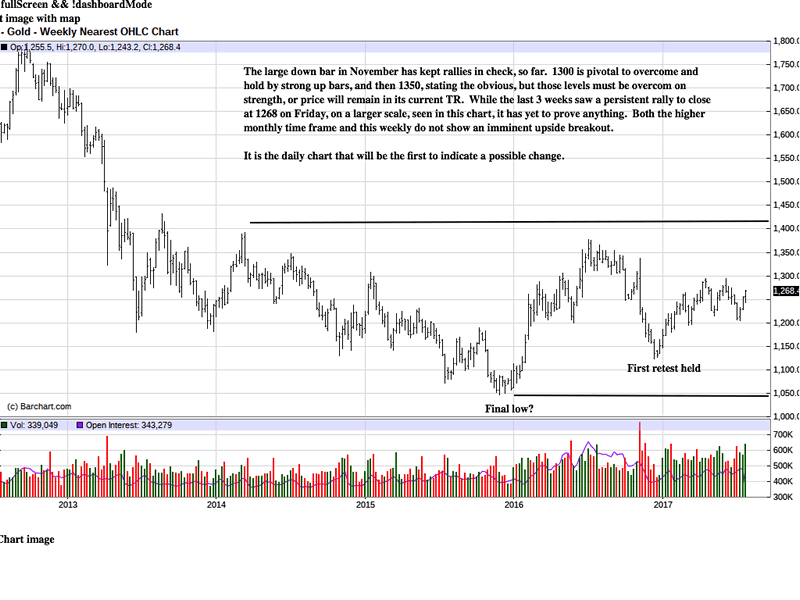

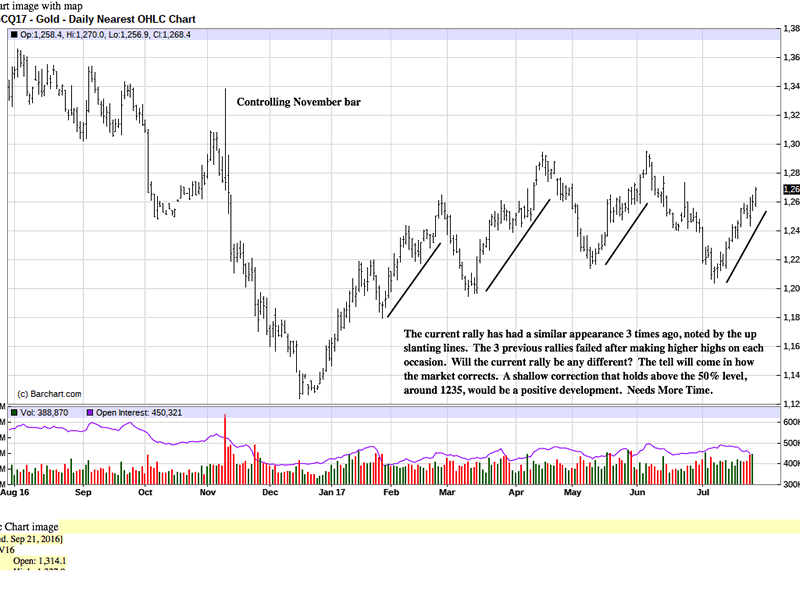

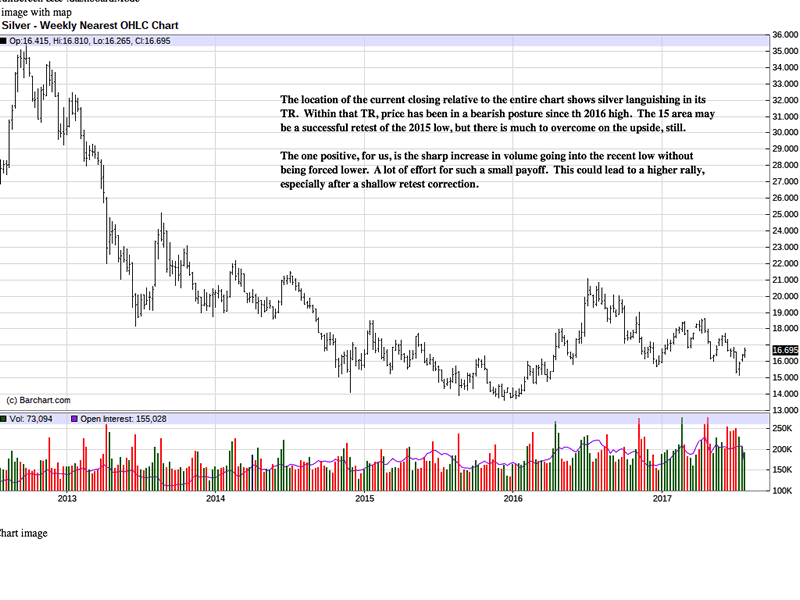

The actual monthly close will be on Monday, but a single day is not likely to materially alter the chart interpretation. The takeaway from this and every other time frame is that a strong rally is not imminent. In fact, we are more likely to see more of the same. the potential for positive change always exists, but until we can see such change developing on the charts, more sideways activity will continue.

TRs [Trading Ranges], are the least telling as to direction. Right now, price is almost at the center of the TR and can go in either direction without changing the TR, at least until there is a decisive breakout, either way.

More of the same…nothing revealing.

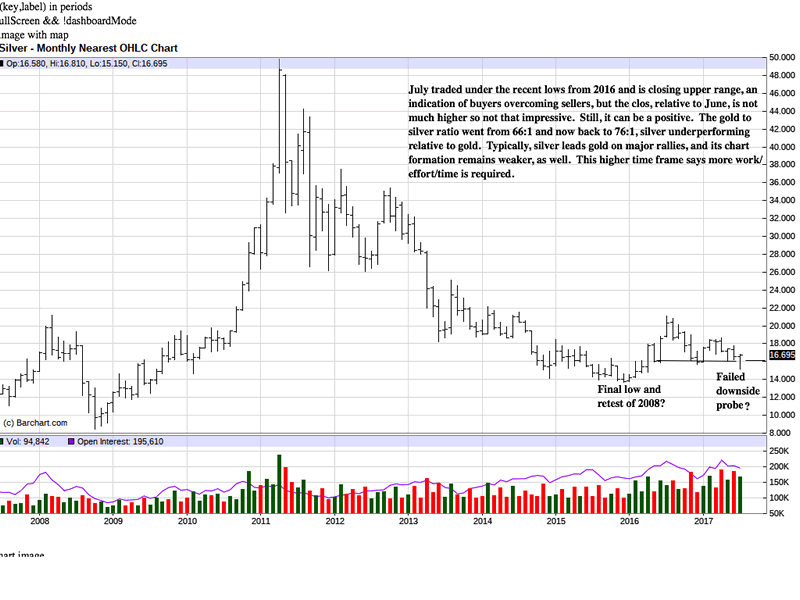

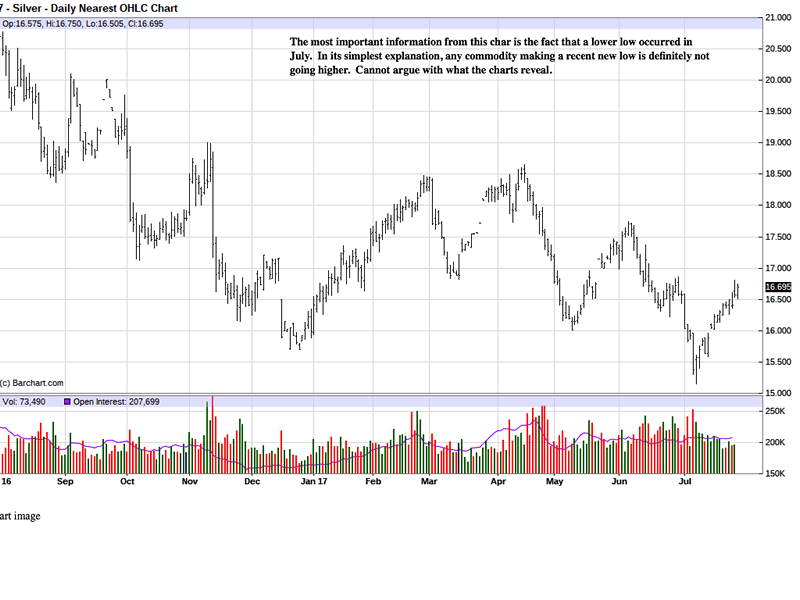

Silver remains weaker, relative to gold. For July to prove its potential for change, price needs to follow through to the upside, or, at a minimum, have a shallow correction.

The comment on volume in the chart is the most positive statement we can make.

Why say more than what the chart clearly reveals?

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2017 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.