No more Stock Market cash Left on the Sidelines...

Stock-Markets / Stock Market 2017 Oct 18, 2017 - 02:36 PM GMT We may have seen a truncated Wave (v) in the SPX this morning. The only way to know is when the SPX declines beneath the Micro-term trendline and mid-Cycle support at 2552.10. That may provide an aggressive short entry point.

We may have seen a truncated Wave (v) in the SPX this morning. The only way to know is when the SPX declines beneath the Micro-term trendline and mid-Cycle support at 2552.10. That may provide an aggressive short entry point.

The next focal point would be the Short-term support and 2-month trendline at 2443.32, as shown in the 2-hour chart which will be posted later.

ZeroHedge mentions that “cash on the sidelines” is officially dead.

The NDX appears to have made its final high at 6118.80. While it may go higher, as mentioned this morning, it’s pattern appears complete. The Ending Diagonal trendline appears at 6095.00 which may give an aggressive short entry point. The next level of support is in the range of 6030.00 to 6043.00.

ZeroHedge reports, “Last month, Bank of America's survey of active investors revealed something striking: for the first time in history, the response to what the professional community perceived as the most crowded trade on Wall Street, was "Long Bitcoin" (according to 26% of respondents), followed by "Long Nasdaq", while "Short US Dollars" was in third spot. One month later, things are back to normal and the 179 participants with $516bn in AUM, have eased back on their cryptocoin euphoria, and for the 5th time this year, "Long Nasdaq" is back in top spot according to 29% of respondents.”

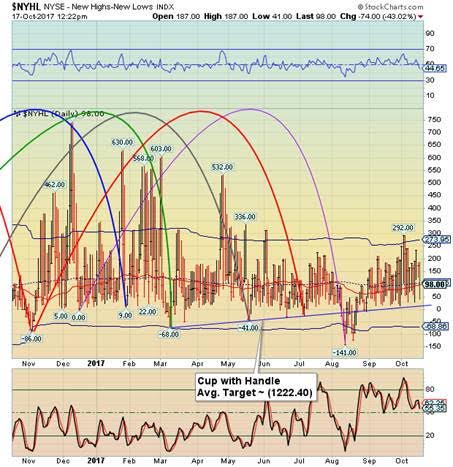

VIX is approaching its breakout point at 10.66 and the 50-day Moving Average at 10.77. Crossing these lines would still be an aggressive signal until the Hi-Lo Index closes beneath its 50-day Moving Average.

The NYSE Hi-Lo Index lies between its 50-day Moving Average at 96.54 and the mid-Cycle resistance at 102.55. Not a clear sell signal yet, since we need to see the final number at the close. Once the selling begins, the Hi-Lo should deteriorate. Lately it has been opening at a low, but closing above supports as buyers have been stepping in during the day. Buying index funds puts an equal weight among all the stocks in the index, thus supporting the Hi-Lo. We need to see index selling to bring this number down.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.