Technology Is Already Eliminating Driver Jobs—Here’s How to Trade It

Commodities / AI Sep 02, 2017 - 12:40 PM GMTBy: John_Mauldin

BY PATRICK WATSON : Everyone is worried about robots. Elon Musk fears they will kill us all if we give them both deadly weapons and autonomy.

BY PATRICK WATSON : Everyone is worried about robots. Elon Musk fears they will kill us all if we give them both deadly weapons and autonomy.

He certainly has a point, but the non-lethal scenarios are no picnic either. Robots are already taking over human jobs at a rapid pace. Robots are already taking over human jobs at a rapid pace.

Worse, artificial intelligence (AI) systems threaten even “knowledge worker” jobs now.

This is a troubling combination.

- Robots can out-move us.

- AI can out-think us.

What happens when those two get together?

Answer: the problem grows exponentially. To see how, consider the humble school bus.

Algorithms Optimizing Routes = Fewer Drivers

Local school officials in Boston recently realized that student transportation was costing them big money: to be precise, a whopping $120 million a year.

Looking to save money, the school system offered a $15,000 prize to whoever could figure out the most efficient bus route map.

Two doctoral students at nearby MIT won the contest. The algorithm they designed eliminated 75 bus routes while still delivering all the students. It will save the school system $5 million a year—a whale of a return on $15,000 invested.

Part of that windfall comes from reducing bus driver positions. The new scheme saves a million bus miles per year, and fewer miles means fewer drivers.

Note how this works.

Boston doesn’t need fancy new self-driving buses to cut bus driver jobs. The routing algorithm doesn’t just replace jobs; it eliminates them. Having done so in Boston, it can now do the same in other places.

Even the bus drivers who keep their jobs may not be safe for long.

The Second Part of the Equation Is Close

Tesla founder Elon Musk tweeted this back in April:

Musk sometimes gets dreamy on his predictions, but this one may be real.

Earlier this month, Reuters obtained emails between Tesla and Nevada state officials. Tesla wants permission to test autonomous electric trucks on Nevada’s highways.

As part of the test, the autonomous trucks will move in a “platoon” formation, with one truck following only inches behind the next. Human drivers could never do that safely, but computers can. It also saves battery power by reducing drag.

Now, add these two together:

- First, advanced algorithms are making transport routes more efficient, reducing the number of vehicles and drivers.

- Second, the remaining vehicles are gaining the ability to drive themselves.

The first part is happening right now—with school buses, delivery routes, and more. It doesn’t need any new technology or permission from regulators.

The second part is coming fast. According to Reuters, Tesla wants to test the trucks without a human backup driver aboard, which suggests they may be further along than most observers thought.

Either development by itself would do away with hundreds of thousands of human jobs. Together, they have a multiplier effect that could speed up the process considerably.

Millions at Risk

How many jobs precisely are we talking about?

The US has 1.8 million heavy truck and tractor-trailer drivers, according to a new Richmond Fed report. Add the 685,000 bus drivers, the 859,000 local delivery drivers, the 189,000 taxi and 160,000 Uber drivers, and multiple millions are at risk.

These potential job losses are both an economic and a social problem.

Given time, the economy will sort it out, but meanwhile people will experience real pain—and political leaders will have to find appropriate responses.

Investment Implications

As an investment matter, automation and robotics is reaching a kind of critical mass. In our analysis, I have long stopped wondering whether machines can do these things, and started wondering how it will work and how to profit from it.

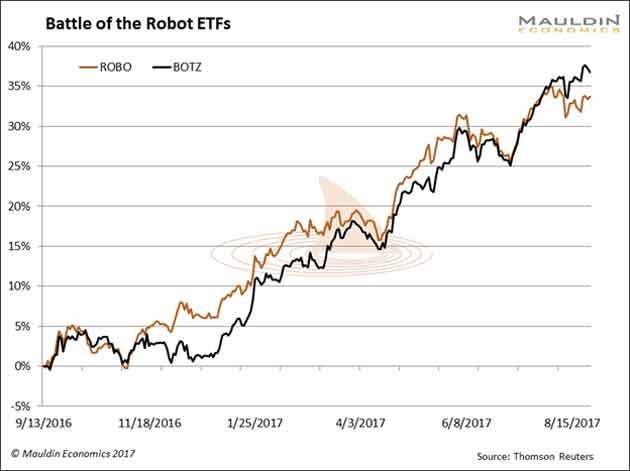

A good place to begin is with the two ETFs that cover this sector:

- Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ)

- Robo Global Robotics and Automation Index ETF (ROBO)

ROBO launched in October 2013, and BOTZ came out in September 2016. Both are up more than 30% since the later one’s inception.

The AI/robot evolution is still in its infancy, so I think more gains will come. More volatility too.

The ETFs are an easy way to get broad exposure whereas buying individual stocks lets you fine-tune the risks to fit your personal goals.

We’ve been following this theme for a while now, using both stocks and options. Selling put options generates current income for our subscribers, since many growth stocks don’t pay dividends.

However, investing isn’t always about growth or income. Sometimes it’s about survival. If automation threatens your job, having your portfolio benefit from it may help hedge your career risk.

Free Report: The New Asset Class Helping Investors Earn 7% Yields in a 2.5% World

While the Fed may be raising interest rates, the reality is we still live in a low-yield world. This report will show you how to start earning market-beating yields in as little as 30 days... and simultaneously reduce your portfolio’s risk exposure.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.