Will Gold Break Out of Sideway Trading?

Commodities / Gold and Silver 2017 Sep 09, 2017 - 03:27 PM GMTBy: Arkadiusz_Sieron

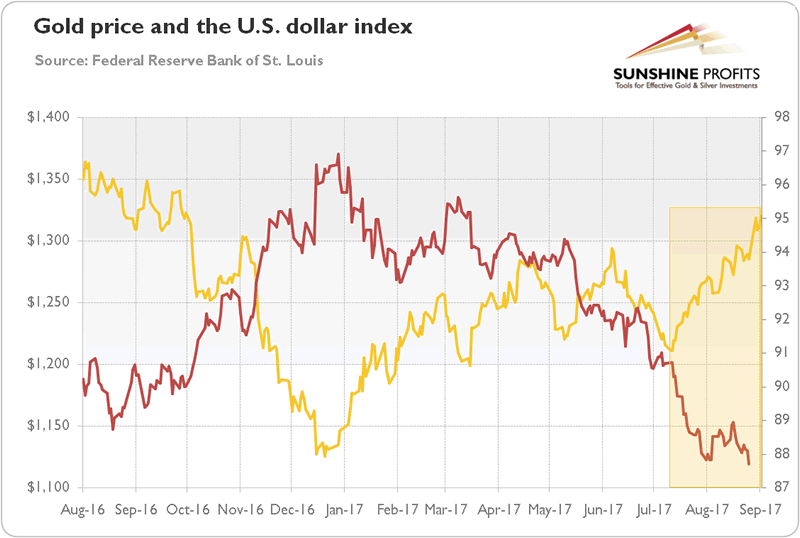

Since July 11, gold has been in a short-term upward trend. The yellow metal has gained more than 8 percent since then until the end of August, mainly thanks to the depreciation of the U.S. dollar, as one can see in the chart below.

Since July 11, gold has been in a short-term upward trend. The yellow metal has gained more than 8 percent since then until the end of August, mainly thanks to the depreciation of the U.S. dollar, as one can see in the chart below.

Chart 1: Gold prices (yellow line, left axis, London P.M. fix) and the U.S. dollar index (red line, right axis, trade weighted index against major currencies).

The U.S. dollar index declined because of political turmoil in the Trump administration and the narrowing divergence between the U.S. and the Eurozone economy. Actually, the economic growth in the latter outpaced the former expansion in the first half of the year. The surprising economic performance in the euro area, with eased political uncertainty after Macron’s triumph in the French presidential elections, boosted the expectations of the ECB’s tightening. As a result, the EUR/USD exchange rate soared, which drove gold’s rally.

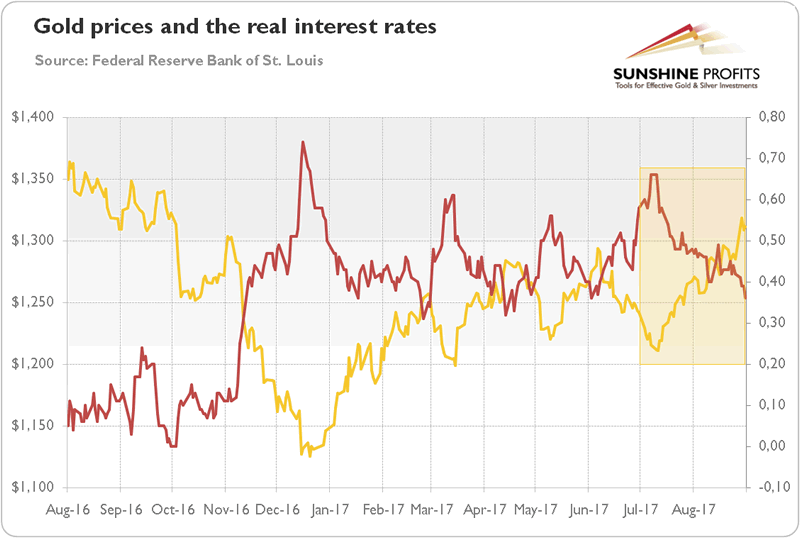

Another bullish factor in the analyzed period was the decrease in real interest rates due to softened expectations for the next hikes in the federal funds rate. As the next chart shows, real interest rates started to decline at the beginning of July, after the June FOMC minutes which were interpreted by markets as slightly dovish.

Chart 2: Gold prices (yellow line, left axis, P.M. London Fix) and the real interest rates (red line, right axis, yields on 10-year Treasury Inflation-Indexed Security, in %) over the last 12 months.

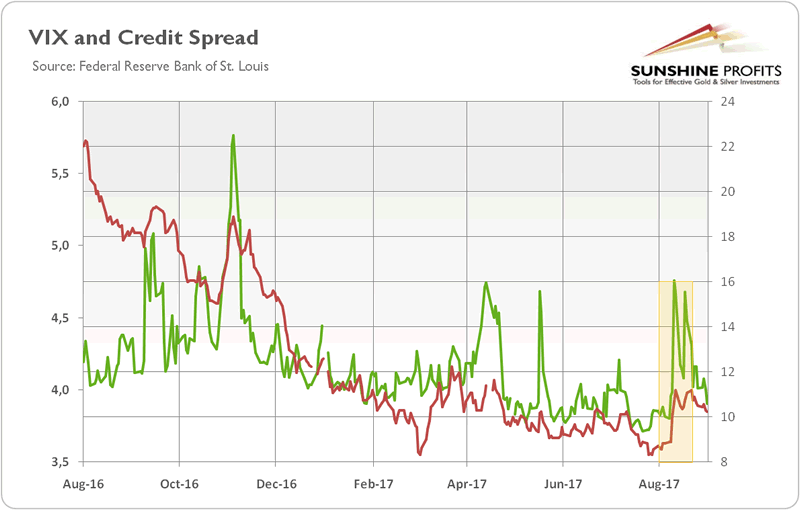

Last but not least, the risk premium increased in August. As one can see in the chart below, both the VIX Index and credit spreads rose in the first half of August, presumably due to the risk aversion fueled by geopolitical tensions due to North Korea.

Chart 3: The market volatility reflected by the CBOE Volatility Index (green line, right axis) and the credit spreads reflected by the BofA Merrill Lynch US High Yield-Option Adjusted Spread (red line, left axis, in %) over the last twelve months.

Gold gained on that safe-haven trade resulting from the recent crisis on the Korean Peninsula, but the recent spike may be only temporary, as it is often the case with geopolitical triggers – however, investors should remember that Congress returns in September and the debt ceiling could also trigger some uncertainty, supporting gold prices.

What does it all mean for the gold market? Well, not so much. Gold has been trading sideways for four years. And since February 2017 until the very end of August 2017, the yellow metal has been locked in its tight trading range of $1,200-$1,300. From the fundamentals point of view, the sideways trend in gold could continue, as we currently have a “goldilocks economy”, which means the economy is neither too hot to cause rapid inflation nor too cold to trigger a recession. The current U.S. recovery is the slowest since WWII, but the economy is expanding, after all.

Hence, gold cannot start a decisive rally, because the global economy grows and the stock market flourishes, while inflationary pressures remains muted. On the other hand, gold has not entered a serious medium-term bear market, most likely because investors were still worried about sluggish growth (when compared to historical averages), the possibility of market correction (due to elevated valuations), Trump’s unpredictability, and… subdued inflationary pressures, which suggest that the central bank’s policies do not work or that the structure of the economy fundamentally changed, as usually a tightening labor market caused prices to go up. Investors are simply confused and do not know what to think about the state of the global economy. Central banks do not help to dispel these doubts, as they send mixed signals which sound as follows: “We are going to tighten (read: economy is expanding), but we will do it very cautiously and gradually (read: economy remains fragile and could not be able to run on its own, without central bank’s drip).”

Having said that, we argue that there is more upside than downside potential to the global economic outlook, and vice versa for the gold market in the near future (hence, investors should be prepared for the bottom). The U.S. economy should accelerate in the second half of the year, while the Eurozone economy should keep its high momentum. Reflation is more probable than recession right now. And after recent personal shifts, Trump’s administration became more centrist and less economically nationalistic, which bodes well for the future. Of course, it does not mean that there are no potential upside catalysts for gold prices – we can’t rule out further escalation of the North Korean crisis or a stock market correction in the fall. Nevertheless, investors should be aware that corrections are quite normal and they are not the same as recessions or market crashes.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.