The Trigger for Volatility, Rates and the Next Crisis

Stock-Markets / Financial Crisis 2017 Oct 21, 2017 - 04:27 PM GMTBy: Harry_Dent

If you’ve read any of my work, you know I think the iceberg that will ultimately sink the global Titanic is China. It has the greatest overbuilding and debt bubble in history, not to mention the obvious real estate and stock market bubbles.

If you’ve read any of my work, you know I think the iceberg that will ultimately sink the global Titanic is China. It has the greatest overbuilding and debt bubble in history, not to mention the obvious real estate and stock market bubbles.

But the Chinese government has too much control over its economy to just let it slide. No. China won’t be the first domino to fall. Rather, the dubious honor may go to lovely and charming Italy.

Italians are fun, laid-back people. I love visiting the country.

But would I bet on it?

No way!

Italians think they’ve died and gone to heaven, but it looks more like hell’s sneaking up on them!

Outside of Greece, Italy has the highest government debt: 130% of GDP and rising. Greece’s government debt is at 180%, but at least Greece keeps getting bailouts, which it can get because it’s small enough to have little impact on the euro.

But what if Italy starts defaulting?

Scratch that. What happens when Italy starts defaulting?

Default it will!

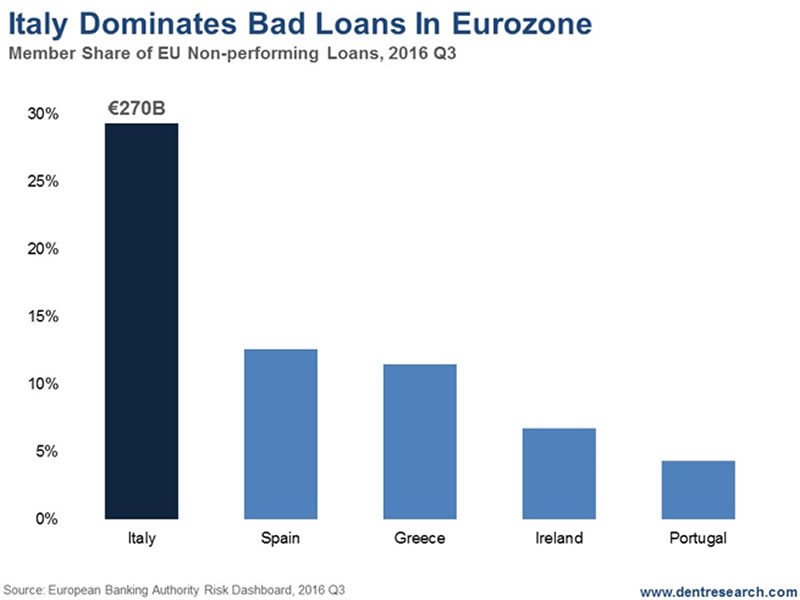

The country has the great majority of the bad loans in the eurozone. Look at this chart.

Of the worst countries in the eurozone, Italy dominates bad loans in the banking and private sector. It has 29% of the total, or $324 billion in bad loans – and that number continues to rise.

Major bank stocks there have already plummeted the most in recent years and are on government life support.

What makes Italy so dangerous is that French banks have the most outside exposure to these bad loans, with Germany taking second spot.

But ultimately Germany has the greatest exposure to a fall in Italy. It is the strongest exporter in Europe, especially to the highly indebted southern European nations.

The euro made that imbalance both possible and attractive. Strong exporters in northern Europe had more favorable exchange rates under the common euro, and the weaker importing nations could borrow more cheaply than under separate currencies.

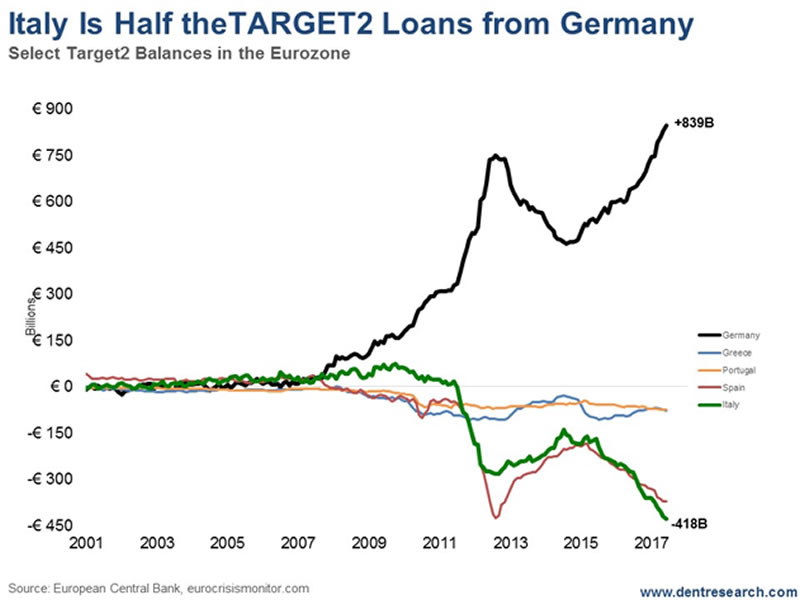

Since Germany’s exports are 46% of GDP, it has a strong incentive to keep floating these southern importers while criticizing them and forcing austerity at the higher political levels. It’s called Target 2 loans. The German central bank (and others) simply defers payments from companies in Italy to some flexible future date.

It’s like a company that gives more credit to their customers just to keep them buying… even though eventually those patrons will be able to repay a penny.

Look at this next chart.

Of the $839 billion in Target 2 loans from Germany’s central bank, half, or $418 billion, are to Italy alone.

Given the potential to default on these loans and on foreign bank loans, Italy is strongly incentivized to leave the euro and default, just like Iceland did when it faced an equally dire situation.

A default, a much weaker local currency and higher inflation (from rising import costs) would mean that Italy’s sovereign bonds would see a massive spike in rates. During the euro crisis, they went from 3% to 7%. This time it would be much worse!

But here’s the most important point. Sovereign bonds around the world are overvalued with often negative yields long term (when adjusted for inflation).

Yet continued strong ECB bond buying and QE has put the Italian 10-year bonds yield at 1.85% versus U.S. Treasuries at 2.2%!

That’s insane!

Italy is bankrupt, and we are the best house in this bad global neighborhood. Yet Italy’s bonds are stronger than ours and yielding less.

How much badly could risk be miscalculated?!

When Italy gets in trouble again and bond yields spike, that will cause bondholders to question all sovereign bonds, even the trusted U.S. ones.

The bond bubble will seem to have topped and burst… but NOT.

Talk about volatility!

Bond yields could spike up across the world creating a global crisis and stock crash, and then, after a while, deflation will set in from the collapse of bubbles and debt deleveraging. Deflation will then cause the best sovereign (and corporate) bonds to fall in yields to even lower levels than today’s unprecedented lows.

The bond bubble will continue next time for fundamental reasons, not artificial.

We’re on a financial assets roller coaster ride and the exciting (treacherous?) section is just ahead. And it’s going to be even hairier in traditionally safer and more stable bets like U.S. Treasury bonds.

Wall Street has a new consensus view that such yields can’t go much lower and will rise modestly for years ahead, with mild rising inflation… a typical soft-landing view.

They will be wrong as usual, just like they’ll be wrong on China.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2017 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.