Is the Stock Market Setting itself up for a Spectacular Crash?

Stock-Markets / Stock Market Crash Aug 22, 2017 - 05:04 PM GMTBy: Sol_Palha

“Neither a man nor a crowd nor a nation can be trusted to act humanely or to think sanely under the influence of a great fear.” Bertrand Russell, Unpopular Essays

“Neither a man nor a crowd nor a nation can be trusted to act humanely or to think sanely under the influence of a great fear.” Bertrand Russell, Unpopular Essays

The stock market crash story is getting boring and annoying to a large degree. Since 2009, there has been a constant drumbeat of the market is going to crash stories. In 2009, many experts felt that the market had rallied too strongly and that it needed to pull back strongly before moving higher up. They were calling for 15%-20% correction. Ten years later and most of them are still waiting for this so-called strong correction or crash. A stock market crash is a possibility but the possibility is not the same thing as certainty, and this is what seems to elude most of the naysayers. One day they will get it right as even a broken clock is correct twice a day. In the interim waiting for this stock market crash has cost these experts a fortune, both in lost capital gains and actual booked losses if they shorted this market.

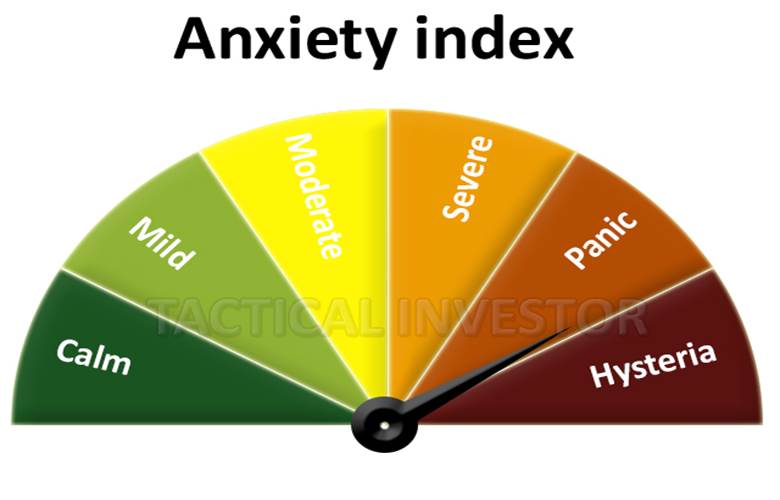

It’s 2017, and the markets are overbought, and we agree that they need to let out some steam, but as for a crash that will only occur when sentiment turns bullish. The crowd has not embraced this market and until they do corrections but not crashes is what we should expect. In fact, we penned an article titled “Dow Could Trade to 30K But not before This Happens”, where we discussed the possibility of the Dow trading to 30k before it crashes. The one factor that could alter this outlook would be for the masses to turn bullish suddenly.

This market will experience a spectacular crash one day; nothing can trend upwards forever and eventually the market has to revert to the mean. Markets never crash on a sour note; the crowd is chanting in joy when the markets suddenly change direction. A simple look at previous bubbles will prove this; the housing bubble, for example, did not end on a note of fear; the crowd was ecstatic. Even the Tulip bubble that lasted from 1634-1637 ended on a note of extreme joy.

Jim Rogers states that the next crash will be the worst one we have seen in our lifetimes.

We’ve had financial problems in America — let’s use America — every four to seven years, since the beginning of the republic. Well, it’s been over eight since the last one. This is the longest or second-longest in recorded history, so it’s coming. And the next time it comes — you know, in 2008, we had a problem because of debt. Henry, the debt now, that debt is nothing compared to what’s happening now.

In 2008, the Chinese had a lot of money saved for a rainy day. It started raining. They started spending the money. Now even the Chinese have debt, and the debt is much higher. The federal reserves, the central bank in America, the balance sheet is up over five times since 2008. It’s going to be the worst in your lifetime — my lifetime too. Be worried Business Insider

In a broad manner of speaking, he is right, but the proverbial question as always is “when”; so far the naysayers have missed the mark by 1000 miles. This entire rally has been based on the fact that the Fed artificially propped the markets by keeping rates low for an insanely long period and infusing billions of dollars into the markets. One day the pied piper is going to collect but as we have stated over and over again over the years, that until the masses embrace this market, a crash is unlikely. A strong correction is, however, a certainty; it’s just a matter of time.

The market has defied every call, and even some of the most ardent of bulls are now nervous; we stated this would occur over two years ago. The Market has put in over 36 new highs this year and is living up to the new name we gave it late in 2016. Up to that point, we referred to this market as the most hated bull market of all time; after that, we started to refer to this market as the most Insane Stock Market Bull of all time. Insanity by definition has no pattern so expect this market to do things no other market has ever done before.

A strong correction is a certainty; the million dollar question is when

We are using the word correction and not crash for until we start seeing non-stop headlines for Dow 35K, and the overall sentiment turns bullish, the markets are unlikely to crash. Sentiment analysis reveals that the crowd is still either uncertain or bearish when it comes to the stock market.

From a technical basis, the markets are extremely overbought. However, markets can remain irrational for a lot longer than most players can remain solvent. An overbought market does not mean that the market is ready to crash. Take a look at the stock NVDA; the stock has been trading in the overbought ranges for over two years, and instead of crashing, it has continued to trend higher.

Take some insurance if you think the market is going to crash

Gold performs well during times of uncertainty or when fear is running high. It is easy to own Gold today. You can either buy the metal or get into one of several ETF’s that invest in the metal. For example GLD and IAU; if you want to take a bit more risk, then getting into the VanEck Vectors Gold Miners ETF (GDX) or the Junior Gold Miners ETF (GDXJ) could be another option.

We have always stated that putting a small amount into Gold made sense and that one should look at it as a form of insurance. You don’t purchase insurance because you know for a fact that disaster is going to strike; you purchase it because in the event disaster should strike, you won’t be caught with your pants down.

Conclusion

The market will crash one day, and it will probably be quite a spectacular crash as this market has soared to stunning heights. The main driving force behind this massive move has been and still is hot money. However, we have continuously stated that this bull market would not crash until the masses embraced it. In 2016 we informed our subscribers that the Dow was getting ready to trade to 21K; this target was hit within three months. The Dow went on to trade to 22K and sentiment is far from bullish. History indicates that markets always crash on a note of euphoria. Instead of worrying about a future crash, why not put in a few common sense measures that could reduce your risk but also allow you to profit from this bull market

- Take some money off the table when you position is showing healthy gains

- Implement trailing stops

- Put some money into safe haven investments like Gold

- Monitor the masses; bull markets have never ended on a sour note

On a separate note, Gold is holding up fairly well, and as long as it does not trade below 1250 on a weekly basis, it has a good chance of testing the 1360-1380 ranges with a possible overshoot to 1400.

Don’t fixate on the crash factor; instead look for great stocks you would like to own. When the market eventually corrects, you will be in a position to pick up top players at a great price.

Irony is the form of paradox. Paradox is what is good and great at the same time.

Friedrich Schlegel

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2017 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.