Bitcoin Hits $6,000, $100 Billion Market Cap As Helicopter Ben and Jamie Demon Warn The End Is Near!

Currencies / Bitcoin Oct 22, 2017 - 10:46 AM GMTBy: Jeff_Berwick

Bitcoin rose more than 6% today to surpass, for the first time ever, the $6,000 US mark.

Bitcoin rose more than 6% today to surpass, for the first time ever, the $6,000 US mark.

More interestingly, bitcoin just surpassed $100 billion in total market capitalization. Or, as Coindesk puts it, $0.1 trillion.

Yes, we are now quantifying bitcoin in the trillions.

When we start talking in the trillions we are beginning to talk about a shift in the financial and monetary system.

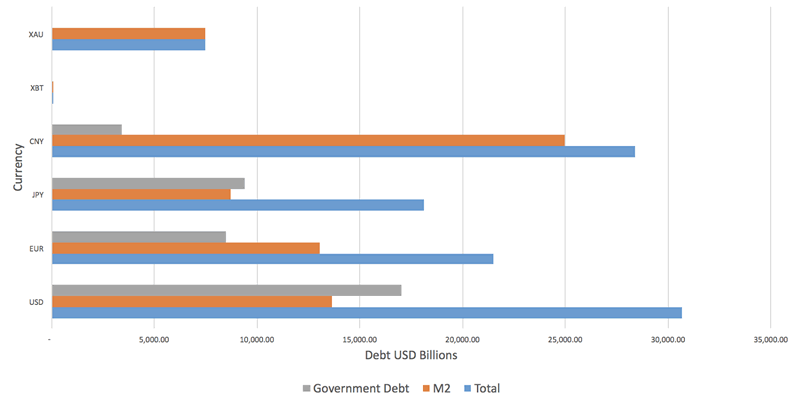

And, as I pointed out recently, bitcoin is still but a glimmer in the all-seeing eye, so to speak, of the overall monetary picture.

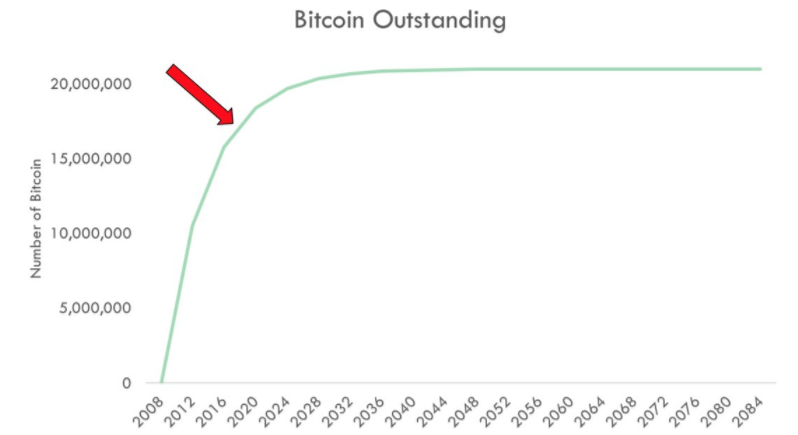

And, while one of bitcoin’s most valuable assets is its hard cap limit of 21 million bitcoins that will ever be created (but that are divisible to the eighth decimal meaning it still has the ability to be used in the smallest of transactions) the fact of the matter is that bitcoin has been in a state of hyperinflation over the first eight years of its short lifespan.

In order to disseminate bitcoin widely it needed to issue a large amount of bitcoin over a short amount of time meaning the total money supply has increased massively in those eight years.

From the perspective of the very first satoshi that was ever mined the money supply growth has been exponential to the N’th degree.

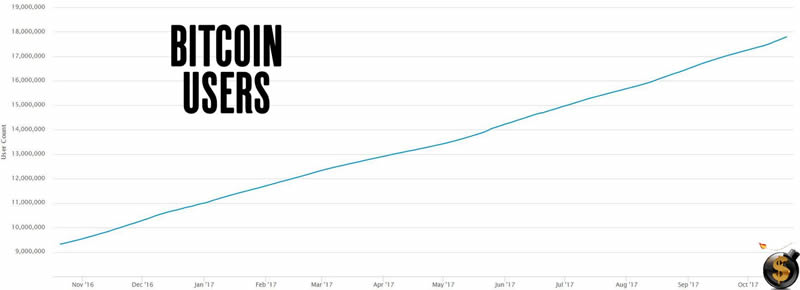

And, demand for bitcoin has been growing dramatically… and with only about 18 million bitcoin wallets in existence, even if each of those wallets were owned by a single individual (which they aren’t as I personally have dozens of different wallets) it would mean that 0.2% of the world’s population currently owns bitcoin.

What happens when that happens? Even the most economically brain dead person, like Paul Krugman, should know it means the price will have to rise.

Will it continue to rise in the short term? That’s anyone’s guess.

And, The Powers That Shouldn’t Be, will do anything they can to stop it… because if they lose control of the money system they lose control of everything.

Initial Coin Offerings (ICOs) now do more in dollar value than Wall Street’s IPOs! That’s why Jamie Demon can’t stop trying to talk bitcoin down and has hinted that the government will try to kill bitcoin and that it will “end badly.”

And, just recently, Helicopter Ben Bernanke who seriously had a plan at one point to drop Federal Reserve Notes from helicopters to “help” the economy, was speaking at a Ripple conference in Toronto. When he was asked about bitcoin competing with the US dollar he replied, “Eventually governments will take any action they need to prevent that.”

And, I have no doubt they will. It will be incredibly interesting times ahead.

The war has just begun.

Make sure you have a front row seat by subscribing to The Dollar Vigilante newsletter (subscribe here) where we cover every facet of this evolution.

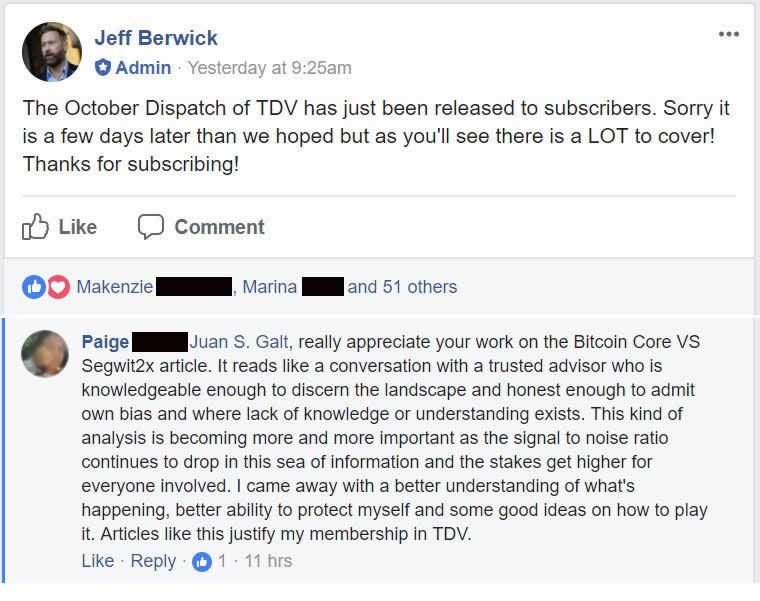

Here was a recent comment from a subscriber on how much they enjoyed our coverage of the upcoming bitcoin Segwit2x fork:

We began that promotion months ago when bitcoin was around $1,500… so, those people who accepted the offer at the time now received the equivalent of $200 in bitcoin, essentially getting our newsletter for free.

Stick with us here at The Dollar Vigilante where we stand at the front lines of this evolution in money and banking.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.