Electric Cars Oil Paradigm Shift Dead Ahead

Commodities / Crude Oil Oct 05, 2017 - 12:35 PM GMTBy: Spock

The Chinese are holding their next national congress assembly from 18th October. This is a major event where macro policy for China is agreed and implemented. On the agenda will be the electrification of national road transport, with a plan to be all electric by 2050. This will achieve two objectives: Reduce pollution in the major cities and to be the global leader in the electric vehicle (EV) technology, and associated technologies. The Chinese are also building the infrastructure around the concept, including a huge electric grid upgrade across the country over the next 10 years, to cope with the additional load.

The Chinese are holding their next national congress assembly from 18th October. This is a major event where macro policy for China is agreed and implemented. On the agenda will be the electrification of national road transport, with a plan to be all electric by 2050. This will achieve two objectives: Reduce pollution in the major cities and to be the global leader in the electric vehicle (EV) technology, and associated technologies. The Chinese are also building the infrastructure around the concept, including a huge electric grid upgrade across the country over the next 10 years, to cope with the additional load.

So the energy paradigm will change quite rapidly over the next few years, then accelerate, as $copper and other metals are in increasing demand to electrify the global road transportation system, led by China.

Therefore, $copper will become the new energy metal, with crude oil demand anticipated to drop off significantly, as 55% of global consumption is for road transport. Coal, natural gas and eventually uranium demand should pick up too, as new power stations are built, to supply the electricity needed.

This is a medium term and longer term paradigm shift, away from oil and towards base metals, battery technology and $copper, as the new strategic metal for energy supply.

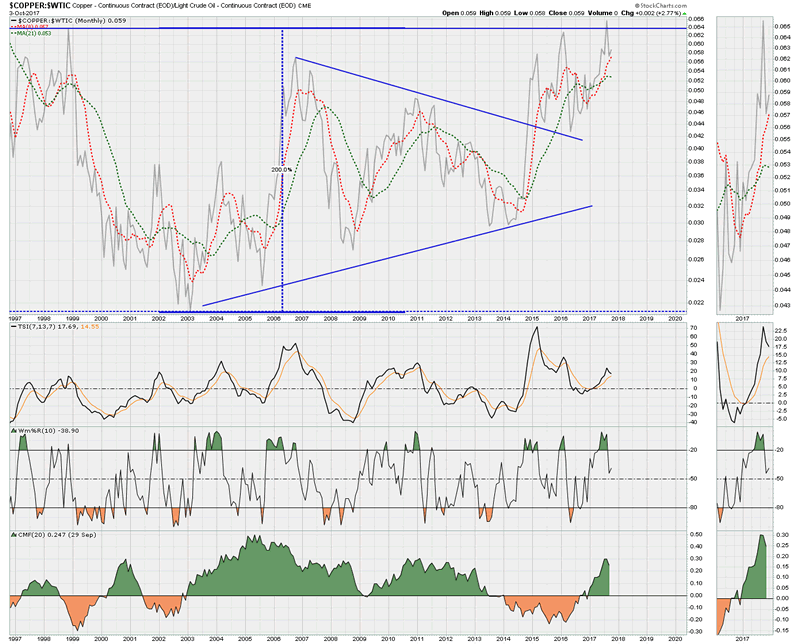

Below is a long term monthly chart of the $COPPER:$WTIC ratio, showing it is in a strong bull market. The chart shows a potential 200% measured move ahead in the ratio. This could mean the following:

1. $copper rising 100% from $3 per lb to $6 per lb, and

2. $WTIC dropping 50% to average $25 per barrel or less over the longer term

This will have profound implications for metals, where supply destruction and a lack of new large scale deposits on the horizon. A new Escondida copper mine (largest copper mine in Chile) is needed every 18 months to meet this future demand. These size deposits are simply not available, and the bigger ones are in risky jurisdictions with poor infrastructure.

The paradigm shift will affect all of us, as society will be forced to adapt to new technologies around the EV sector, and accelerate China’s move to dominate global technology and innovation. The West had better get its act together, otherwise it will just get left behind, which is becoming increasingly evident as it grapples with internal and domestic social and political issues….and not focusing on what is more important for their economies to survive in a world where engineering, technology and innovation will rule.

It will also be another nail in the coffin for the petrodollar system, as major oil suppliers like Saudi Arabia, suffer negative balance of payments, as their economy is 90% dependent on oil exports as their main source of income. Unless they can diversify their economy away from oil, and quickly, they risk insolvency. It may already be too late for them, as true diversification takes a generation to implement.

Long term macro trade: Long metals, Long EV battery components, short oil, short USD

Note: Copper and other mining stocks are a strong weighting in the SpockG portfolio, with about 40% allocated to this sector alone.

Be good. Spock

© 2017 Copyright Spock - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.