Wikileaks Mocking US Government Over Bitcoin Shows Why There Is No Stopping Bitcoin

Currencies / Bitcoin Oct 15, 2017 - 04:41 PM GMTBy: Jeff_Berwick

As I write, bitcoin is currently yet again at an all-time high, now over $5,800 with a $97 billion market cap.

As I write, bitcoin is currently yet again at an all-time high, now over $5,800 with a $97 billion market cap.

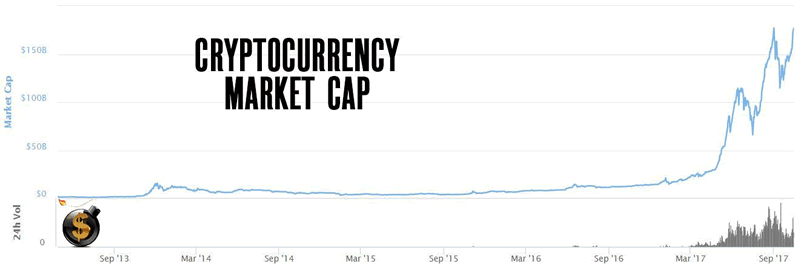

And the cryptocurrency space as a sector is on the cusp of an all-time high as well, sitting at $177 billion, just shy of the $178 billion high hit six weeks ago.

People who are against bitcoin - and why in the world would you be against a free market money unless you are an immoral statist or a paid government troll? - like to make themselves feel better about missing out on the biggest thing since the internet by saying, “The government will shut it down!”

First, if you really believe the government will do that AND you are not doing everything within your power to end government then you are a pathetic slave of epic proportions.

But, there really isn’t a lot, short of shutting down the power and/or internet, the government can do to stop bitcoin.

And, again, if you think the government will soon cut off the internet or power to try to keep people enslaved and you aren’t spending every waking minute trying to get rid of government… then, again, you are a pathetic slave who likely deserves all the oppression coming to you.

That said, aside from trying to bring the world back to the stone age the government and the central banks don’t have a lot they can do.

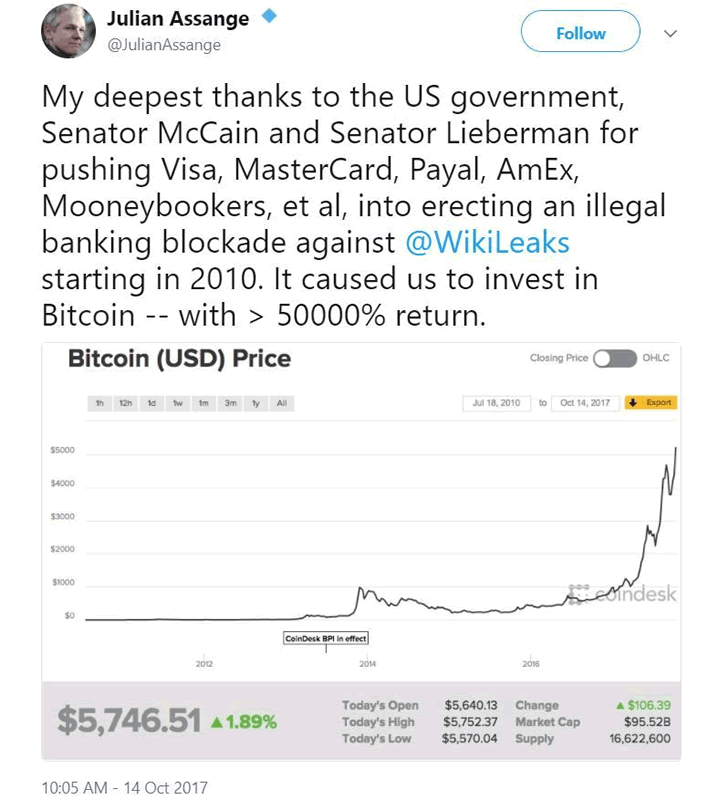

Look what happens when they try to get rid of Wikileaks, for example.

I am still not entirely sure what to make of Wikileaks, but agents of the state have tried everything they can to stop it… and what happened? They made Wikileaks exponentially wealthier in the process.

At the end of 2010, bitcoin was trading at less than $0.30. If Wikileaks even had $10,000 worth of bitcoin then and hadn’t sold it since they’d have $200 million in funds that cannot be stolen by the government.

Whoops, that really backfired on demented McCain.

Another whistleblower, Edward Snowden, has also been active on Twitter advocating for an even more private cryptocurrency, ZCash.

Considering how ostracized he has been by the US government it is not hard to imagine that he also moved all of his capital into bitcoin years ago as well.

If so, those are two attempts by the US government to stop the flow of real information that ended up massively enriching their targets.

While Jamie Demon may be trying to talk down bitcoin I know, personally, of numerous JPMorgan employees that have been heavily involved in cryptocurrencies who either have or will soon be quitting their jobs with JPMorgan.

Because, you see, many of the people who currently work for the system, whether it be government agencies or central banks or crony capitalist organizations like JPMorgan, don’t do it because they are outright evil.

They do it because that is where the money is. They sold their soul, so to speak.

But, what happens when it becomes more profitable to be on the side of freedom and righteousness?

We are just starting to find out now!

Even Christine Lagarde has hinted at potential defeat to cryptocurrencies and Helicopter Ben Bernanke has been speaking at cryptocurrency conferences… likely looking for his next buck.

The war is far from over, but we are beginning to see the scales tilt significantly in favor of cryptocurrencies and the decentralization and freedom that stems from them.

How much more will all this be amplified if bitcoin hits Trace Mayer’s potential target of $27,000 per bitcoin?

We’ll have to wait and see.

If you still haven’t gotten involved in cryptocurrencies, it still isn’t too late.

With bitcoin still hitting all-time highs, we continue to offer our special 10% off The Dollar Vigilante newsletter where we’ve been covering bitcoin since 2011. You can get access to it HERE.

Your average person gets their financial advice from people like brokers at JPMorgan. There is a reason they are called brokers… because they will make you broker.

You need to take control of your own financial future. Start with us today, HERE, at The Dollar Vigilante.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.