A Very Good Day for Gold

Commodities / Gold and Silver 2017 Aug 30, 2017 - 01:25 PM GMTBy: Clive_Maund

What happened yesterday in the gold market was VERY bullish. After looking like it was topping out at its April and June highs, gold surged through them. While we were wary of it topping out here like a lot of traders, we definitely have a handle on the big picture which couldn't be more positive, with the dollar set to crash as it heads towards loss of its reserve currency status, and a slowly dawning awareness among the hordes of fools holding paper denominated gold, that the only thing that matters is physical possession—if you own paper gold, you could find yourself well and truly out in the cold. You can wave your piece of paper in the air and demand delivery, only to be bluntly informed "Sorry, mate—none left—go ask the Chinese if they'll let you have a little".

What happened yesterday in the gold market was VERY bullish. After looking like it was topping out at its April and June highs, gold surged through them. While we were wary of it topping out here like a lot of traders, we definitely have a handle on the big picture which couldn't be more positive, with the dollar set to crash as it heads towards loss of its reserve currency status, and a slowly dawning awareness among the hordes of fools holding paper denominated gold, that the only thing that matters is physical possession—if you own paper gold, you could find yourself well and truly out in the cold. You can wave your piece of paper in the air and demand delivery, only to be bluntly informed "Sorry, mate—none left—go ask the Chinese if they'll let you have a little".

The great news is that this nascent bull market in gold (and silver), or more accurately second upleg of the larger bull market that started in about 2001 is set to dwarf the 2001—2011 upleg, and if you can't own physical, forget ETFs and other paper rubbish—own shares of the companies that dig the stuff out of the ground—the large and mid-cap producers which are still selling at silly cheap prices, especially when you consider where gold and silver are headed. We started going for them a shade early a few months ago, and ended up looking temporarily stupid, but things are looking a lot better now and the key point to make here is that there is still everything to go for and there is a nice long list of them to choose from, and here's another point—some of the biggest of these companies may seem lumpy and boring, but even these ones look destined to rise to many times their current prices during the mega-bull market that is about to start gaining traction.

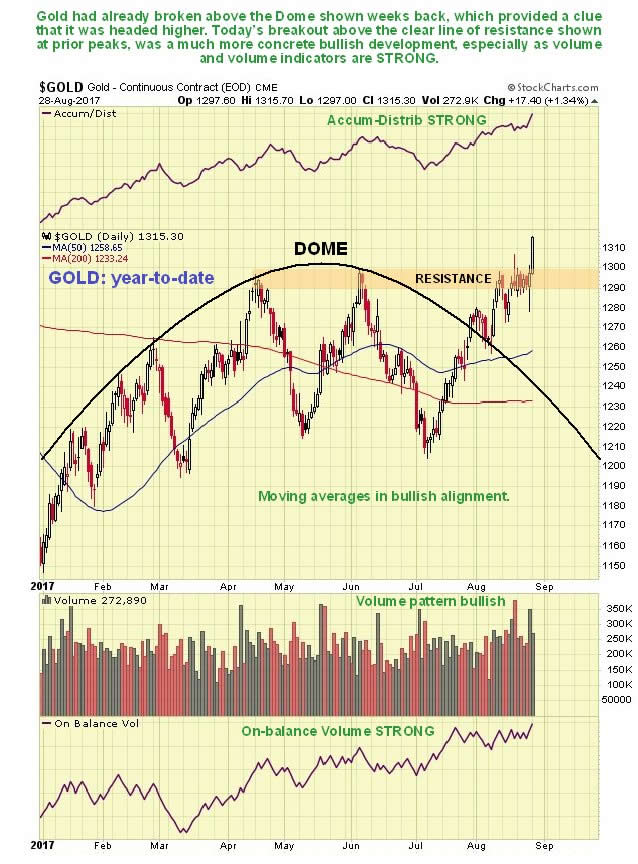

Now we'll quickly review some key charts. On gold's 6-month chart we see how it broke strongly through resistance at its April and June highs today, that had threatened to turn it lower again.

On the 10-year chart for GDX, a proxy for gold stocks, we see that we are at a truly great entry point for gold and silver stocks, as GDX is just starting to rise up from near to the Right Shoulder low of its giant Head-and-Shoulders bottom pattern. GDX could rise surprisingly quickly towards its 2011 highs, especially if the dollar breaks down from its Broadening Top pattern, which is expected to trigger a dollar crash, and very possibly a stock market crash, since a crashing dollar will choke off the inflow of funds to the U.S., and this time, unlike 2008, gold and silver are unlikely to crash as they will be about the only game in town.

We are well aware that the dollar is oversold here with a high short position, but that won't save it if breaks down from its Broadening Top, which would likely trigger a crash. Remember that we are headed towards a new paradigm where the dollar loses it reserve currency status, and the U.S. for the first time has to face the true consequences of its bankruptcy.

China and other Eastern powers, which have built up big quantities of physical, and can back their currencies with gold if they so choose, are going to ride the storm much better than frail, debt-wracked Western economies who have stupidly sold all or most of their gold. As a citizen of a Western country you don't have to go down the gurgler like most of your compatriots whose investments will head rapidly in the direction of worthlessness, because you have the option to invest in the one sector that will outshine all the others in the coming financial mayhem—the Precious Metals sector.

The path ahead is clear—buy physical gold and silver that you can either have in your possession or securely stored. Failing that avoid ETFs, paper contracts and other IOUs and instead invest in the better mining stocks, starting with the large and mid-cap producers. U.S. investors should try to get some of their funds into mining stocks on the Canadian market, because the Canadian dollar should do well as the U.S. dollar crashes, in part because Canada is more of a resource based economy.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.