Physical Gold In Vault Is “True Hedge of Last Resort” – Goldman Sachs

Commodities / Gold and Silver 2017 Sep 07, 2017 - 12:19 PM GMTBy: GoldCore

– Physical gold is “the true currency of the last resort” – Goldman Sachs

– Physical gold is “the true currency of the last resort” – Goldman Sachs

– “Gold is a good hedge against geopolitical risks when the event leads to a debasement of the dollar”

– Trump and Washington risk bigger driver of gold than risks such as North Korea

– Recent events such as N. Korea only explain fraction of 2017 gold price rally

– Do not buy gold futures rather “physical gold in a vault” is the “true hedge”

What’s increasing the demand for gold? Is it Kim Jon-Un’s calls for nuclear war? Trump’s tough tweets on government and trade and unleashing “fire and fury” on North Korea? The threat of World War III?

Possibly not, according to Jeff Currie of Goldman Sachs. This is more to do with the market mechanics underlying such events.

Currie released a note arguing that gold’s strong performance of late is less to do with the current perceived risk in the geopolitical sphere and instead from the currency debasement that arises from central banks printing money.

In light of this, investors should be buying up gold. Goldman’s Currie refers to gold as the ‘geopolitical hedge of the last resort’. This is the case ‘if the geopolitical event is extreme enough that it leads to some sort of currency debasement’ and especially so ‘ if the gold price move is much sharper than the move in real rates or the dollar.’

Read on to see in exactly what form Currie believes you should be investing in gold.

It has become too easy to pin gains on geopolitics

As we have repeatedly pointed out, the gold price jumps following events such as North Korea testing missiles or Hurricane Harvey or a declaration from Trump. However these jumps are not frequently sustainable.

What is going on in the U.S. and global markets and economy which really provides long-term support for the every-strengthening gold price.

Currie writes:

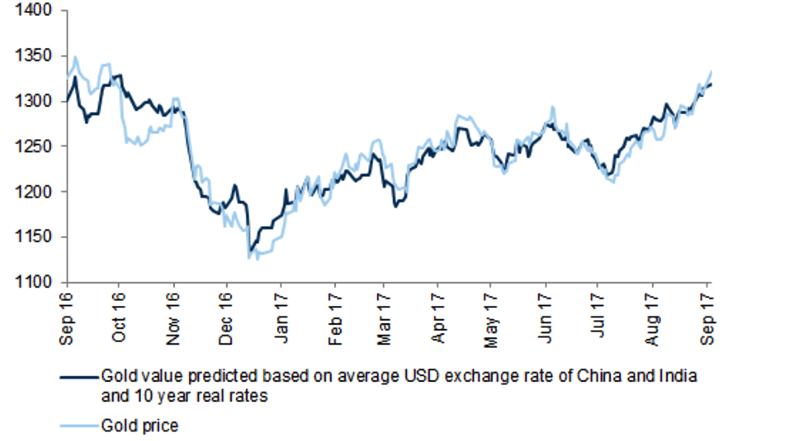

“It is tempting to blame the rally in gold prices on recent events in North Korea. While these events have helped to create a bid in gold, they only explain [roughly] $15 of the more than $100 [per ounce] rally since mid-July.”

It is too easy to pin gold’s rise on geopolitical events. Instead, argues Currie, these events are only really impacting gold if they lead to ‘actual currency debasement.’

Instead, the recent rally has been down to the decline in the U.S. dollar and lower real interest rates.

Gold is the currency of the last resort

All about that (de)base

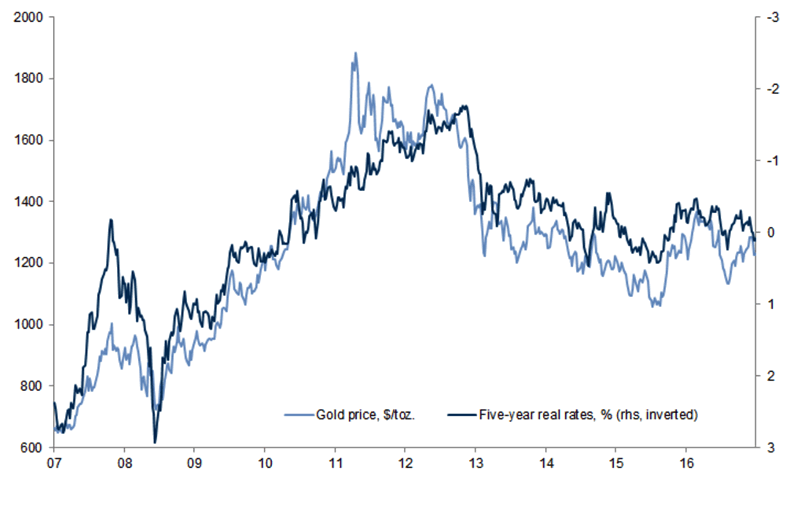

This dynamic is captured by a negative correlation between gold prices and real interest rates. As the central bank prints more currency, the price of the currency as measured by the real interest rate declines. The lower real interest rate, in turn, reduces the opportunity cost of holding a real asset like gold, leading the market to bid up gold prices. So at the core, gold is a hedge against debasement, which is why we have termed it the “currency of last resort.”

Bigger things to worry about than Korea

Interestingly gold’s move this year has had far more to do with President Trump than it has to do with North Korea.

Currie argues that Kim Jong-Un might only be responsible for 15% of the yellow metals’ move. 85% of the price rise can be accounted for by the fact that the Trump risk premium is reflected in both real interest rates and a weaker US dollar.

This does not mean that gold will no longer be classed as a hedge against geopolitical risk (as well as currency debasement). But, in the current climate gold is reacting more to Trump risk and the ongoing devaluation of monetary assets.

We find that gold can effectively hedge against geopolitical risk if the geopolitical event is extreme enough that it leads to some sort of currency debasement, and especially if the gold price move is much sharper than the move in real rates or the dollar. For these events, gold essentially serves as a call option and can therefore be thought of as a “geopolitical hedge of last resort.” For example, gold served as an effective hedge after the events of September 11, 2001 when the US Federal Reserve substantially increased dollar liquidity, debasing the US dollar. Gold also proved an effective hedge during the Gulf Wars as governments printed money.

Learn from Lehman

In conclusion, gold is still very much as we have argued – a hedge against geopolitical risk and currency debasement.

Investors must consider gold-market liquidity when using gold to protect themselves. Goldman Sachs argue that liquidity in the gold market is

crucial when deciding to hedge via physical gold in a vault versus COMEX gold futures.

Investors should not assume that during a geopolitical event liquidity will not be a problem:

Using a gold futures contract as the basis of the hedge makes the implicit assumption that market liquidity will not be a problem in the realization of a geopolitical event.

Goldman Sachs say investors should buy physical gold and physically backed gold ETFs as opposed to ETFs or Comex Futures. Their logic for this? The liquidity event that was the collapse of Lehman Brothers.

The importance of liquidity was tested during the collapse of Lehman Brothers in September 2008. Gold prices declined sharply as both traded volumes and open interest on the exchange plunged. After this liquidity event, investors became more conscious of the physical vs. futures market distinction and began to demand more physical gold or physically-backed ETFs as a hedge against black-swan events.

Owning physical gold bullion coins and bars in the safest vaults in the world will again be the primary way to protect yourself and your wealth in the event of a geopolitical crisis and liquidity crunch.

“The lesson learned was that if gold liquidity dries up along with the broader market’s, so does your hedge—unless it is physical gold in a vault, the true “hedge of last resort.”

Gold Prices (LBMA AM)

06 Sep: USD 1,340.15, GBP 1,028.03 & EUR 1,122.11 per ounce

05 Sep: USD 1,331.15, GBP 1,029.51 & EUR 1,120.43 per ounce

04 Sep: USD 1,334.60, GBP 1,030.98 & EUR 1,120.53 per ounce

01 Sep: USD 1,318.40, GBP 1,020.18 & EUR 1,107.98 per ounce

31 Aug: USD 1,305.80, GBP 1,013.17 & EUR 1,098.31 per ounce

30 Aug: USD 1,310.60, GBP 1,014.93 & EUR 1,096.71 per ounce

29 Aug: USD 1,323.40, GBP 1,020.34 & EUR 1,097.36 per ounce

Silver Prices (LBMA)

06 Sep: USD 17.77, GBP 13.62 & EUR 14.90 per ounce

05 Sep: USD 17.88, GBP 13.80 & EUR 15.03 per ounce

04 Sep: USD 17.80, GBP 13.75 & EUR 14.95 per ounce

01 Sep: USD 17.50, GBP 13.53 & EUR 14.69 per ounce

31 Aug: USD 17.34, GBP 13.47 & EUR 14.62 per ounce

30 Aug: USD 17.44, GBP 13.49 & EUR 14.60 per ounce

29 Aug: USD 17.60, GBP 13.59 & EUR 14.62 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.