Eurozone Crisis Is Back, Gold Will Be Safe Haven Again In Looming EU Crisis

Commodities / Gold and Silver 2017 Oct 26, 2017 - 04:20 PM GMTBy: GoldCore

– Gold will be safe haven again in looming EU crisis

– Gold will be safe haven again in looming EU crisis

– EU crisis is no longer just about debt but about political discontent

– EU officials refuse to acknowledge changing face of politics across the union

– Catalonia shows measures governments will use to maintain control

– EU currently holds control over banks accounts and ability to use cash

– Protect your savings with gold in the face of increased financial threat from EU

Editor: Mark O’Byrne

When we talk about the Eurozone crisis we are usually referring to the Eurozone debt crisis. According to the OECD the debt crisis of 2011 was the world’s greatest threat.

In the years that followed, Germany, France and the UK led EU members in their efforts to stave off debt defaults from the likes of Ireland, Portugal, Italy, Spain and, of course, Greece. This was partly in order to protect the German, French and UK banks who had lent irresponsibly into the periphery EU nations and were very exposed.

In recent months one could argue that things were starting to look up for the single-currency area. Recent headlines report that the Eurozone’s recovery is firmly under way. Manufacturing workloads are rising and companies are hiring at their fastest pace in over a decade.

Of course much of the recovery is attributed to the ECB and their bond purchasing ‘stimulus’ of €60 billion euros every single month … courtesy of Super Mario’s Bazooka. This is unlikely to come to a halt later today in what is being touted as the central bank’s most important policy meeting recently.

There are a few different potential outcomes to the meeting, but none will address the new and very real and very pressing Eurozone crisis: the growing political crisis.

Political change: the real Eurozone crisis

Ever since the debt crisis exposed the cracks in the ‘single currency’ union, the increasingly two-tier economy has caused more and more problems, both economic and political.

Germany has surged ahead in terms of productivity and GDP growth. Meanwhile the southern states have experienced economic pain.

Throw into the mix various EU requirements on countries such as free movement of labour and refugee quotas and it isn’t just the poorer countries that are feeling the heavyweight of eurozone politicians.

This has inevitably given way to a populist surge in politics as voters become increasingly disenfranchised with the EU first, country second approach of their own elected governments and the unelected bureaucrats in Brussels.

This is now a real political risk and reality which the bureaucrats of the EU seem to treat like an embarrassing smell: something they hope will just disappear and require no acknowledgement.

In truth this will continue to snowball as the EU will inevitably remain economically and socially unbalanced. This is a eurozone crisis that is no longer about poor countries unable to cover their debts, this is a eurozone crisis that threatens the very nature of the European Union.

A populist surge has already arrived

Political risk has long been present in the Eurozone. Since the creation of the single-currency union and its various requirements of participating countries, there has arguably been an underlying nationalist movement protesting against the imbalance across the market, the bureaucrats and the control of Brussels.

Only in the last couple of years however, has this political issue gained an international and influential stage. Brexit was of course one of the catalysts that sparked the reaction (followed by Trump’s election) prompting worries that a populist surge was about to sweep through Europe.

The concerns are not completely unfounded. We can now briefly look across Europe to the likes of Spain and the Czech Republic and see that this is exactly what has been (and is) going on.

The most current and serious of these political issues is in Catalonia. On October 1st, 90% of the 43% of voters who participated in the unofficial referendum voted for independence from Spain.

Has the EU appreciated the damage that could be done as a result of not only a legal (and successful) Catalonian referendum and the current fallout alone?

Holger Schmieding, chief economist at Berenberg in London said earlier this month “for the euro zone as a whole, the possible Catalan impact will probably be too small to make a noticeable difference.” This is a common EU response.

But they seem to be forgetting that events in Catalan are not just seen as isolated to the region. The rest of world sees this as a reflection on Spain and therefore, the Eurozone.

The Eurozone has no easy answers to questions such as will the region be allowed to use the euro or what will happen to Spanish banks? The country is the Eurozone’s fourth-largest. Given Spain’s national net debt is more than one trillion euros anything that rocks the stability of the country will have a ripple effect across the EU and beyond.

Czech Trump secures major victory at home and across EU

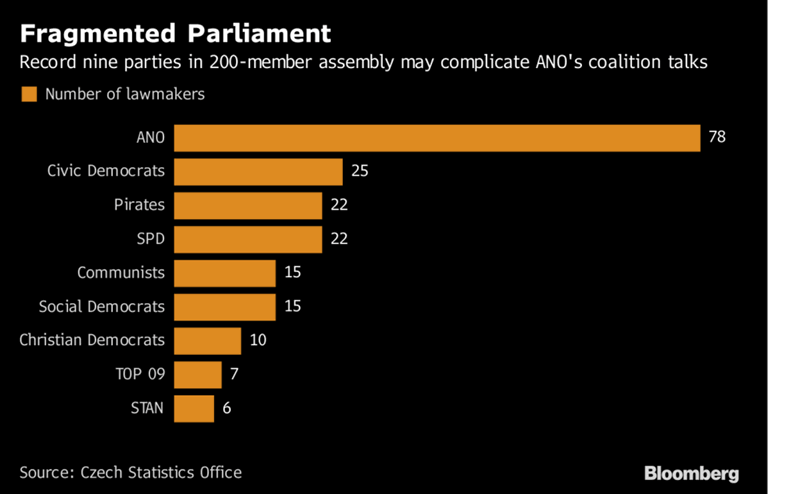

Last weekend saw a dominant win in the Czech Republic for the euroskeptic ANO party. It is the first time an outwardly anti-euro leader has been elected within the EU-region. The result was not surprising given the general consensus in the country. Parties opposed to deeper integration won more than half of the vote.

ANO leader and multi-billionaire, Sebastian Kurz, is likely to form a coalition with the far-right Freedom Party. Both oppose the euro and have blamed increased terrorism attacks on Germany’s immigration policy. Meanwhile parties such as the anti-Muslim Freedom and Direct Democracy, the SPD, gained a significant number of votes.

Angela Merkel is likely looking at the Czech election with some apprehension. She was closely contested in her own recent election. Whilst she remains Chancellor, right-wing parties gained significant ground and she is yet to form a coalition.

As with the Catalan referendum or Brexit vote, this is not about increasing levels of racism or an ‘anti-Europe’ stance. Despite what the headlines say no-one has declared their country should leave the continent. Brits remain a part of Europe as do the Czechs, they just no longer wish to be under the rule of a government that operates outside of their own (perceived) interests. The benefits of which are increasingly unclear to them.

This change in the political landscape is evidence of the widening gap between the winners and losers of globalisation. This has inevitably generated negative sentiment toward the EU, the embodiment of globalisation and corporate and banking dominance of the continent.

EU’s approach to national and individual sovereignty

As we saw in the UK, much of Europe is split over its feelings towards the EU and the eurozone. However as long as the EU continues to resist and ignore the concerns of voters they are likely to cause more moderates to turn against them.

Anecdotal, I know, but I see evidence of this happening here in the UK. On a recent visit back to London it was clear that many friends and acquaintances (all Remainers in the 2016 referendum) were appalled at the ‘bullying’ tactics and financial demands of the EU Brexit negotiators.

This has prompted many of them to question if a renegotiation of the UK’s place in the EU wasn’t such a bad idea after all.

We also see evidence of this in Spain where Madrid has taken measures that only serve to inflame tensions and irritate Catalonians: from low flying helicopters around the Catalan region to consideration of suspending the constitution and imposing direct rule. Residents are reportedly growing increasingly frustrated with the capital and even more so with the European Commission’s apparent indifference to the situation.

On an individual level, we must hope that this will lead to many savers and investors considering their own financial sovereignty or freedom against the backdrop of EU-focused nationalism. As more disgruntled EU citizens express themselves in the way the Brits, Czech and Catalonians have done, the greater pressure there is on the euro and the EU’s financial markets.

As we have seen with Catalonia, the response from governments when things aren’t going to plan is to exert more force and control. Whether it is threats of preventing free movement for Brits, to removing local power in Catalonia, there are a number of ways individual freedoms can disappear over night.

Protect your sovereignty with your wealth

The same can be said for our wealth, with or without a rise in populism. Currently the EU wields significant power over not only how we spend our money but how we hold it and its security.

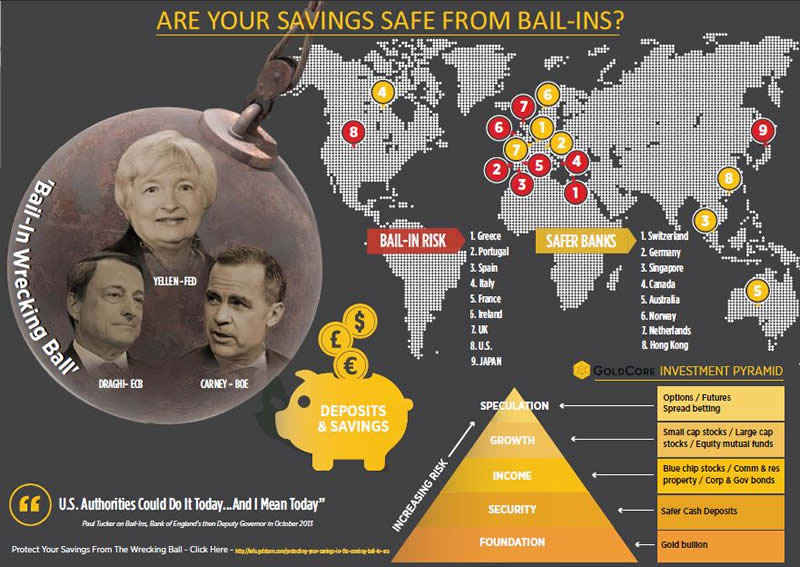

As explained earlier this year there is a major clamp down across the EU on cash payments. This is one area of control. The more covert measures are negative interest rates and bail-ins.

Bail-in rules have been in operation since the beginning of 2016. The rules basically mean that desperate governments are able to confiscate some of your savings in times of financial crisis and bank insolvency.

One wonders what other excuses they could find in order to gain access to your funds. Political protests, increased fracturing across the EU and concerns over maintaining control are just a few that spring to mind.

With the same disregard EU officials have shown for the growing discontent across the union, they have dismissed the concerns individuals have for the value and safety of their savings.

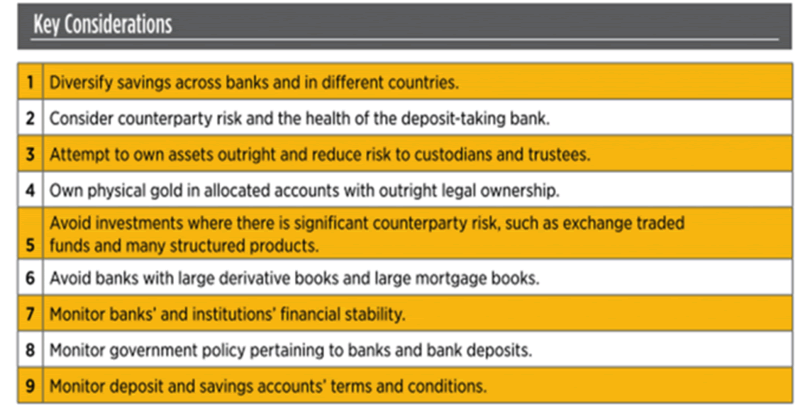

Investors should protect themselves from these risks by diversifying their savings and owning physical gold -not paper or digital gold. This reduces the level of counterparty risk your savings are exposed to and ensures some level of sovereignty and financial safety and freedom when it comes to your wealth.

These financial risks including Bail-ins are a threat to all savers in the western world.

Fail to prepare, prepare to fail.

Read our guide on how to protect yourself from bail-ins here

Gold Prices (LBMA AM)

26 Oct: USD 1,278.00, GBP 968.34 & EUR 1,082.34 per ounce

25 Oct: USD 1,273.00, GBP 964.81 & EUR 1,081.67 per ounce

24 Oct: USD 1,278.30, GBP 970.36 & EUR 1,087.32 per ounce

23 Oct: USD 1,275.25, GBP 967.79 & EUR 1,085.62 per ounce

20 Oct: USD 1,280.25, GBP 974.27 & EUR 1,084.76 per ounce

20 Oct: USD 1,280.25, GBP 974.27 & EUR 1,084.76 per ounce

Silver Prices (LBMA)

26 Oct: USD 16.97, GBP 12.84 & EUR 14.37 per ounce

25 Oct: USD 16.89, GBP 12.75 & EUR 14.34 per ounce

24 Oct: USD 17.04, GBP 12.92 & EUR 14.49 per ounce

23 Oct: USD 17.00, GBP 12.90 & EUR 14.47 per ounce

20 Oct: USD 17.08, GBP 12.96 & EUR 14.46 per ounce

20 Oct: USD 17.08, GBP 12.96 & EUR 14.46 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.