USD Weakening. So are Stocks

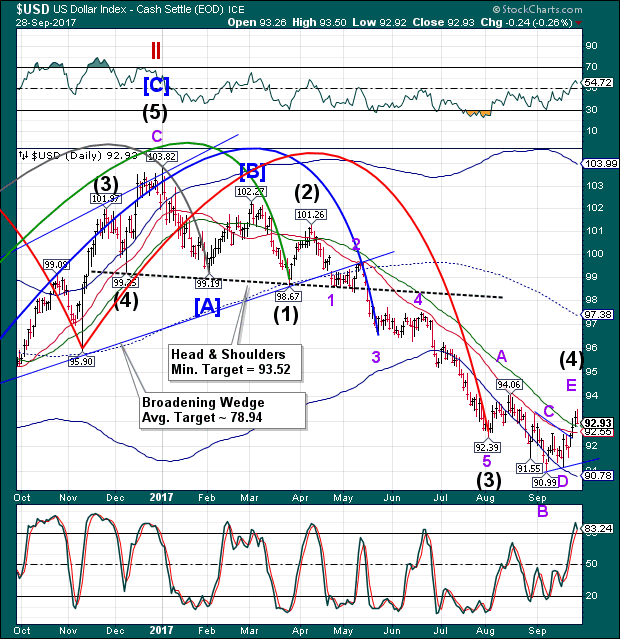

Stock-Markets / Stock Market 2017 Sep 29, 2017 - 04:33 PM GMT The USD futures are in the headlines this morning. It has broken above its 50-day Moving Average at 92.81 and the analysts are calling for a stronger USD. But it may beat a hasty retreat, since the top aof Wave E suggests completion and reversal.

The USD futures are in the headlines this morning. It has broken above its 50-day Moving Average at 92.81 and the analysts are calling for a stronger USD. But it may beat a hasty retreat, since the top aof Wave E suggests completion and reversal.

ZeroHedge writes, “The dollar rally paused on Friday and looked poised to finish its best weekly gain of the year with a whimper, when in a repeat of the Thursday session the, Bloomberg dollar index first rose more than 0.1% during Asia hours before slumping around the European open as month and quarter-end flows came into play again.”

Update, “The dollar is extending its losses after Core PCE - among the Fed's most critical inflation indicators - slumped to just 1.29% YoY, the lowest since Oct 2015.”

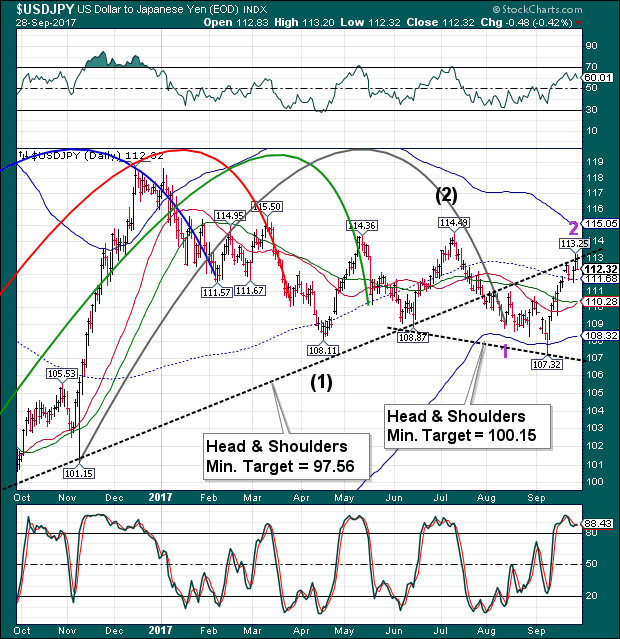

USD/JPY has also pulled back from the Head & Shoulders neckline. The recent rally has caused yet another H&S formation in which the rally has completed a right shoulder. It appears to be a confirmation of the original Head & Shoulders formation. This double confirmation raises the probability of completion to nearly 100%.

You may notice that the SPX futures are highly correlated to the USD/JPY. Should we match up declines, that would project a minimum 12 % decline in the SPX.

The reality is that losses in USD/JPY may have a multiplier effect on a decline in SPX.

There may be a reason why SPX could not go higher yesterday. Wave (v) is equal to Wave (i) at 2511.12. Wave 5 is equal to Wave 1 at 2500.87. The outlier is that Wave (5) is equal to Wave (1) at 2524.38. The final rally formation is corrective, which may allow a final probe higher, but it has fulfilled all but one price targets. In addition, the 30.1-year Cyclical pivot from the 1987 crash is October 1.

NDX reached its high on September 18, exactly 51.6 years from February 9, 1966 when the DJIA topped out at 1000 for the first time in history.

By the way, the DJIA also topped out at 22419.51 on the 21st and hasn’t been able to better that price since then.

Doug Kass at RealInvestmentAdvice says, “I expect comparisons between the FANG stocks and Dr. Evil of the Austin Powersfilm series to be an ongoing investment storyline over the next year given these digital gatekeepers’ increased dominance over the U.S. economy. This idea might receive a lot more play in U.S. political and antitrust circles — and produce more legal challenges — than most investors currently presume.”

VIX futures are rising, although not near a buy signal. However, we may see the VIX toppin near the Head & Shoulders neckline in very short order.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.