Stock Market Cycle Act II

Stock-Markets / Stock Market 2017 Aug 22, 2017 - 11:51 AM GMTBy: Ed_Carlson

Cycles warn that the sell-off in equites during the last two weeks should find a bottom this week – temporarily. The Bradley model does not hold much hope for those who hope to trade the bounce as it points an upwards-to-sideways move until mid-September when it drops precipitously into mid-October.

The Decennial pattern warns of a nasty sell-off in equities during years ending in the number 7 (i.e. 2017). Since 1907 each of these years (with the exception of 1947 which suffered a mere 6.2% drop) has seen a double-digit decline beginning somewhere between June and October.

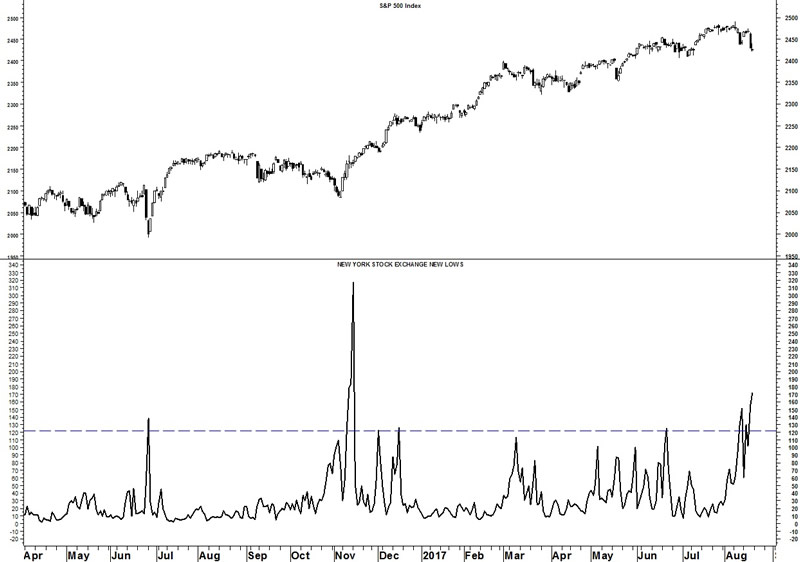

One non-cyclical indicator warning of a low is NYSE new 52-week lows (chart). They have reached a high enough level to indicate that market participants have thrown in the towel (the selling is over for now).

Try a "sneak-peek " this month at Seattle Technical Advisors.com

Ed Carlson, author of George Lindsay and the Art of Technical Analysis, and his new book, George Lindsay's An Aid to Timing is an independent trader, consultant, and Chartered Market Technician (CMT) based in Seattle. Carlson manages the website Seattle Technical Advisors.com, where he publishes daily and weekly commentary. He spent twenty years as a stockbroker and holds an M.B.A. from Wichita State University.

© 2017 Copyright Ed Carlson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.