Plan for Run On The British Pound

Currencies / British Pound Oct 04, 2017 - 08:10 AM GMTBy: GoldCore

Run On The Pound ? Jeremy Corbyn Says Should Plan For

Run On The Pound ? Jeremy Corbyn Says Should Plan For

– Right to plan for ‘run on pound’ if Labour wins says Corbyn and Labour party

– British pound already down 20% since Brexit, collapse already in play

– Run on the pound likely due to Labour’s ‘command economy’ approach

– Collapse in Sterling would undermine UK financial system

– Portfolios holding sterling and related assets would be significantly affected

– Pension funds and property the most likely to get hit by run on the pound

– Gold to benefit as sterling collapse picks up pace

Editor: Mark O’Byrne

Last week Labour Shadow Chancellor John McDonnell said the party was carrying out “war-game-type scenario-planning” for events such as “a run on the pound”.

A run on the pound would see the value of the currency plummet, increase inflation and increase the value of those age old stores of value – namely gold and silver.

McDonnell’s reasons for war-gaming were because of expectations that a ‘radical’ Labour government would face a range of challenges.

He said was seeking to “answer the question about what happens when, or if, they come for us”.

When asked what McDonnell meant by ‘they’, party leader Jeremy Corbyn said he was likely referring to outside forces who have previously punished Labour governments in such a way.

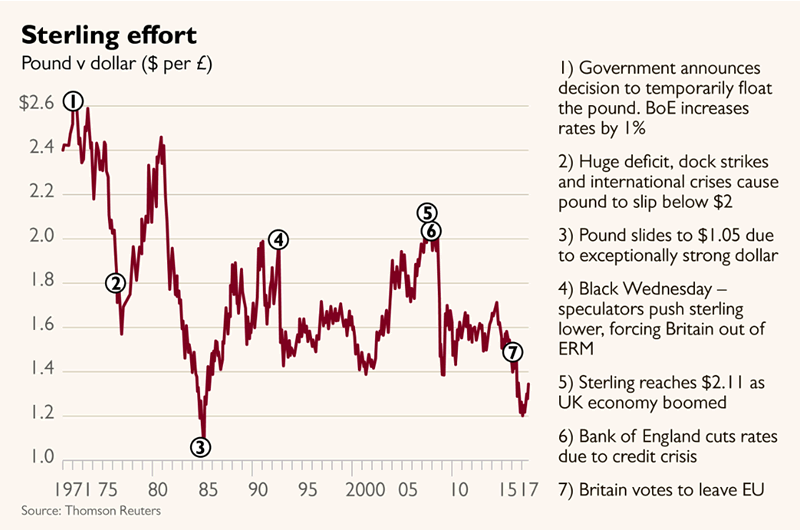

Of course the most famous run on the pound in living memory happened in 1992 but for Labour it was nearly 50 years ago that still haunts them.

In November 1967 Harold Wilson’s government announced it was lowering the exchange rate. The pound fell to $2.40, down from $2.80, a fall of just over 14%.

Wilson is now much ridiculed for his statement made on national radio and television in which he ‘reassured’ citizens that:

“It does not mean that the pound here in Britain, in your pocket or purse or in your bank, has been devalued.”

Wilson’s comments, whilst derided at the time, seem to still ring true for our own government who do not appreciate that ongoing policies have resulted in a ongoing devaluation in the pound.

Labour’s adverse effect on the pound

It is not a ridiculous thought that ‘they’ might come for us should Labour be victorious. If one takes a look at Labour’s policies then we would come about as close to a command economy as one can get in peacetime.

McDonnell has pledged to ‘take back’ rail, water, energy and the Royal Mail.

Both the CBI the British Chambers of Commerce have denounced the shadow chancellor’s plans as “forced nationalisation”

Europe has seen this before, writes Alex Rankine:

Not since François Mitterrand took the French presidency in 1981 has a European party come this close to power with such a radical policy programme. Mitterrand’s purist socialist experiment was “brought to heel” by the markets when the franc slumped, creating a surge in inflation and a policy U-turn.

Labour are prepared for this and almost seem to be relishing the idea. Mark Serwotka, from the PCS union representing civil servants, said Labour would face “huge” opposition should it win. Serwotka predicted “all the usual arms of the ruling class will be brought to bear”.

The union leader included using financial markets to bring “economic pressures” such as “the flight of capital” and trying to destabilise the economy.

For the Conservatives, “Labour’s plans would go too far, and ordinary working people will end up footing the bill,” Chancellor Philip Hammond said.

The problem is, ordinary working people are already footing the bill. Without the help of Labour’s socialist policies.

What is a “run on the pound” and the consequences

A run on a currency usually happens when markets feel it is overvalued or is likely to drop quickly.

Both international investors and speculators sell the currency and assets denominated in that currency en masse, forcing its value down.

The UK’s most recent, famous example is from 1992. That September, a day now known as Black Wednesday, the falling value of sterling forced the Conservative government exit the European Exchange Rate Mechanism after its attempts to support the currency failed.

In the most recent threat of a run on Sterling Labour’s opposition seized on McDonnell’s comments. Current Chancellor of the Exchequer Philip Hammond said Labour’s economic policies would trigger “a collapse in business investment and a crash in the value of the pound, causing a shock wave of inflation”.

When there is a panic sell of a currency, the value drops and we see a rise in price of imported goods and raw materials.

There is of course major capital flight. A sudden exodus of large sums of money out of the country which would undermine the stability of the financial system in the UK.

Altogether financial shocks such as these could push up inflation.

It sounds awful but the truth is Labour’s success may only mean an acceleration of what is already in place.

The value of the pound has been in decline for many decades now. This is thanks to stealth inflation caused by loose monetary policies and little focus on preserving the value of the pound in our pockets.

Between 2007 and 2008 the British Pound fell 21% (peak to trough). Whilst the rest of the world was on the verge of deflationary collapse we experienced an inflationary recession. GDP contracted at a top rate of 6.1% annually and inflation touched 5.1%.

We still haven’t recovered. Previously we would have hauled ourselves out of such a fall thanks to manufacturing. Generally manufacturing has higher returns to scale than services.

Today we don’t have that option. As a result we are extremely reliant on capital inflows into the City of London to limit a fall in sterling. But, as 2007 -2008 showed, this is an extremely unstable source of foreign demand for our currency.

No right for Tory smugness

Of course one thing that in all of their criticism the Conservative Party appears to have forgotten is that for the past year the United Kingdom has been experiencing a collapse in the Pound, whilst under their rule.

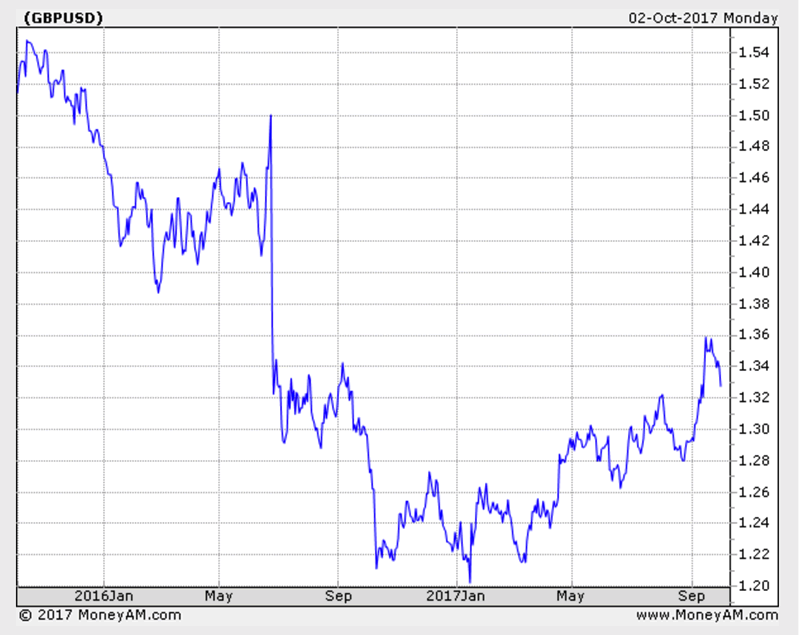

Since the Brexit vote on June 23rd 2016 the value of Sterling has fallen by over 20% against the U.S. Dollar.

Many point to Brexit as the leading cause, it is most certainly the catalyst. However Conservative policies have done little to boost confidence in the currency in the last two years.

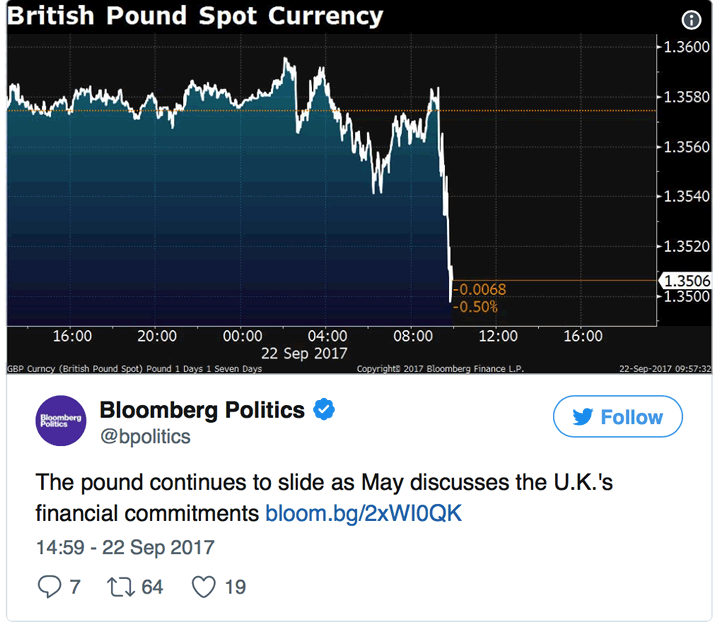

Concerns are so serious regarding Brexit and Mrs May’s ability to keep her government on side that not even a speech in Florence could give the pound a much needed boost.

Conclusion – no need for war-gaming, we’re already at war

Labour’s practice runs should perhaps be closer observed by those already in power. They should see it as a reflection of what is already happening. The only difference is the Labour scenario would be at a faster pace.

As demonstrated, the British Pound is already in free-fall. Just because we haven’t seen major capital flight since the 1970s does not mean that it isn’t happening. Just because inflation measures suggest there is little inflation in the economy does not mean it isn’t there.

Currency devaluation is very much a part of every-day financial life. We all witness it, as prices increase and our paper and electronic fiat currencies no longer goes as far.

Already pension funds and the housing market are in a state of disarray. Few really know how pension funds are going to manage their major deficits and the housing market is on the brink of collapse.

A run on the pound would merely be the final spark in a highly combustible environment. With or without a Labour victory savers’ personal wealth is already at great risk.

In all previous collapses in currencies, gold and silver have acted as hedges and safe havens. We only need to look at situations such as the stagflation that afflicted most western economies in the 1970s to see this. Or indeed the more extreme versions as seen in the Weimar Republic historically and Zimbabwe and Venezuela today.

Investors would be well advised to line their portfolios with gold bullion before the UK economy or electorate throws up yet another fuse for the international markets to take a dislike to.

UK investors have the great benefit of being able to invest in gold capital gains tax (CGT) free when they buy Gold Sovereigns or Gold Britannias for insured delivery or stored in the safest vaults in Switzerland, Singapore and Hong Kong.

The best time to get insurance is before the event you need to protect against happens … whether that be car insurance, health insurance or the financial insurance of gold coins and bars.

Gold Prices (LBMA AM)

03 Oct: USD 1,270.70, GBP 959.00 & EUR 1,081.87 per ounce

02 Oct: USD 1,273.10, GBP 956.48 & EUR 1,084.55 per ounce

29 Sep: USD 1,286.95, GBP 963.15 & EUR 1,090.82 per ounce

28 Sep: USD 1,284.30, GBP 961.04 & EUR 1,091.40 per ounce

27 Sep: USD 1,291.30, GBP 963.83 & EUR 1,099.54 per ounce

26 Sep: USD 1,306.90, GBP 969.59 & EUR 1,105.38 per ounce

25 Sep: USD 1,295.50, GBP 957.89 & EUR 1,089.26 per ounce

Silver Prices (LBMA)

03 Oct: USD 16.61, GBP 12.53 & EUR 14.13 per ounce

02 Oct: USD 16.58, GBP 12.46 & EUR 14.12 per ounce

29 Sep: USD 16.86, GBP 12.60 & EUR 14.27 per ounce

28 Sep: USD 16.82, GBP 12.53 & EUR 14.28 per ounce

27 Sep: USD 16.89, GBP 12.58 & EUR 14.38 per ounce

26 Sep: USD 17.01, GBP 12.67 & EUR 14.43 per ounce

25 Sep: USD 16.95, GBP 12.57 & EUR 14.27 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.