British Pound Rallies Higher Against US Dollar

Currencies / British Pound Aug 23, 2017 - 02:51 PM GMTBy: Richard_Cox

Currency markets are starting to shake the summer doldrums that are typically characterized by weak trading volumes and low price volatility, and one of the primary beneficiaries has been the British Pound (GBP). Markets are still being forced to deal with the potential implications that could unfold after the next round of Brexit negotiations but the broader global interest rate story still seems to be setting the tone for the currency relative to the US Dollar. When viewing the forex markets in terms of the GBP/USD, bullish trends look much more pronounced and investors are wondering about whether or not it is time to establish larger positions in the cable.

Of course, this strength in the GBP has not been seen against the Euro. When viewed through currency pairs like the EUR/GBP, the trend scenario is quite different and we have even seen analyst speculation suggesting a growing possibility that the European Central Bank (ECB) might even be forced to intervene in the forex markets in order to prevent further strength in the Euro currency.

But within the British economy itself, the central issue continues to be the Brexit negotiations as there are still significant questions about how with will impact instruments like the FTSE 100 into the final months of this year. The Bank of England would prefer not to see excessive volatility in stock markets and so it is expected that the central bank will do everything in its power to allay investor fears and avoid potential uncertainties.

For investors that are specifically focused on the forex markets, it will also be important to note the possible changes in monetary policy focus that will be highlighted by the Federal Reserve. There are still some differences in agreement with respect to whether the US central bank will continue raising interest rates this year. The Fed has offered several dovish policy statements for the market’s consumption and this has led to downside pressure on the US Dollar given the expectations that we will not see any additional rate tightening for the US economy in the months ahead. This creates opportunities for investors implementing strategies in CFD trading, as there are several markets (stocks, commodities, and currencies) which will likely be impacted by the outcomes in these areas.

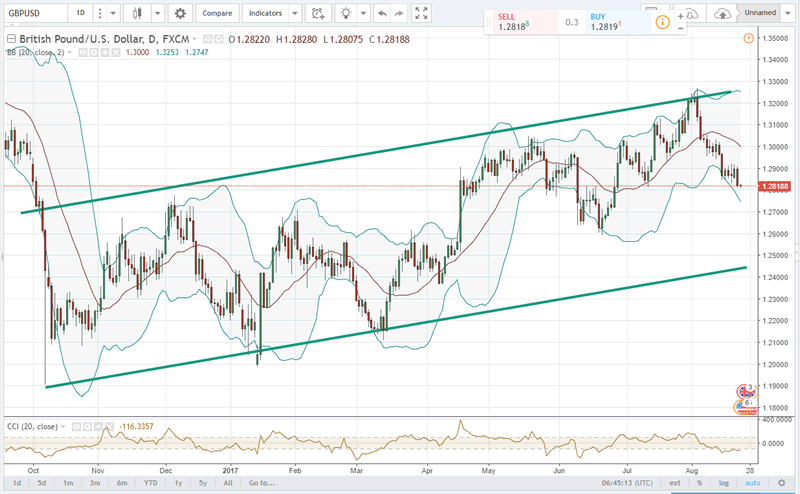

The next price levels to watch in the GBP/USD can be found at 1.2610 to the downside, and 1.3030 to the topside. This area defines the immediate trading range on the hourly charts, which exists within a much broader uptrend channel on the daily charts. Overall, the bias remains positively as long as we are able to hold above the 1.2610 area as any downside breaks here would likely lead to a test of the rising uptrend channel that we are now watching on the daily candlesticks.

Overall, traders will be weighing the outcomes of the next Brexit negotiations alongside the monetary policy statements that are made public by the US Federal Reserve. These are ultimately the trends that should define the price directions that are seen as we start activity in 2018 and so there are very important implications that should develop once markets decide whether to test the top or bottom of the current trading range in the GBP/USD.

By Richard Cox

© 2017 Richard Cox - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.