Stimulus Checks Spent, Stock Market Optimism Turns to Pessimism

Stock-Markets / Financial Markets Aug 31, 2008 - 02:44 AM GMT

Personal income decreased $89.9 billion, or 0.7 percent, in July, in contrast to an increase of $7.4 billion, or 0.1 percent, in June and an increase of $218.0 billion, or 1.8 percent, in May. Disposable personal income (DPI) decreased $114.7 billion, or 1.1 percent, in July, compared with a decrease of $208.0 billion, or 1.9 percent, in June and an increase of $595.9 billion, or 5.7 percent in May. Personal consumption expenditures (PCE) increased $24.1 billion, or 0.2 percent, in July, compared with an increase of $65.5 billion, or 0.6 percent, in June. The pattern of changes in income reflects the pattern of payments associated with the Economic Stimulus Act of 2008.

Personal income decreased $89.9 billion, or 0.7 percent, in July, in contrast to an increase of $7.4 billion, or 0.1 percent, in June and an increase of $218.0 billion, or 1.8 percent, in May. Disposable personal income (DPI) decreased $114.7 billion, or 1.1 percent, in July, compared with a decrease of $208.0 billion, or 1.9 percent, in June and an increase of $595.9 billion, or 5.7 percent in May. Personal consumption expenditures (PCE) increased $24.1 billion, or 0.2 percent, in July, compared with an increase of $65.5 billion, or 0.6 percent, in June. The pattern of changes in income reflects the pattern of payments associated with the Economic Stimulus Act of 2008.

Personal saving …was $133.8 billion in July, compared with $272.9 billion in June. Personal saving as a percentage of disposable personal income was 1.2 percent in July, compared with 2.5 percent in June. Purchases of durable goods decreased 1.6 percent, compared with a decrease of 1.4 percent (in June). Purchases of motor vehicles and parts accounted for most of the decrease in July and about one-half the decrease in June. Purchases of nondurable goods decreased 0.9 percent in July, compared with a decrease of 0.3 percent in June. Purchases of services increased less than 0.1 percent, compared with an increase of 0.2 percent (in June).

Now we know officially what we have personally known for a while. Income is going down . Consumer spending , the chief engine of our economy, is also slowing down.

Bank of China is pulling support for Fannie and Freddie.

Bank of China has cut its portfolio of securities issued or guaranteed by troubled US mortgage financiers Fannie Mae and Freddie Mac by a quarter since the end of June.

The sale by China 's fourth largest commercial bank, which reduced its holdings of so-called agency debt by $4.6bn, is a sign of nervousness among foreign buyers of Fannie and Freddie's bonds and guaranteed securities.

How bad September?

( MarketWatch ) –“ September is almost upon us.” Says Mark Hulbert, “ You'll take this as very bad news indeed if you read any of quite a few of the investment newsletters I follow. Their editors have recently been making a big deal out of September's supposed tendency to be bad for the stock market.

( MarketWatch ) –“ September is almost upon us.” Says Mark Hulbert, “ You'll take this as very bad news indeed if you read any of quite a few of the investment newsletters I follow. Their editors have recently been making a big deal out of September's supposed tendency to be bad for the stock market.

But should you change your behavior because of this historical tendency?” Mark suggests that he cannot find the culprit for this dismal history for the month of September, therefore, we should discount it. Should we?

Are treasury bonds reversing down?

Today's decline in treasuries was attributed to unanticipated signs of optimism from businesses and consumers this month. Business activity in the Chicago region unexpectedly improved this month. The index rose to 57.9 from 50.8 in July. Readings above 50 indicate overall business expansion. Economists had forecast the index to slide below that dividing line.

Today's decline in treasuries was attributed to unanticipated signs of optimism from businesses and consumers this month. Business activity in the Chicago region unexpectedly improved this month. The index rose to 57.9 from 50.8 in July. Readings above 50 indicate overall business expansion. Economists had forecast the index to slide below that dividing line.

Consumer confidence was also higher this month than previously reported. The University of Michigan/Reuters improved more than expected to 63 from a preliminary reading of 61.7.

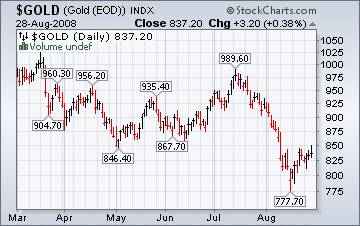

Is the rally in gold over?

Gold's rally to 849.70 on Thursday may have capped the rally for now. The reason? 850 has stood as either support or resistance to the price of gold since October 2007. Once resistance is broken, the index or commodity will often “retest” that area before resuming the trend. Unfortunately, the near-term trend can be considered to be down.

Gold's rally to 849.70 on Thursday may have capped the rally for now. The reason? 850 has stood as either support or resistance to the price of gold since October 2007. Once resistance is broken, the index or commodity will often “retest” that area before resuming the trend. Unfortunately, the near-term trend can be considered to be down.

The Japanese like our “ growing economy …”

…But where the Bureau of Economic Analysis got their calculation for a 3.3% growth in Gross Domestic Product is beyond me. Factory output advanced 0.9 percent in July from the previous month, Japan 's trade ministry said today before markets opened, while economists had expected a decline. Inflation in Tokyo , a harbinger of nationwide inflation, slowed in August for the first time since November, the government said in a separate report. Inflation across Japan exceeded 2 percent this month for the first time in a decade.

…But where the Bureau of Economic Analysis got their calculation for a 3.3% growth in Gross Domestic Product is beyond me. Factory output advanced 0.9 percent in July from the previous month, Japan 's trade ministry said today before markets opened, while economists had expected a decline. Inflation in Tokyo , a harbinger of nationwide inflation, slowed in August for the first time since November, the government said in a separate report. Inflation across Japan exceeded 2 percent this month for the first time in a decade.

Chinese shares have more realistic valuations…

…but that doesn't mean that they are a bargain yet. The optimism about the prospects for China 's economy meant that Shanghai shares were last year trading at more than 50 times predicted annual profits on average. But speaking in a video interview for FT.com, Ms Ulrich said the plunge in mainland Chinese shares this year meant price-earnings ratios are now looking more realistic. “If you look at the Shanghai traded shares, the p/e multiples are now on 18 times, similar to that in the US for the very first time,” she said. “So some rational investors are beginning to see value emerging, but it will take a while for the market's confidence to be rebuilt.”

…but that doesn't mean that they are a bargain yet. The optimism about the prospects for China 's economy meant that Shanghai shares were last year trading at more than 50 times predicted annual profits on average. But speaking in a video interview for FT.com, Ms Ulrich said the plunge in mainland Chinese shares this year meant price-earnings ratios are now looking more realistic. “If you look at the Shanghai traded shares, the p/e multiples are now on 18 times, similar to that in the US for the very first time,” she said. “So some rational investors are beginning to see value emerging, but it will take a while for the market's confidence to be rebuilt.”

More upside to come in the U.S. Dollar.

The most popular train of thought regarding the dollar goes like this, "The dollar has moved powerfully higher since it bottomed out against the major currencies, and a respite is in order."

The most popular train of thought regarding the dollar goes like this, "The dollar has moved powerfully higher since it bottomed out against the major currencies, and a respite is in order."

Analysts are attempting to link the dollar's coming demise to the worsening banking and real estate conditions in the U.S. What many do not understand is, this is precisely why the dollar is strengthening. The banking and real estate crisis are drawing liquidity out of our economic system, making the dollar more scarce and, therefore, more valuable.

Putting lipstick on a pig…

…might be one way of describing the “positive” July housing numbers . Mr. Rosenberg (analyst for Merrill Lynch) says in a research note called "Home Sales - Taking the Lipstick off this Pig" that ] pundits seem happy with the July numbers because it appears the housing market appears is bottoming out. However, he points out that the average number for July and the previous two months is "still the weakest since September 1991." A look at the June Case-Schiller index bears this out.

…might be one way of describing the “positive” July housing numbers . Mr. Rosenberg (analyst for Merrill Lynch) says in a research note called "Home Sales - Taking the Lipstick off this Pig" that ] pundits seem happy with the July numbers because it appears the housing market appears is bottoming out. However, he points out that the average number for July and the previous two months is "still the weakest since September 1991." A look at the June Case-Schiller index bears this out.

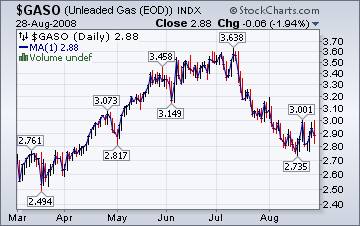

Prices, demand and supplies all falling together.

What is unusual about the price of gasoline is that wholesale prices have fallen 21% from the peak, while retail prices have dropped 11%. Gasoline consumption has dropped 1.6% in the same period. Even more amazing is that supplies have dropped 10%. What happened to good old supply and demand? A major hurricane is about to hit the Gulf coast and prices barely budge.

What is unusual about the price of gasoline is that wholesale prices have fallen 21% from the peak, while retail prices have dropped 11%. Gasoline consumption has dropped 1.6% in the same period. Even more amazing is that supplies have dropped 10%. What happened to good old supply and demand? A major hurricane is about to hit the Gulf coast and prices barely budge.

The Energy Information Agency attributes the drop in prices to increasing consumer sensitivity. Maybe so, but even they are only calling for a moderate drop in prices going forward. The chart suggests a much more dramatic outcome. Let's see how it goes.

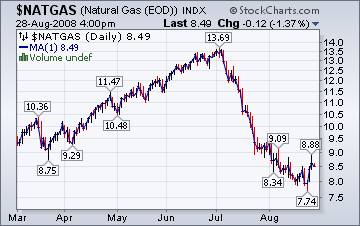

Hello, Gustav!

The Energy Information Agency's Natural Gas Weekly Update tells. “ The steady and steep decline in spot natural gas prices this summer abruptly ended this report week with the advent of Gustav, a tropical storm which is forecast to reach hurricane status shortly and appears to be tracking toward the U.S. Gulf Coast. While landfall would not occur until early next week, cities such as New Orleans are already preparing evacuations. From the perspective of the energy industry, crews would need to be airlifted from offshore platforms and rigs. Natural gas production likely would be temporarily shut-in, but the extent and duration of lost production capacity is still speculative.”

The Energy Information Agency's Natural Gas Weekly Update tells. “ The steady and steep decline in spot natural gas prices this summer abruptly ended this report week with the advent of Gustav, a tropical storm which is forecast to reach hurricane status shortly and appears to be tracking toward the U.S. Gulf Coast. While landfall would not occur until early next week, cities such as New Orleans are already preparing evacuations. From the perspective of the energy industry, crews would need to be airlifted from offshore platforms and rigs. Natural gas production likely would be temporarily shut-in, but the extent and duration of lost production capacity is still speculative.”

Has the market bottomed yet?

The question is often asked, and seldom answered. We will only know when we are “there” after it has already passed. Prieur du Plessis gives us a course in investor psychology that may help us determine whether we can stay apart from the crowd or not…an important lesson in today's market.

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.