Bitcoin Hits New All-Time High Above $5,000 As Lagarde Concedes Defeat and Jamie Demon Shuts Up

Currencies / Bitcoin Oct 13, 2017 - 02:23 PM GMTBy: Jeff_Berwick

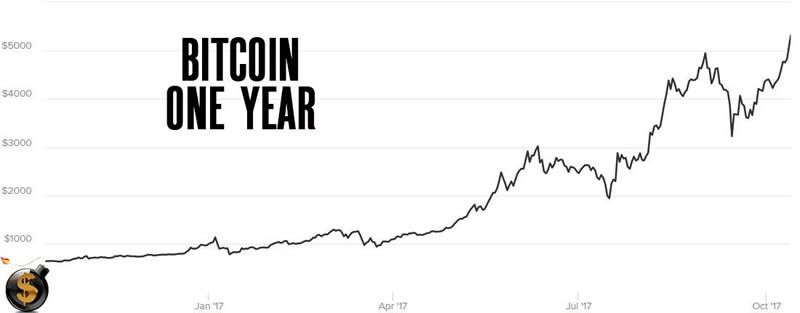

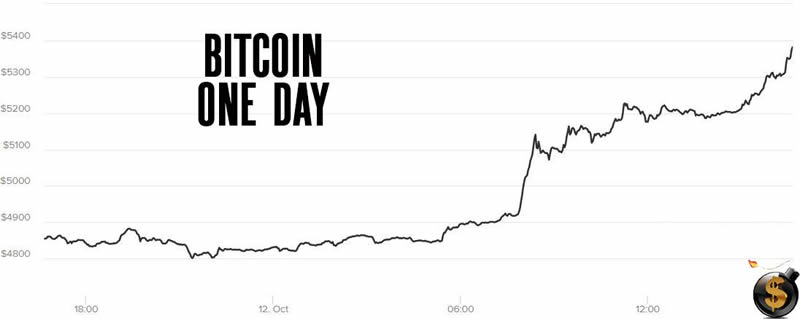

Bitcoin has just soared through $5,000 USD for the first time ever topping its old high of $4,950.72 on September 1st.

Bitcoin has just soared through $5,000 USD for the first time ever topping its old high of $4,950.72 on September 1st.

It rose over $500, or 10%, today to hit a high of $5,341.

Combined with Bitcoin Cash it now sits near $5,700.

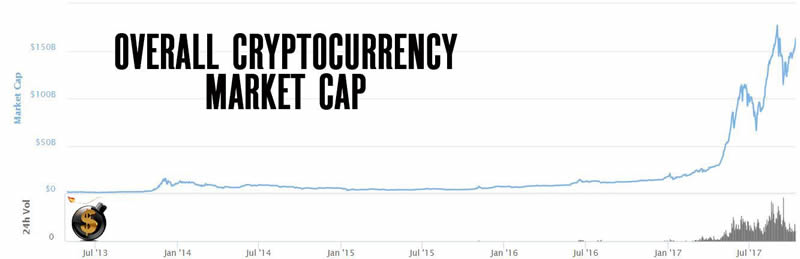

This isn’t an all-time high for the cryptocurrency space as a whole, though, as it hit a high of nearly $180 billion on September 1st and currently stands at just over $160 billion.

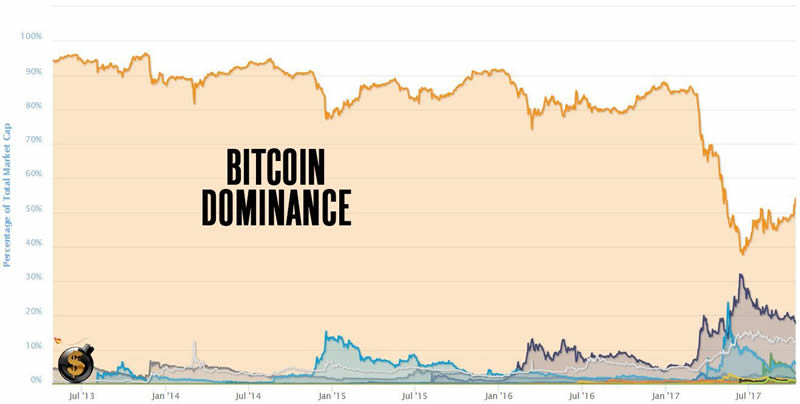

That may be due, partially, to people moving back into bitcoin prior to the next big fork in November.

Bitcoin has been gaining back market dominance against the rest of the cryptocurrencies since June and again claims more than 50% share of the entire market.

While bitcoin is still small in the grand scheme of things no one can avoid having to comment on it… from the IMF to the Federal Reserve to JPMorgan.

Recently, Christine Lagarde said that bitcoin could ultimately give central banks a run for their money. Not sure if the pun was intended or not, but it is apropos.

Of course, being the television puppet for the IMF, a communist style central planning agency, Lagarde has serious concerns about how governments will be able to extort bitcoin.

But, in the interview, she showed her massive lack of knowledge of the space. When asked about China banning Initial Coin Offerings (ICOs) she responded, “China has decided to ban the initial offering of bitcoins.”

She doesn’t even know what an ICO is!

Another commie, Axel Weber, who previously served as head of Germany's central bank displayed even more ignorance this week saying bitcoin is not a currency because it is not a store of value. That’s quite laughable considering his predecessors oversaw the Weimar Republic hyperinflation and the euro has lost about 99.999% of value versus bitcoin in the last eight years.

He said in 2015 that bitcoin was set to fail, "because there is no lender of last resort – there will always be boom and bust."

Not only has he been wrong on bitcoin’s failure, having risen 2,000% since his remark, but he doesn’t even realize that the reason bitcoin isn’t failing is BECAUSE there is no “lender of last resort” who can print up bitcoin on a whim and give to their commie friends.

Not to mention, central banks are the cause of booms and busts due to their manipulation of interest rates and counterfeiting of money.

And, since bitcoin has nearly doubled in price since Jamie Demon, of JPMorgan said it was a fraud, he has finally shut up about it, saying today, "I wouldn't put this high on the category of important things in the world, but I'm not going to talk about bitcoin anymore."

Good. Go back to doing your fraudulent deals with your dying fractional reserve banking system, Jamie.

Even Peter Schill hasn’t had much to say since he admitted publicly to Joby Weeks that he hasn’t even read Satoshi Nakamoto’s eight-page bitcoin whitepaper.

Meanwhile, one of the smartest minds in bitcoin, Trace Mayer, who first introduced me to bitcoin in 2011 at $3, has said his bitcoin price target for this coming February is $27,395!

That’s interesting timing because both Joby Weeks and Trace Mayer will be speaking at Cryptopulco at Anarchapulco as well as the TDV Internationalization & Investment Summit in February in Acapulco along with many other big names in the space such as Roger Ver, Dan Larimer and many more.

Our price target for bitcoin isn’t as high as Trace’s, but one thing is for sure… bitcoin isn’t going away and has the potential to take down the entire fraudulent central banking system.

No one can ignore it now… and the really interesting part is that there are currently only about 14 million bitcoin wallets in existence. If every one of them is owned by a solitary individual then that means 0.2% of the world’s population owns bitcoin currently.

What if that number goes to 2%?

And, institutional investors are just starting to invest now.

Where could this all go?

The sky is really the limit.

For now, though, we’ll enjoy another all-time high in bitcoin and a 177,000% gain for TDV subscribers who bought when we first recommended it at $3 in 2011.

In our celebration, we are offering a limited time discount of 10% to the TDV newsletter which includes, for free, our Bitcoin Basics book as well as the Book of Satoshi, to name just a few.

You can get access to that HERE.

We plan to increase rates for the newsletter at year end due to demand and inflation of the always depreciating US dollar so you can get the best price you will ever get by subscribing today, HERE.

This show is just getting started so stick with us here at TDV!

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.