Strange Things Happening In The Paper Gold Market

Commodities / Gold and Silver 2017 Oct 25, 2017 - 12:06 PM GMTBy: John_Rubino

Back in September the hedge funds that speculate with gold futures contracts got extremely bullish, which – since speculators are usually wrong when they’re overexcited – was a signal that gold would be going down for a while. It did:

Back in September the hedge funds that speculate with gold futures contracts got extremely bullish, which – since speculators are usually wrong when they’re overexcited – was a signal that gold would be going down for a while. It did:

Then things departed from the usual script. A falling gold price tends to make trend-following speculators bearish, which leads them to close out their long positions and expand their short bets. It also leads commercial players – the banks and fabricators that tend to be right at turning points – to start shifting from short to long.

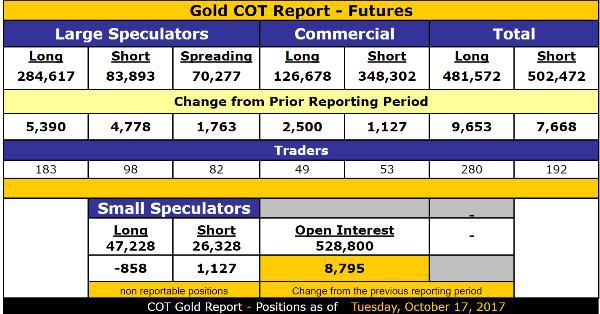

But not this time. As the most recent commitment of traders (COT) report shows, speculators are staying long and commercials are staying short.

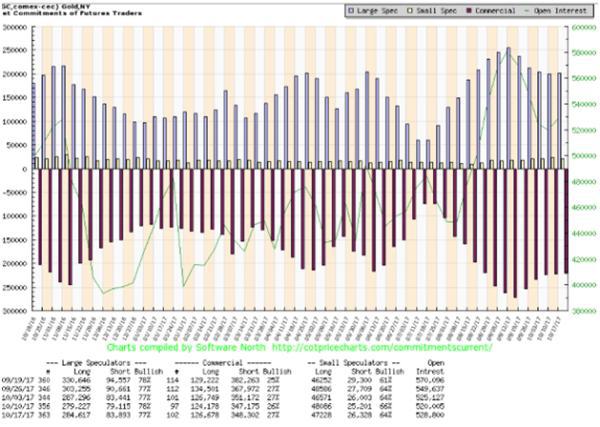

Here’s another way to visualize the process. The gray bars on the next chart represent the speculators and the red bars the commercials. Note how their positions tend to move in waves either away from or towards the middle line that represents zero. But lately their positions have flattened out.

The implication? It might take a bigger drop in gold’s price to make speculators and commercials switch sides.

This of course means nothing for gold’s long-term, highly-positive trend. But it does matter for traders who want to play the monthly or quarterly squiggles, and investors looking for entry points to buy bullion or mining stocks. That entry point might be a few weeks and another hundred or so dollars off.

By John Rubino

Copyright 2017 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.