Stock Market Waiting Game...

Stock-Markets / Stock Market 2017 Sep 20, 2017 - 03:11 PM GMT SPX futures are flat this morning. At this point it appears to be a waiting game between the market and the Fed. There appears to be at least one more probe higher (Ending diagonal). A throw-over above the upper Diagonal trendline is probable. Should that be the case, a decline beneath the Brexit trendline (red) may be an aggressive sell signal while a decline beneath the lower Diagonal trendline near 2495.00 may be a confirmed sell signal.

SPX futures are flat this morning. At this point it appears to be a waiting game between the market and the Fed. There appears to be at least one more probe higher (Ending diagonal). A throw-over above the upper Diagonal trendline is probable. Should that be the case, a decline beneath the Brexit trendline (red) may be an aggressive sell signal while a decline beneath the lower Diagonal trendline near 2495.00 may be a confirmed sell signal.

ZeroHedge comments, “The day has finally arrived: today the Fed will officially announce the start of its balance sheet shrinkage (full preview here) while keeping rates unchanged, perhaps hiking again in December (market odds at 56%), while revising its economic projections and "dots", most likely in a lower direction.”

NDX futures have had a little more activity, but appears to be opening flat this morning.

A flat upper trendline is considered an invitation for a throw-over even though two of the three ending calculations have already been met. A decline beneath the Diagonal trendline and Short-term support at 5973.58 gives an aggressive sell signal.

ZeroHedge observes, “Today’s Fed meeting is critical for all financial assets. A large part of the framework for how to trade the year ahead will be clarified between Wednesday’s statement, the dot plot and subsequent FOMC member speeches in coming days.

Fed meetings are often overhyped, particularly by financial commentators. Don’t dismiss the hype this time. And because the Fed’s decision is so crucial for the path of FX and rates, every other asset hinges on the outcome by extension.

It’s not that Fed guidance has never mattered before, but it’s vital now that we have moved beyond the data dependence that was the key theme for the last few years.”

VIX futures are hovering near the 10 level. Its Wave structure may allow another probe lower. The current Master Cycle, which I originally tagged on September 1, is now 19 days overdue. We may have seen the low on Monday, but today may tell us whether a new low will be made.

As usual, a buy signal (SPX sell) is made at the 50-day Moving Average at 11.00.

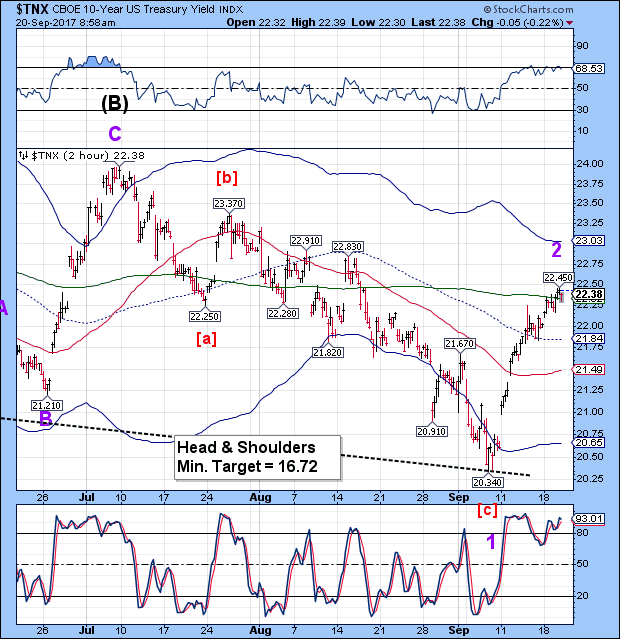

TNX is hovering beneath yesterday’s high. The retracement makes it appear that the market is expecting higher rates from the Fed. Whether they raise rates or not, it appears that the decline may resume shortly.

ZeroHedge comments, “It is virtually guaranteed that on Wednesday the FOMC will make history by officially announcing the Fed's plan to begin shrinking its balance sheet through the gradual phasing out of bond reinvestments, which however in a world in which other central banks continue to pump $125 billion per month, will hardly by noticed by markets at least in the beginning.”

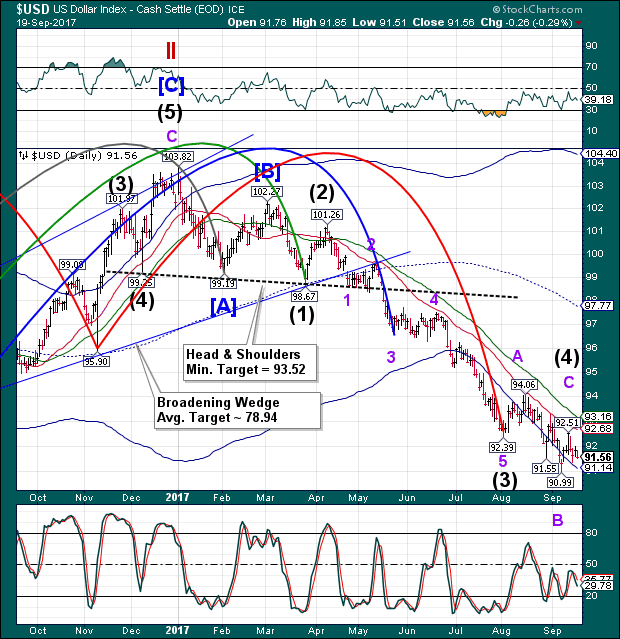

The USD has eased down to a low of 91.38 in morning trading. The Wave structure allow for a spike higher, should the Feds set a time certain for the next rate hike. Otherwise the decline may resume.

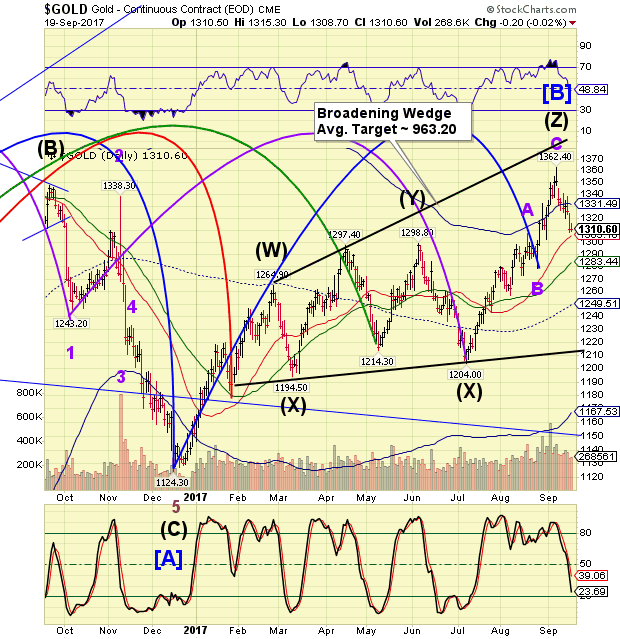

Gold may have done a small retracement this morning to 1319.85. It is on an aggressive sell signal with a confirmed signal beneath Intermediate-term support at 1305.16.

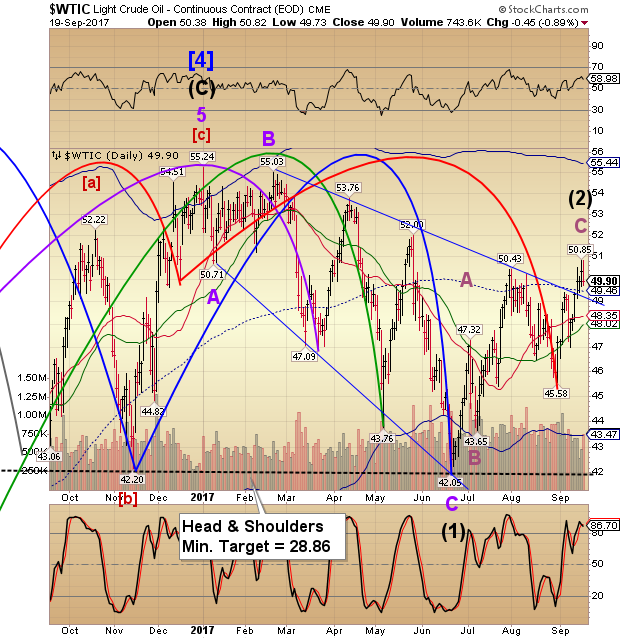

Crude oil futures continue to vacillate beneath Friday’s high. This morning’s high was 50.55. This may confirm that the turn that I had announced last week was valid. However, a sell signal won’t be generated until crude drops beneath it’s mid-cycle support at 49.46. The Wave structure does not appear to allow another probe higher.

There has been a change of plans for my aunt’s passing. We will attend the funeral tomorrow instead of driving to Detroit tonight. I may have time to do a newsletter after all.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.