Gold and Silver Precious Metals Nearing Breakout

Commodities / Gold and Silver 2017 Aug 15, 2017 - 01:14 AM GMTBy: Jordan_Roy_Byrne

The outlook for precious metals has changed quite a bit over the last month. In early July, Gold and gold stocks were weak and threatening severe breakdowns below key levels such as $1200 Gold and $21 GDX. Those moves reversed course and now Gold and gold stocks are threatening resistance. The prognosis has turned bullish and with the help of a correcting stock market precious metals could build on their recent rebound.

The outlook for precious metals has changed quite a bit over the last month. In early July, Gold and gold stocks were weak and threatening severe breakdowns below key levels such as $1200 Gold and $21 GDX. Those moves reversed course and now Gold and gold stocks are threatening resistance. The prognosis has turned bullish and with the help of a correcting stock market precious metals could build on their recent rebound.

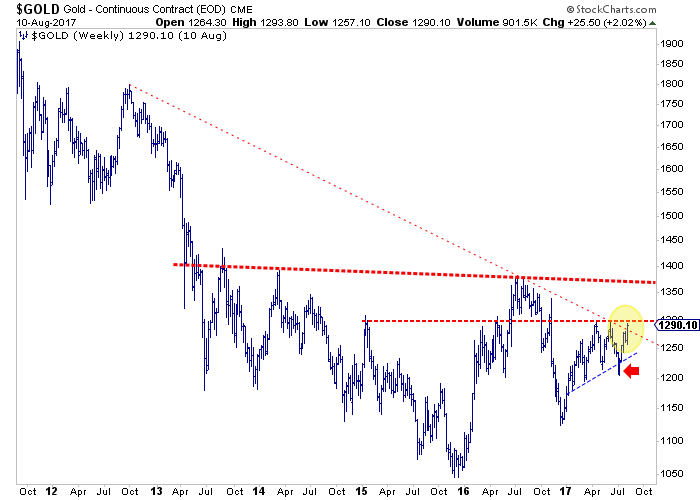

Below we plot the weekly bar chart of Gold which is testing critical resistance in the $1290-$1300 area. Gold could close the week at its highest weekly close in 2017, just weeks after breaking its 2017 uptrend. That early July breakdown proved to be a false break as Gold has been able to rally back up to resistance. Gold has broken the downtrend line since 2011 but the most important resistance is $1300. With a break above $1300, Gold could be on its way to a retest of the 2016 high at $1375.

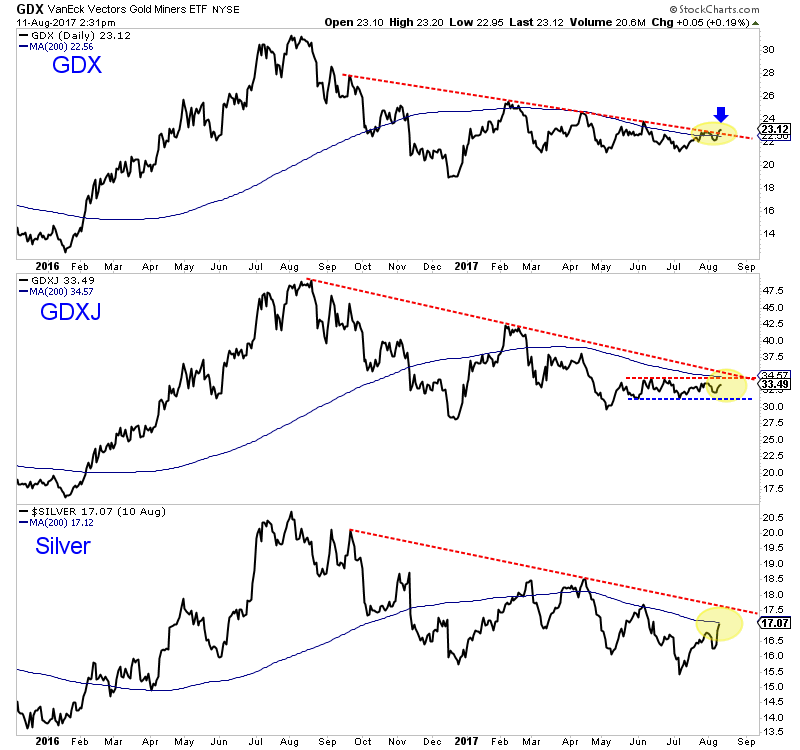

Turning to the miners, we find that GDX has already broken its downtrend and the 200-day moving average. GDXJ faces strong resistance at $34-$35. Silver has a little ways to go before it can break its downtrend line but its relative strength in recent days is quite encouraging.

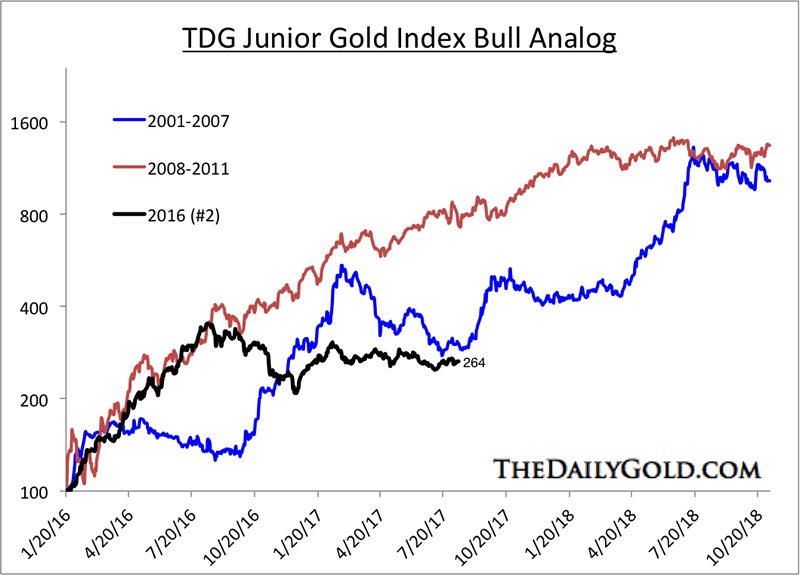

While there are only a few data points in the junior bull analog chart (which is based on our junior indices), it suggests the juniors could be close to starting a new leg higher. If Gold is going to rise to $1375 then the juniors would enjoy a good pop. The analog chart shows the significant upside potential in juniors if Gold were to clear $1375 and advance towards $1550-$1600.

There are several reasons we have turned bullish. First, precious metals were breaking down in early July yet that reversed course entirely. Gold has rallied back to +$1290 and well above resistance at $1240-$1250. If Gold were going to break below $1200 then the rally would have rolled over again around $1240. Second, intermarket activity has turned quite favorable for Gold. The US$ index has not made a new low but Gold has perked up. Meanwhile, Gold is benefitting (as it should) from weakness in the equity market. We think the weakness could continue and drive Gold to $1375.

The bottom line is Gold is now showing strength on both a nominal and relative basis. If this continues then Gold will clear $1300 and the gold stocks (which have been lagging) could push higher in sudden and aggressive fashion. Consider learning more about our premium service including our favorite junior exploration companies.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.