Gold Price is Headed to $1,500 by Year End

Commodities / Gold and Silver 2017 Sep 07, 2017 - 08:51 PM GMTBy: Jason_Hamlin

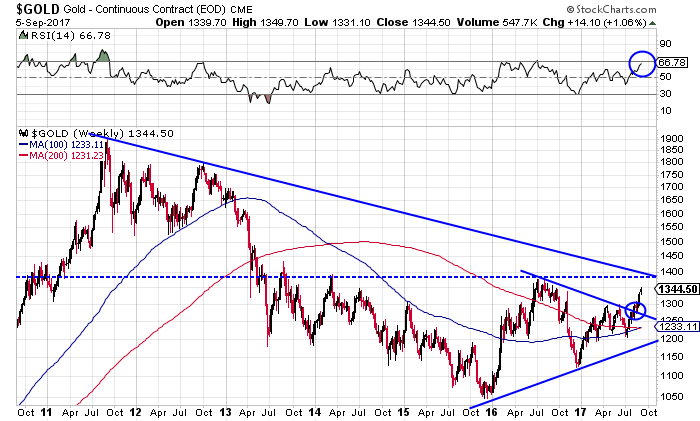

A confluence of factors has been pushing the price of gold higher over the past few weeks and I believe it is headed for $1,500 by the close of 2017. After hitting a low around $1,200 in July, the price of gold has since advanced by more than 10% or $140 to $1,340.

A confluence of factors has been pushing the price of gold higher over the past few weeks and I believe it is headed for $1,500 by the close of 2017. After hitting a low around $1,200 in July, the price of gold has since advanced by more than 10% or $140 to $1,340.

The chart shows a significant breakout through both the 100 and 200-day moving averages over the past month. More importantly, gold pierced trend-line resistance that had been in place for over a year.

The RSI is nearing overbought levels, so this rally may run out of steam soon. While a near-term pullback on profit-taking makes sense, I expect it to be short and shallow. For the price to reach $1,500 by year end, gold first needs to take out key resistance at the 2016 high of $1,375. There will likely be a battle around this level and the result will determine the direction of the gold price over the next year.

Gold is being supported by a weaker dollar in 2017 and rising geopolitical tensions generating safe-haven demand. The odds of war on the Korean peninsula have increased greatly in recent days, with some analysts believing that things could quickly escalate into a wider regional war, potentially with the use of nuclear weapons.

The United States government is once again forced to raise the debt ceiling or risk government shutdown. Ratings agency Fitch has warned of a potential downgrade of the “AAA” debt rating of the U.S. should they fail to raise the debt ceiling in time. Savvy investors are starting to pick up on the fact that central banks will not be able to raise rates or unwind their balance sheet at anywhere near the pace originally projected.

Investors may also be looking to hedge their long equity or bond positions, as both markets are showing signs of being over-extended. I believe we will see a major stock market correction within the next 12 months.

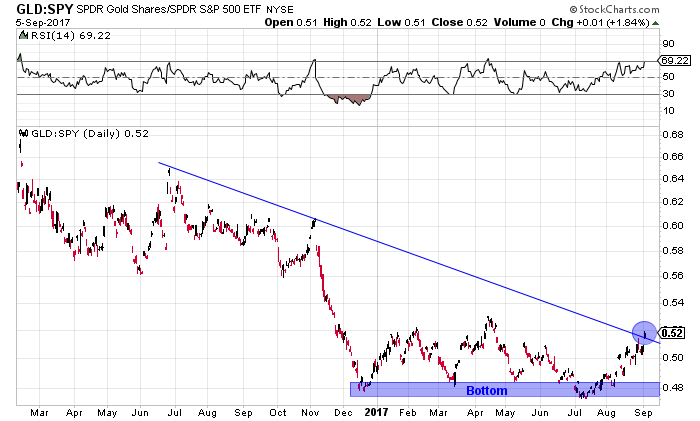

Gold vs S&P 500

When comparing gold vs the S&P 500, we can see that the ratio appears to have formed a bottoming pattern in 2017. In other words, the days of equities outperforming gold may be coming to an end. We can expect a rise in gold prices, drop in stock prices or most likely a combination of the two in the near future.

As you can see in the chart, this GLD-to-SPY ratio spiked higher through the resistance trend line to 0.52 over the past week. If it can hold above this line, an acceleration of the trend is expected.

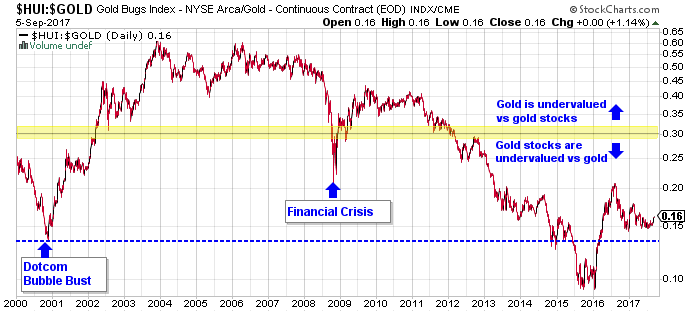

Gold vs Mining Stocks

While we are examining key ratios, it is worth pointing out that mining stocks remain very undervalued relative to gold. The HUI-to-gold ratio shows the price relationship of the NYSE ARCA Gold Bugs Index to the gold price over time. The lower the number, the more that mining stocks are undervalued compared to the metal they mine. At the current level of 0.16, gold stocks look very undervalued relative to gold.

In fact, the current HUI:Gold ratio of 0.16 is lower than it was during the 2008 financial crisis and not too far above the levels seen during the dotcom crash. The ratio would need to double to return to the average level seen over the past 17 years.

This suggests that mining stocks are likely to offer powerful leverage to the advance in the gold price during the next upleg. We have seen mining stocks outperforming gold by a factor of 2-to-1 over the past few weeks, but I believe we will see leverage in the 3x to 4x range once the gold price breaks above $1,500 and starts climbing back toward all-time highs.

Of course, the best-in-breed mining stocks will provide leverage far greater than 2x to 4x. In fact, our top mining stock pick in 2017 is up nearly 150% year to date, versus a gain of 16% for gold. The leverage on this stock is nearly 10x and they are not some obscure junior miner on a lucky streak. This is a multi-billion market cap company with some of the most talented people in the business driving their projects forward.

If gold moves from $1,340 to $1,500 over the next few months, those holding the metal will enjoy a gain of 12%. However, those holding quality mining stocks are likely to see gains of 35% on the low end to 100% on the high end.

This is why we employ a dual-pronged strategy of not only holding physical metals for the safe-haven aspects, but also investing in quality miners for the leverage. As the HUI-to-gold ratio climbs back above 0.30 and towards 0.50, we will start to reduce exposure to mining stocks again in favor of bullion or other assets we view as undervalued. But for now, we believe that mining stocks are offering investors incredible value in a minefield of overvalued assets.

To get our top stock picks, monthly contrarian newsletter, model portfolio and more, sign up for our $99 introductory special. We cover not only precious metals, but energy, agriculture, cannabis stocks and cryptocurrencies.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. Click here for instant access!

Copyright © 2017 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.