Capital Destruction in Precious Metals and Banking

Commodities / Gold and Silver 2017 Oct 05, 2017 - 12:10 PM GMTBy: The_Gold_Report

Precious metals expert Michael Ballanger discusses capital destruction in precious metals and banking.So there you have it. A clear breakout to all-time highs confirmed by every measure everywhere with momentum charging ahead and high-fives and champagne corks flying about with reckless abandon and serial glee. To quote Chuck Prince, who left Citigroup in 2007 with an exit bonus of around $12.5 million, $68 million in stock and options, $1.7 million pension, an office, a car and a driver for five years during which time Citigroup shed $64 BILLION in valuation, "As long as the music is playing, you've got to get up and dance." So when John Paulson's pit bull Marcelo Kim got up at the Denver Gold Show and assailed the gold mining executives for $85 billion in wealth destruction since 2010, perhaps it might have been instructive to remind him that one executive alone in the banking business (Prince) blew 75% of that on his own.

Precious metals expert Michael Ballanger discusses capital destruction in precious metals and banking.So there you have it. A clear breakout to all-time highs confirmed by every measure everywhere with momentum charging ahead and high-fives and champagne corks flying about with reckless abandon and serial glee. To quote Chuck Prince, who left Citigroup in 2007 with an exit bonus of around $12.5 million, $68 million in stock and options, $1.7 million pension, an office, a car and a driver for five years during which time Citigroup shed $64 BILLION in valuation, "As long as the music is playing, you've got to get up and dance." So when John Paulson's pit bull Marcelo Kim got up at the Denver Gold Show and assailed the gold mining executives for $85 billion in wealth destruction since 2010, perhaps it might have been instructive to remind him that one executive alone in the banking business (Prince) blew 75% of that on his own.

Now add up the other guys like Bear Sterns and JP Morgan and the rest of the money-centre banks and they make the Gold Miners look like rocket scientists. Oh, and don't forget to mention that the gold mining industry has to cope with serial intervention and malevolent manipulation affecting the product they sell while the banking industry consistently rips off millions of consumers with nary a crook landing in jail. And—let us not forget who it was that asked Goldman Sachs to design a product specifically for him that was actually intended to fail, to die, to go-to-zero, so he could SHORT it. It was John Paulson. Does anyone hear get the impression that it might be a good time to trot out the word "hypocrisy"?

I have followed Art Cashin for years and as the director of floor operations for UBS, he is one of two people often contributing to CNBC content that I actually admire and enjoy (the other being Rick Santelli). Last night after the close, Art actually told Kelly Evans that "I've been doing this for fifty years and I've never seen anything like it so it is rather odd." Wait a minute. "RATHER ODD"? Now, Mr. Cashin—was it not "rather odd" that the global banking industry went from devastation to celebration in a mere five years as the Fed, the Bank of Japan, the European Central Bank and the Swiss National Bank all conspired to buy every toxic bond on the planet with fictitious money?

Was it not "rather odd" that stocks are not allowed to correct despite national disasters like three hurricanes into the U.S. within a four-week period? Was it not "rather odd" that gold and silver have never followed through once in the past four years after a technical "breakout"? This entire travesty of commerce referred to lightly as a "market" has gone from "rather odd" since the end of the GFC in March 2009 to "exceedingly corrupt" here in Q4 2017. However, at the end of the day, it has come down to doing one's utmost to avoid LOSING money and that is the sole reason I write this missive.

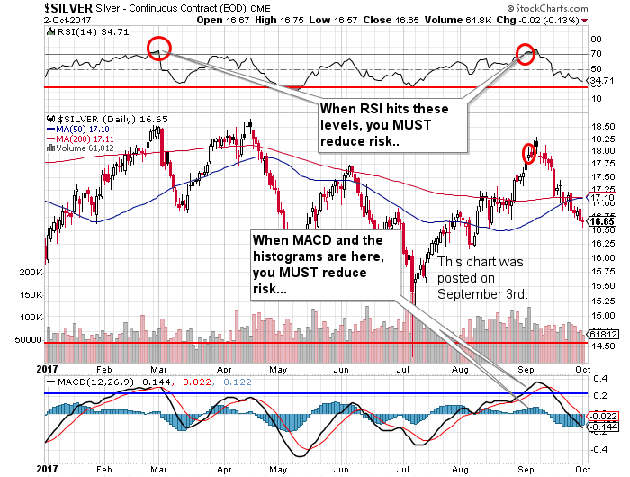

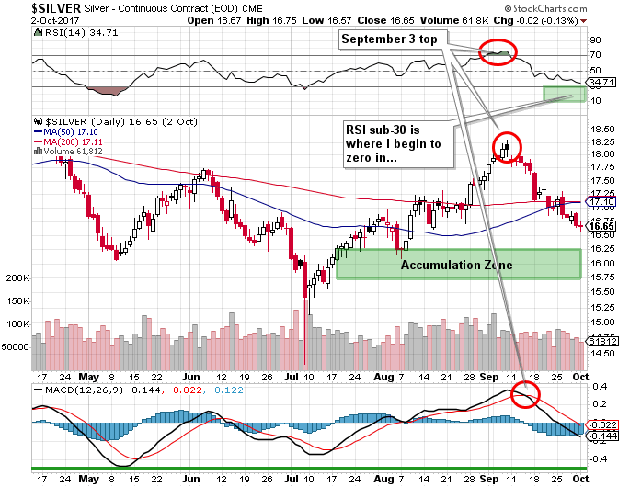

Silver Year to Date

One month ago tomorrow, I posted this chart with the sage advice that one must REDUCE RISK. Now, while I abhor commentaries that constantly remind the reader of one or more decent "call(s)" on any particular market, most fail to include the prior ten that were poor, so what I want to make perfectly clear is that I did NOT sell all of my holdings in gold miners nor gold miner ETFs. In retrospect, THAT should have been the "call." However, I sold only the call options and the leveraged positions in SIL (Global X Silver Miners ETF) and JNUG (Direxion Daily Gold Miners Bull 3X ETF). Granted, I am now flat SIL and holding fully-paid-for JNUG, with the $13.55 ACB for the latter certainly little solace now that it has been crushed from $25 to under $18. Similarly, I should not have simply exited the SIL positions; I should have shorted it or at least bought a few put options to take advantage of the impending top that was so very clear.

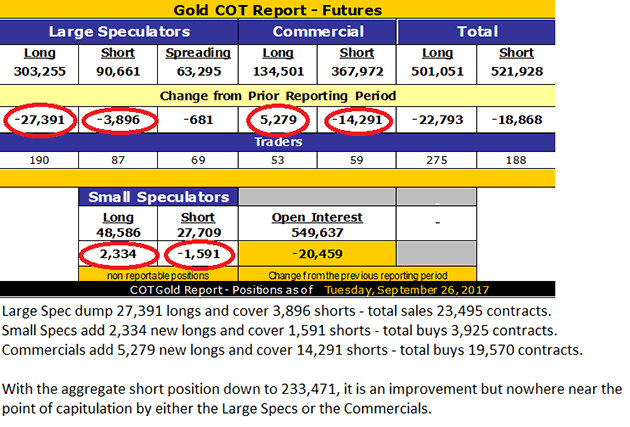

Shifting to the present, it is obvious that market participants have indeed had to experience additional pain since my last post last week. I thought the Commercials would behave a little better into the end of the month but, alas, they really didn't and just kept pressing their luck covering a paltry amount in the week ended September 22. Last Tuesday marked the second week of short covering with an even greater 19,750 contract reduction in the aggregate but it is still way too high for a meaningful bottom to be in place.

As you can see, we are still long way off the net Commercial short position reported on July 18 at 73,635 for gold as it traded at around $1,232. While that figure has started to reverse downward, I need to see a great deal more covering before I want to go long and since I have tended to be painfully early in the past, I am going to err on the side of caution and capital preservation this time around. One thing for sure is that "seasonality" has not worked worth a pinch of whale blubber as the two strongest months of September and October have proven 50% faulty with twenty-eight days left for October to validate the trade. Perhaps the Indian wedding season has been postponed and perhaps the global demand for jewelry has been vaporized due to the hurricanes but more than likely, some twenty-something desk trader was promised a new iPhone if he could find a way to keep gold and silver under $1,250 and $16.00 through Diwali and Christmas.

Gold COT Chart

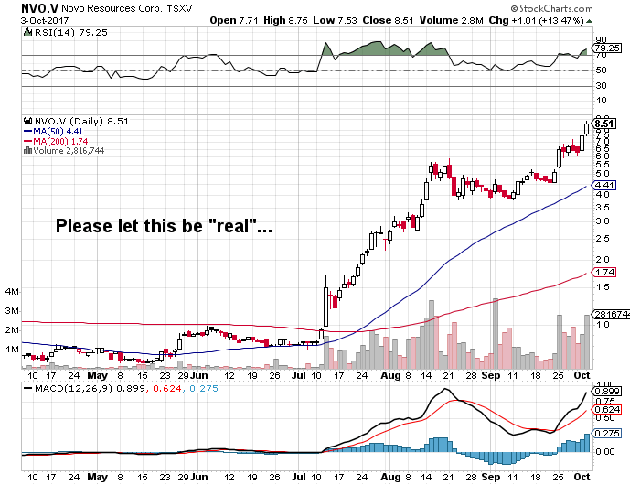

As for the current state of the junior exploration sector, the one stock dominating the airwaves in the past three months has been Novo Resources (NVO.V), which has seen a meteoric rise in price since last July when it exploded out of the gates after reporting results from a small bulk sample that sent the market into a major "tizzy." In the printed material, the company is attempting to draw a corollary to the Witwatersrand Basin of South Africa, the largest gold bearing region in the world with some fifty tons of gold (as opposed to "ore") having been extracted from the area. The gold in Witwatersrand was situated in conglomerates and the basis of the excitement is that Novo's "Purdy's Reward" project apparently has the same "nugget effect" in situ gold mineralization as the monster in South Africa. Now, to date, a relatively small bulk sample and a highly-effective video shown at the Denver Gold Show has propelled from a 52-week $0.66 low to well over $8.00, creating an (undiluted) market cap of in excess of $1 billion. Now, IF this turns out to be "real" and all of the hype and fist-pumping bears out, it will mark the first major "new discovery" story (it really isn't) in years and based upon the price action, it will be a shot of adrenalin for a largely moribund exploration market.

However, if it turns out to be, err, shall we say, "a disappointment," the resulting losses are going to be the fodder upon which books are written, lawsuits are launched, and sectors (like junior gold exploration) get ignored for at least half a decade. I have no means of determining the outcome so I congratulate all that took the (early) plunge and wish the rest of you the very best of fortune as the larger bulk sample ultimately reveals how this story unfolds. At a $1 billion (plus) market cap, there is not only no room for error or disappointment; there is a prerequisite for world-class grades and ounces. In the meantime, the momentum crowd is having a field day and since "the music is playing, you got to get up and dance."

Novo Resources

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report aricles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts courtesy of Michael Ballanger.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.